TSMC Q1 FY12/24 Earnings Review

Earnings season. Let’s go.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

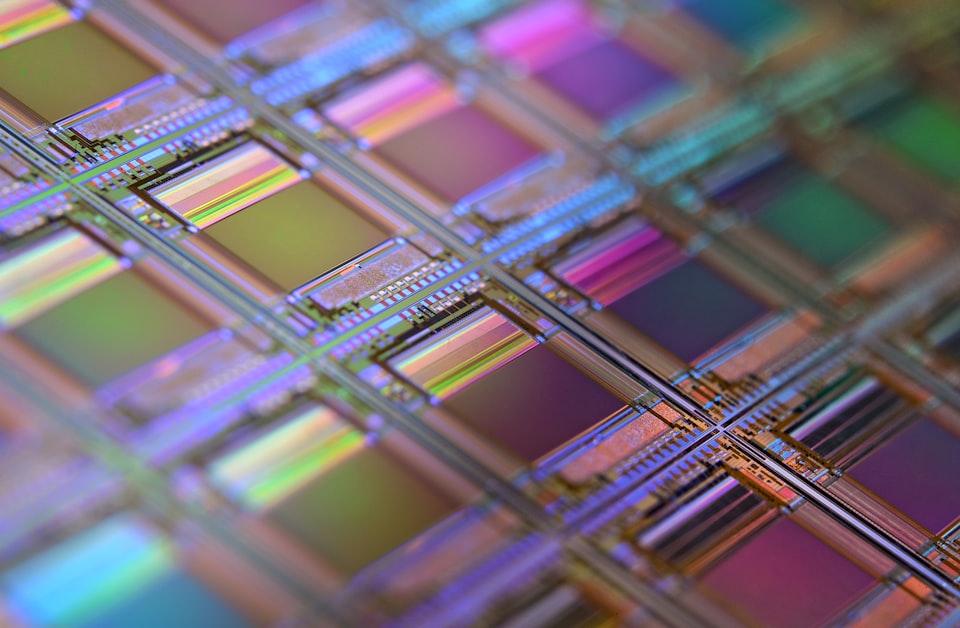

Simple, It Isn’t.

by Alex King

These are the real-world factors that lie beneath TSMC’s stock price.

- Will China actually, or even with-gusto feint towards, invading Taiwan?

- Will advanced semiconductor volume hold up across the board or only from Nvidia?

- Will Intel’s foray into merchant fabrication make any near-term headway into TSM’s more-or-less monopoly in small feature size?

Then you have all the, you know, revenue and earnings and cashflow and stuff.

The company just reported its Q1 of FY12/24 this morning before the open. We run through the numbers, valuation and stock price outlook below, for our paying Market Insight and Inner Circle subscribers.