PagerDuty Q4 FY1/24

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Waiting For A Bigger Friend

By Alex King

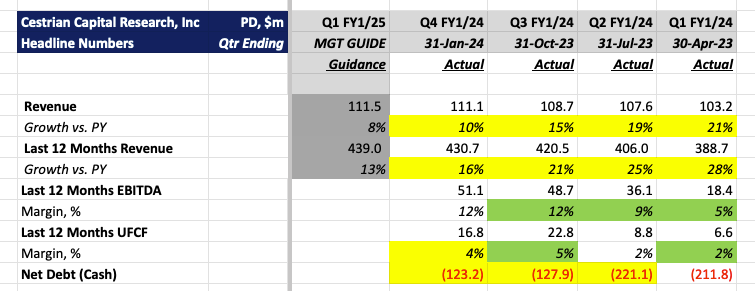

PagerDuty ($PD) is a niche enterprise software business. It provides monitoring and alerting functionality deep within the datacenter. The company is small - less than $500m in TTM revenue - and right now is neither growing quickly (+10% this quarter vs. PY; +16% on a TTM basis vs. PY) nor generating high cashflow margins (+4% TTM UFCF as of this quarter).

Here’s the headline numbers.

The stock is likely under accumulation - in anticipation, I believe, of a sale of the company. Nothing the management team has accomplished in recent years gives the impression that they can keep growing as an independent vendor; the company as-is has the look of a product set that should belong to a larger consolidator.

Read on for our fundamental, technical and valuation analysis, latest stock charts and rating.