Inner Circle - Portfolio Update

Our school report below.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

How It’s Going.

by Alex King.

First up, a warm welcome to all our new free-tier readers here. Whether you’ve joined us from StockTwits, X, one of our Seeking Alpha articles, a Substack note or you simply stumbled over our stuff on the open Internet, we’re delighted to see you.

At the end of each week we post an update on our model portfolios that we run here in the Inner Circle service. Usually we post them in our members-only Slack chat environment, but since we have so many new folks joining us on the free side - and naturally we’d like you to move up to the paid tier, where you’ll find these model portfolios in detail, and analysis on their constituent stocks - I thought a public post would be in order.

Below we run through the portfolios created in 2023 to check in on how they’re going. As you know, we created a new-for-2024 portfolio this week - if you missed it you can read all about that here.

For those of you that are free readers here, if you’d like to learn more about what a paid membership brings you, you can do so here. If you’re unsure, why not sign up for a monthly membership - if you like the service and want to take the cheaper annual or extended (6-year) memberships, we’ll roll your first month’s payment into your upgrade. That way you don’t have to spend the big bucks on day one, you’ll spend just $299 to work out if you like the service or not - that’s less than you lost on your last bad trade! - and if you do like it you get your $299 back when you take out your annual or extended membership.

OK. Let’s get to the portfolio performance, in each case from inception to date.

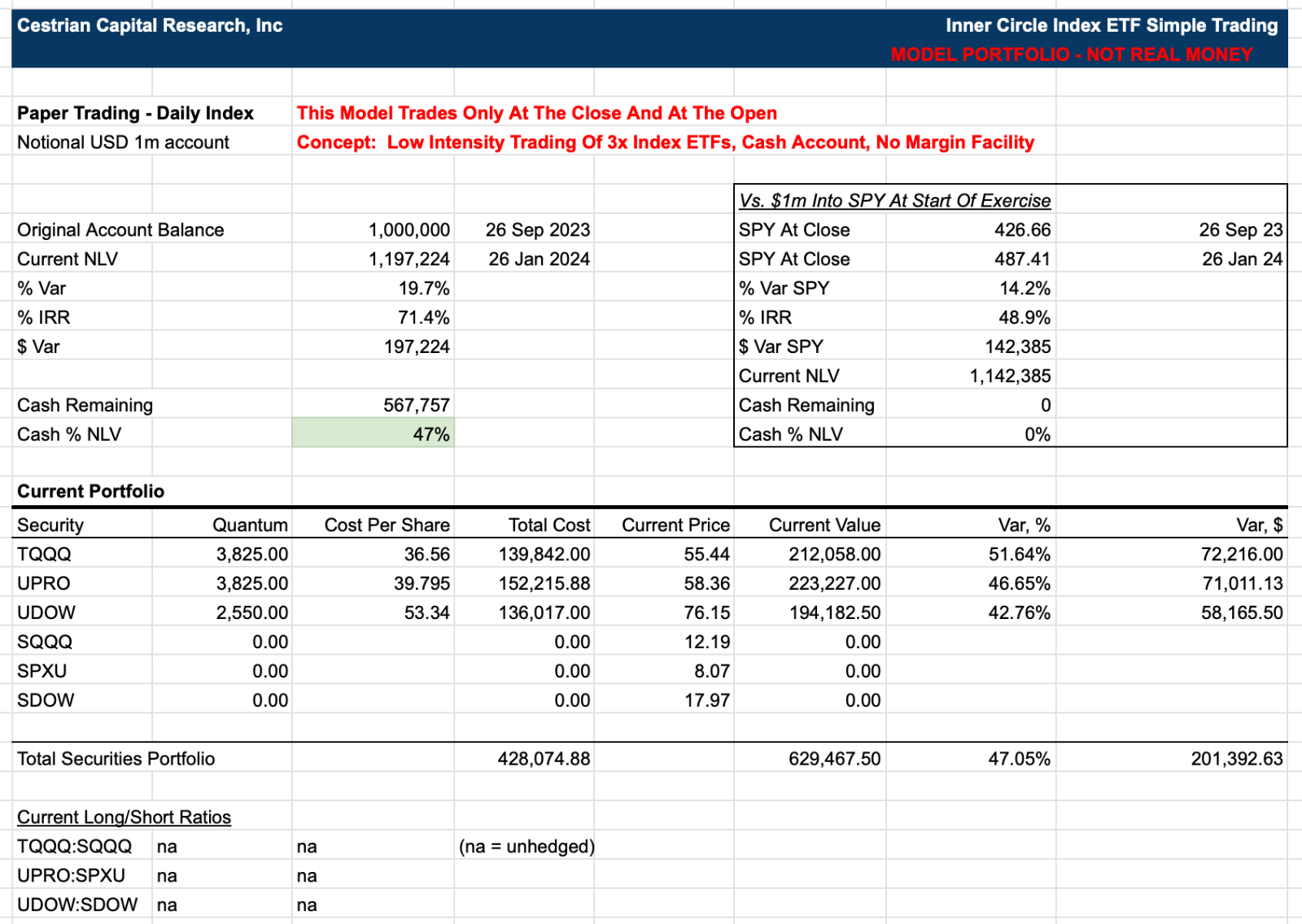

Hedged Equity Index Portfolio

The goal of this portfolio is to beat buy-and-hold the S&P500. We do this by using 3x ETFs that provide leveraged long, and leveraged short, exposure to the S&P500, Nasdaq-100 and Dow Jones 30. The portfolio is intended to have low trading volume (trades happen only at the open and the close; and even then, most days see no trades) - all trades are posted hours ahead of time as an alert in our Slack system. It’s a model cash account, no margin facility. Inception was 26 September 2023.

So far, +19.7% vs +14.2% for the S&P500 in SPY form. The portfolio is presently held 47% in cash vs. the S&P500 control group being 100% deployed on day one. Currently unhedged.

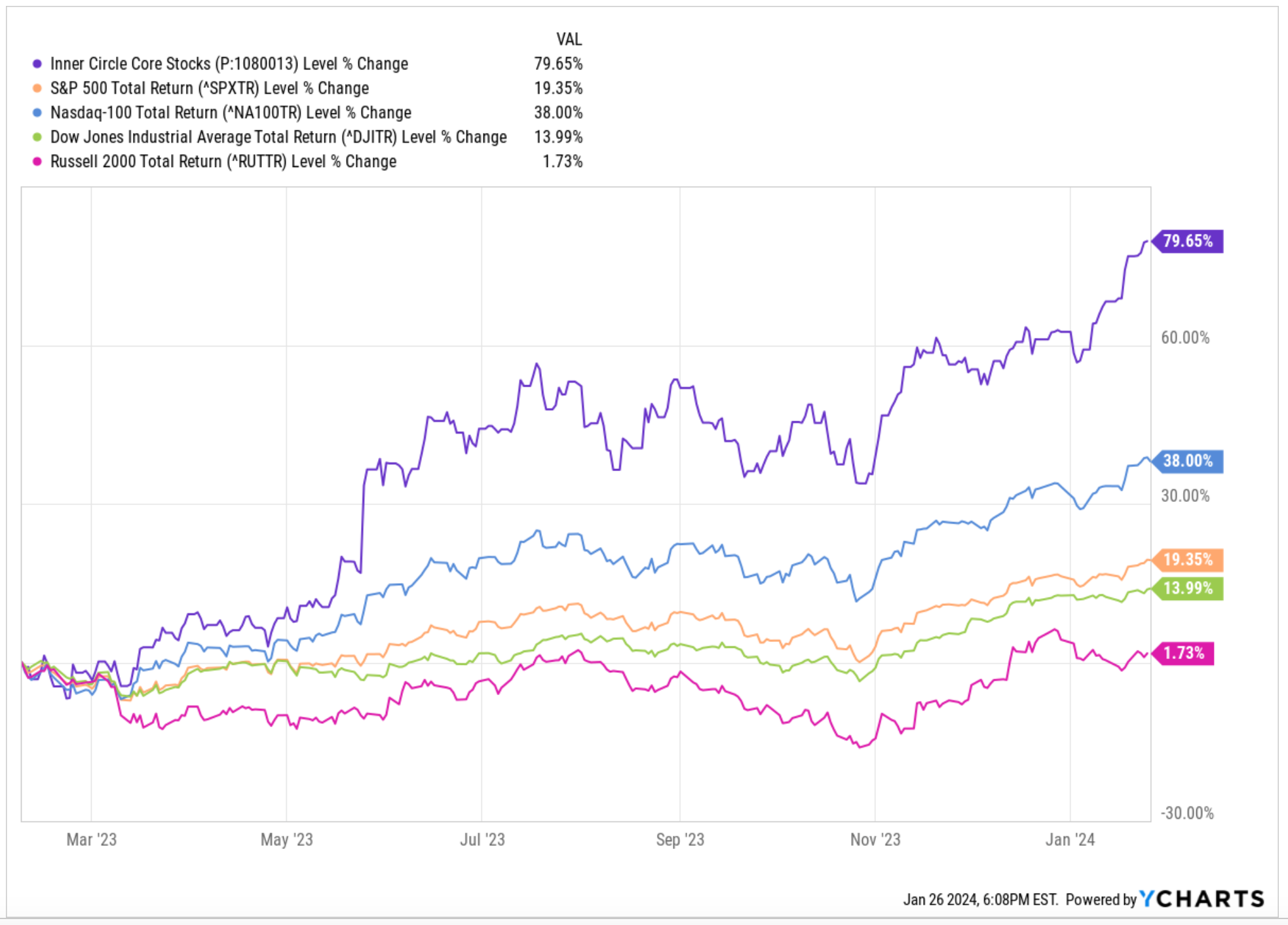

Inner Circle Core Stocks Portfolio

This is a 5-stock core portfolio, simple buy and hold, inception 7 February 2023. A blend of major names, growth names and value names. Returns are all on a total return basis - any dividends are re-invested into the stock that produced them. The portfolio was 100% deployed on day one and has seen no changes from inception.

Performance: +79.7% vs. +38.0% Nasdaq vs. +19.4% S&P500 vs. 14.0% Dow vs. +1.7% Russell 2000.

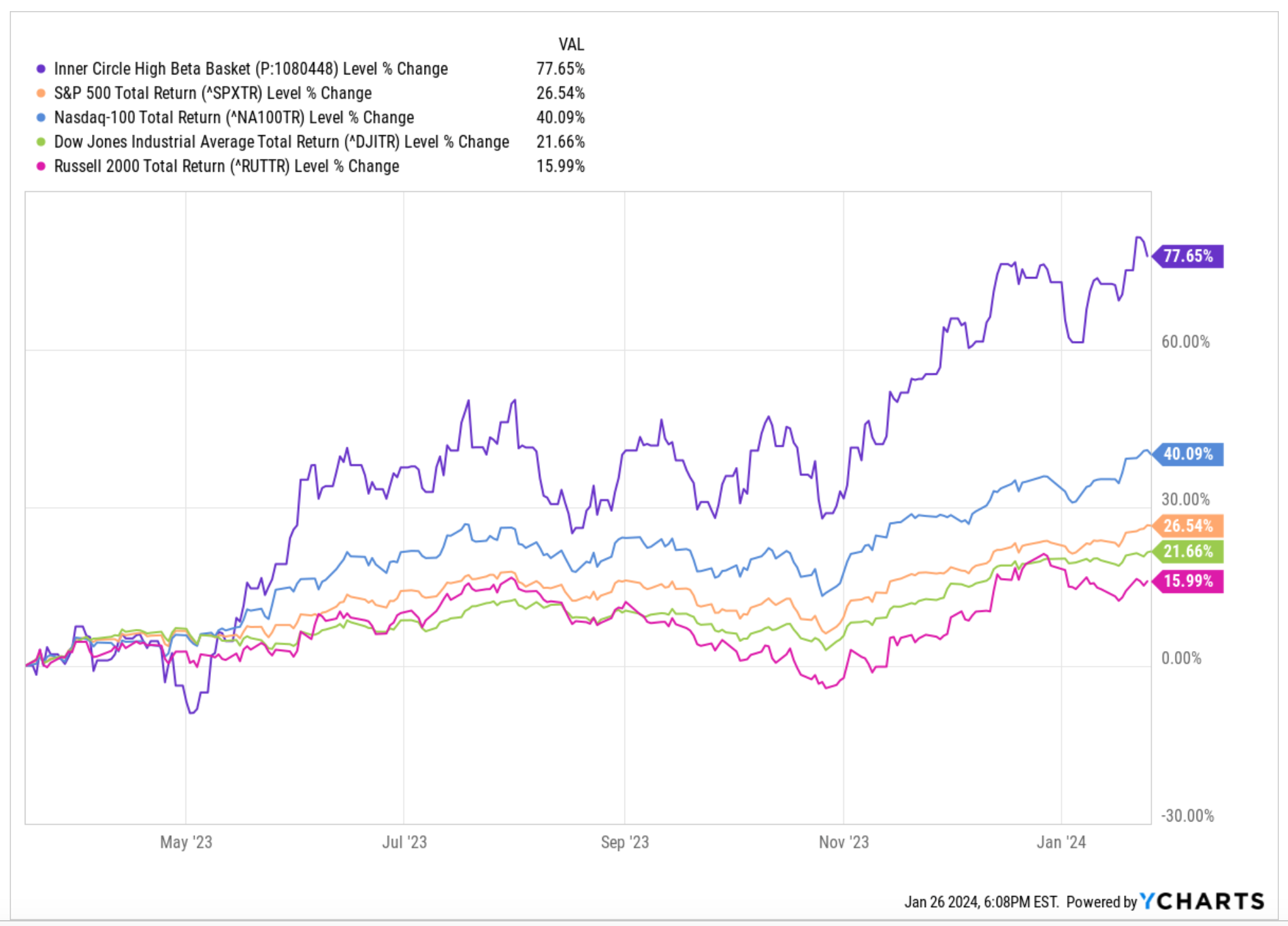

Inner Circle High Beta Stock Portfolio

This consists of high-beta software stocks. This is a 5-stock core portfolio, simple buy and hold, inception 17 March 2023. Returns are all on a total return basis - any dividends are re-invested into the stock that produced them. The portfolio was 100% deployed on day one and has seen no changes from inception.

Performance: +77.7% vs +40.1% Nasdaq vs. +26.5% S&P500 vs. +21.7% Dow vs. +16.0% Russell 2000.

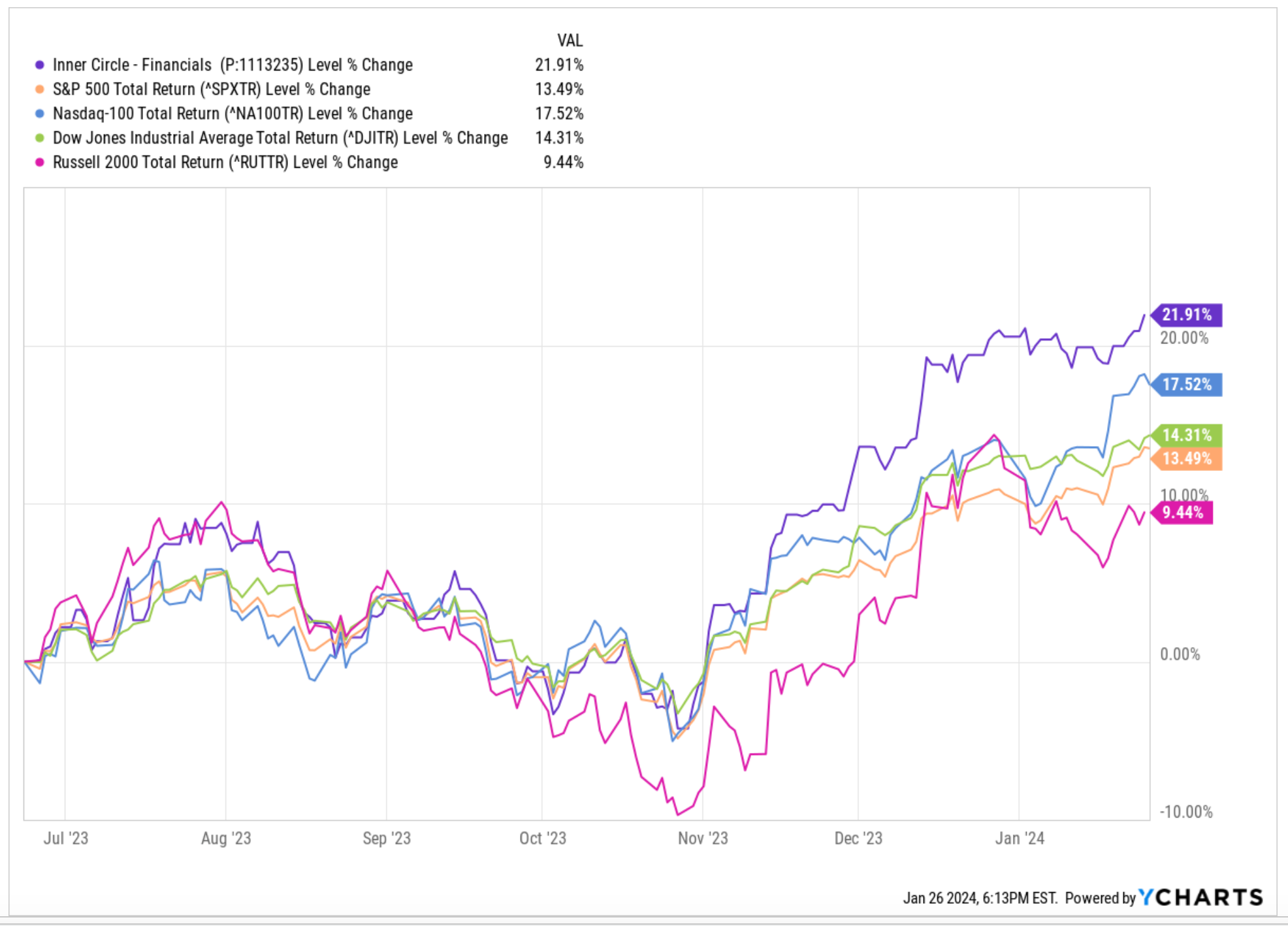

Inner Circle Financial Stock Portfolio

This consists of financial sector stocks. This is a 5-stock core portfolio, simple buy and hold, inception 23 June 2023. Returns are all on a total return basis - any dividends are re-invested into the stock that produced them. The portfolio was 100% deployed on day one and has seen no changes from inception.

Performance: +21.9% vs. +17.5% Nasdaq vs. +14.3% Dow vs. +13.5% S&P500 vs +9.4% Russell 2000.

Any questions at all, please post them in Slack (if you’re a paying member) or in the comments field below.

Cestrian Capital Research, Inc - 26 January 2024.