Initiating Coverage Of Synopsys At Hold

Like Cadence, But Better

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

We Can Keep It Brief

Before you read this note, be sure to have caught up with our recent work on Cadence Design Systems - specifically this note. The key take-away as regards Synopsys is the outperformance of SNPS vs. CDNS stock since around 2016/17. My supposition was that this arose in part from the former’s earlier move to (1) subscription revenue vs. upfront license sales but in the main because of (2) its also-earlier move to sell more intellectual property licenses and less software subscriptions. In this case, intellectual property means chip designs; either whole IC designs or, more commonly, elements of a whole-IC that other chip companies use on their own larger devices. For instance a fabless semiconductor company like Broadcom ($AVGO) developing integrated communication ICs might license specific i/o protocol IP from an IP licensing business such as $SNPS. This is how $AAPL produces its own CPUs; it licenses the CPU design from $ARM.

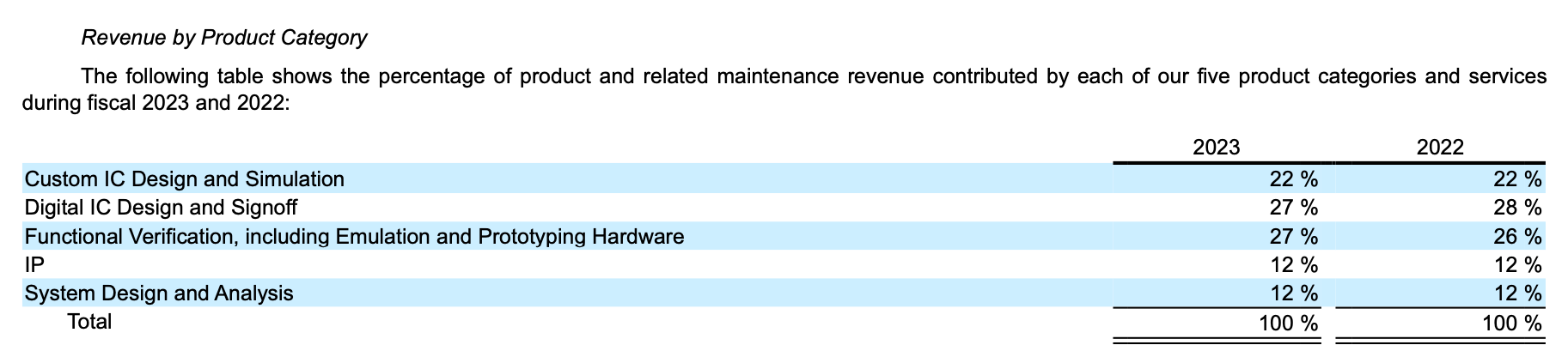

It turns out that this is true. Here’s the revenue split at Cadence - for the full year ending 31 December 2023, 12% of CDNS revenue was intellectual property licensing.

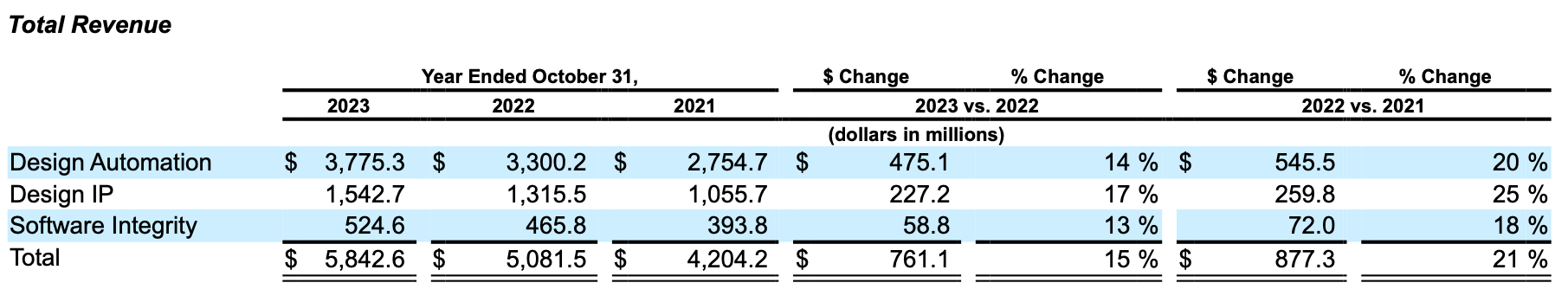

Whereas at Synopsys, the equivalent number is 26% ($1542.7m/$5842.6m) for their financial year ending 31 October 2023. You can see that at SNPS, IP is also the fastest-growing segment.

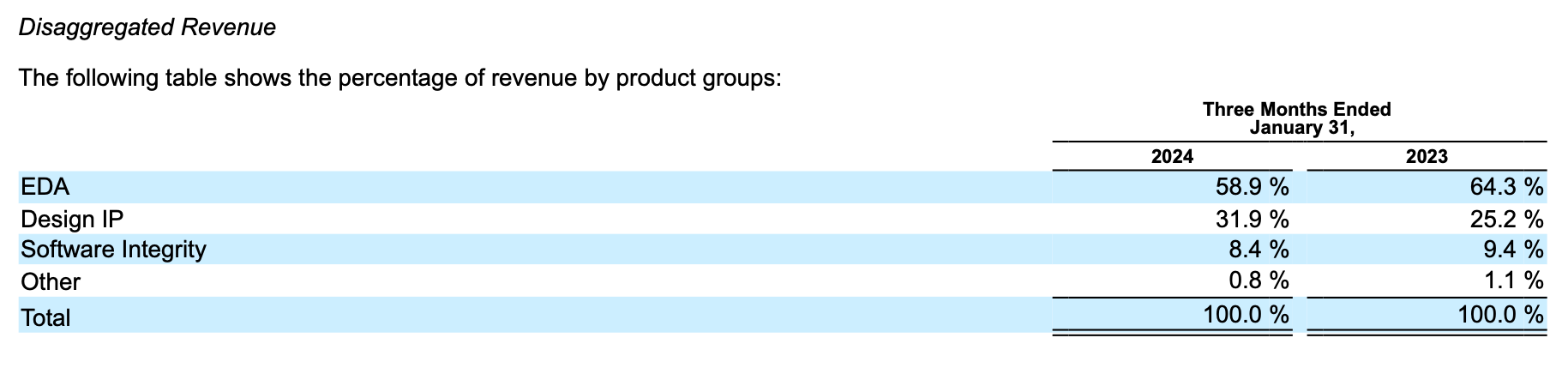

In the most recent quarter at SNPS, 31 January 2024, the proportion is up once more, to 32%.

The performance of one stock relative to another is always for myriad reasons, only some of which have to do with the underlying issuer, but some of the delta can be explained by that weighting of IP revenue above.

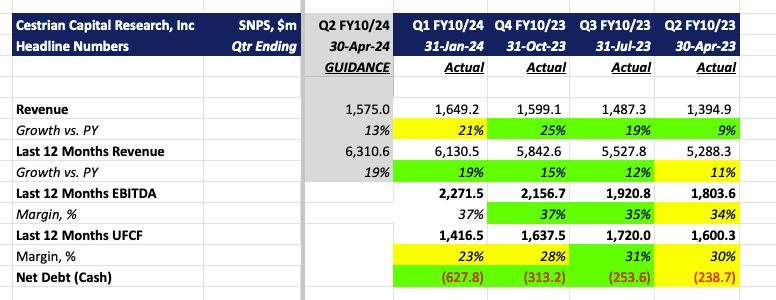

Anyway, here’s the headline numbers for the quarter just posted.

Let’s now take a look at Synopsys fundamentals, technical analysis of SNPS stock, valuation multiples, and our rating.