Initiating Coverage Of Broadcom At Hold

Not Your Grandparents’ Chip Business

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Charts Win, Again

Once upon a time in prehistory, let’s call it the early 2000s, Broadcom (the ticker was BRCM back then) was a pureplay communications semiconductor business. And red hot it was too, most of the time. It developed and acquired element after element of many of the difficult bits and pieces you need for wireline, fiber, and wireless comm. The stock was high-high-high-beta as a result. Wonderful on the way up and terrible on the way down, if you were a long-only investor at any rate.

Today’s Broadcom - ticker $AVGO - isn’t that company. It is rather a strange beast, in truth one big leveraged buyout portfolio that happens to have a public stock ticker. The revenue line is an unholy admixture of highly volatile semiconductor products, and deathly-boring enterprise software subscriptions. The stock has behaved of late as if it is a pureplay chip company, but, it isn't, so, don't expect it to be.

I think the best way to invest in or trade AVGO is purely on technicals. The fundamentals aren’t very helpful, because you can’t really track any trends - the company is a serial acquiror and so comparing this quarter to the quarter a year ago is usually pointless.

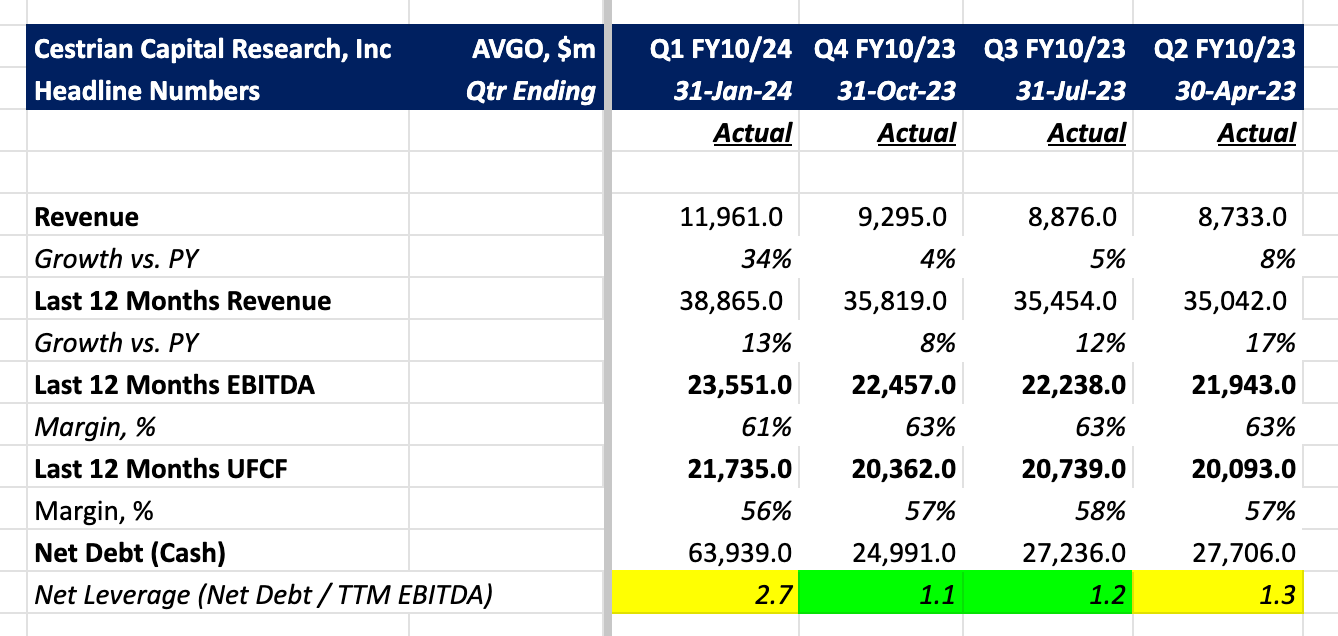

The one number to keep an eye on I think is leverage, which is to say Net Debt / TTM EBITDA (or if you want to get cute do Net Debt / TTM unlevered pretax free cashflow ... much uglier usually!). Right now leverage is relatively high for a public company at 2.7x, but that's because the full EBITDA contribution from the recent VMWare acquisition is not yet included in the TTM EBITDA calculation. So leverage should drop in the next couple quarters apropos of nothing other than time passing. If leverage starts to look ugly - say >4x Net Debt / TTM EBITDA - it's time to start to worry, but for now thing continues to lever up, acquire, extract money from the quarry, delever, rinse and repeat. This is a game of sorts, it's not a pure way to build a business, but as long as you are good at the game - and this company is - it's fine. Generally speaking conglomerates like this one will one day be broken up, be it by the FTC, the DOJ, or by activist investors, but that day is not today.

Here's the headline numbers up to and including the most recent quarter.

Read on for the full set of fundamentals, valuation analysis, technical analysis, price targets and our rating.