ZScaler (ZS) Q2 FY7/24 Earnings Review

- ZScaler remains our top pick in cybersecurity, post-earnings selloff notwithstanding.

- We explain our logic below, together with technical and fundamental analysis.

- There’s useful material in this note re. technical analysis, worth reading even if you care not a jot about ZS.

- Read on!

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Why Scalability Matters

by Alex King

ZScaler (ZS) reported its Q2 of FY7/24 on Feb 29 after the close. The stock was around -10% at the time of writing (2250 Eastern, March 04) - but the print was good.

Before we delve into the detail I want to rehearse why ZS is our top pick in the cybersecurity sector. This is based on three reasons.

- Superior technical and economic scalability. From inception, ZS has provided an entirely in-network security service. Customers are not required to use proprietary hardware (as they are with Palo Alto Networks or Cisco, for instance), nor to install proprietary software on their own hardware devices (as they are with Crowdstrike and others). Centralization of security means a more scalable product - each additional network resource placed within the ZS perimeter should present no meaningful burden to the ZS infrastructure - and lower cost, because customer IT staff are not required to carry out extensive rollouts.

- Superior execution. The ZScaler founder-CEO Jay Chaudhry is on his sixth owner-operated software company. Management is a learned skill and repeated experience can help the committed manager raise their game continuously.

- Fundamental financial strength. Large forward order book, high degree of prepaid sales, steadily increasing cashflow margins, rock solid balance sheet, etc.

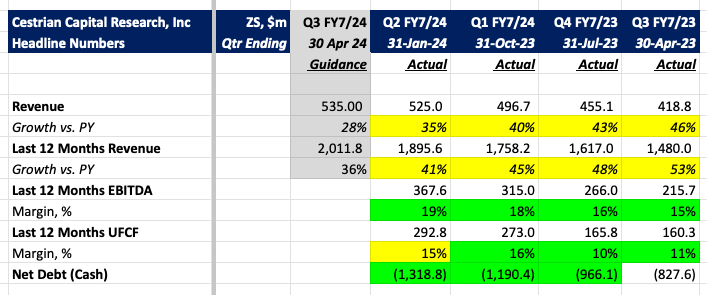

Here’s the headline numbers as of this quarter, including guidance for next quarter.

In short:

- Revenue growth continues to fall - now +35% growth vs PY in the quarter / +41% vs PY on a TTM basis.

- EBITDA margins continue to climb - now 19% on a TTM basis vs. 13% a year ago.

- Unlevered pretax free cashflow margins dropped a touch this quarter - to 15% down from 16% last quarter - but the trend remains up.

- The balance sheet now features $1.3bn net cash - enough to keep the wolf from the door.

This tells a story of a company which continues to mature - that’s why growth rates are falling - but which is navigating the move to lower growth / higher margin rather well.

Let's turn to the stock price outlook, more detailed financials, valuation analysis, and our rating.

I recently intiated a new position in ZS just before the close on March 01, 2024. To learn more about the specifics (short-term/long-term, Long/Short) read on !!

Members of our Inner Circle Service get real time trade disclosure alerts. To learn more about the Inner Circle Service, click here.

Get our 🎥 content, click here and subscribe.

Not a paying member? Subscribe for fundamental and technical analyses of 40+ stocks. Hit the button below now!

Technical Analysis

Here's how we see the stock longer term. You can open a full page version of this chart, here.

ZS stock followed a pattern common to many high-beta 2021 heroes come the 2022 rate hike cycle. Which is to say it dumped nearly 80% of the value created between the Covid lows and the 2021 highs!

The stock entered what looks like an institutional accumulation pattern - sideways action, rangebound at the lows - in May 2022, in common with most such names. In our minds we all believe the 2022 bear market took until October 2022 to stop and find support. That’s untrue. Stock after stock commenced accumulation patterns in late Q2 2022; ZS is no exception.

Here's how we see the stock shorter term. You can open a full page version of this chart, here.

On a shorter term basis, the stock is trading nicely to technicals, as follows:

- From the bear market low (struck late, in May 2023) of $85, the stock put in a Wave 1 up to $164, peaking in June 2023.

- Then a shallow Wave 2 down, only a .382 retracement to around $131, bottoming there in August 2023.

- Wave 3 peaks at a perfect 1.618 extension of that Wave 1 placed at the Wave 2 low. And I mean perfect. Peaks at $259 in mid February.

- Wave 4 is currently underway. Often a Wave 4 will feature an A-B-C correction, which is to say an A down leg, a B countertrend move up, then a C leg down. More often than one might expect, A-B-C moves terminate at A=C which in this case would mean a Wave 4 low around $195, which would also be the 50% retracement of the Wave 3. The Wave 4 down could go lower - anything above $164 remains a viable chart - but I would be surprised if it fell that far.

- Wave 5 may terminate somewhere in the $270-300 range - that’s the typical W5 termination zone between the .618 and .786 extension of the Wave 1-3 combined, placed at the Wave 4 low - and here I assume the Wave 4 low is the Wave 1 high, so that’s a cautious outlook.

Let’s take a look at the detailed numbers.

Fundamental Analysis

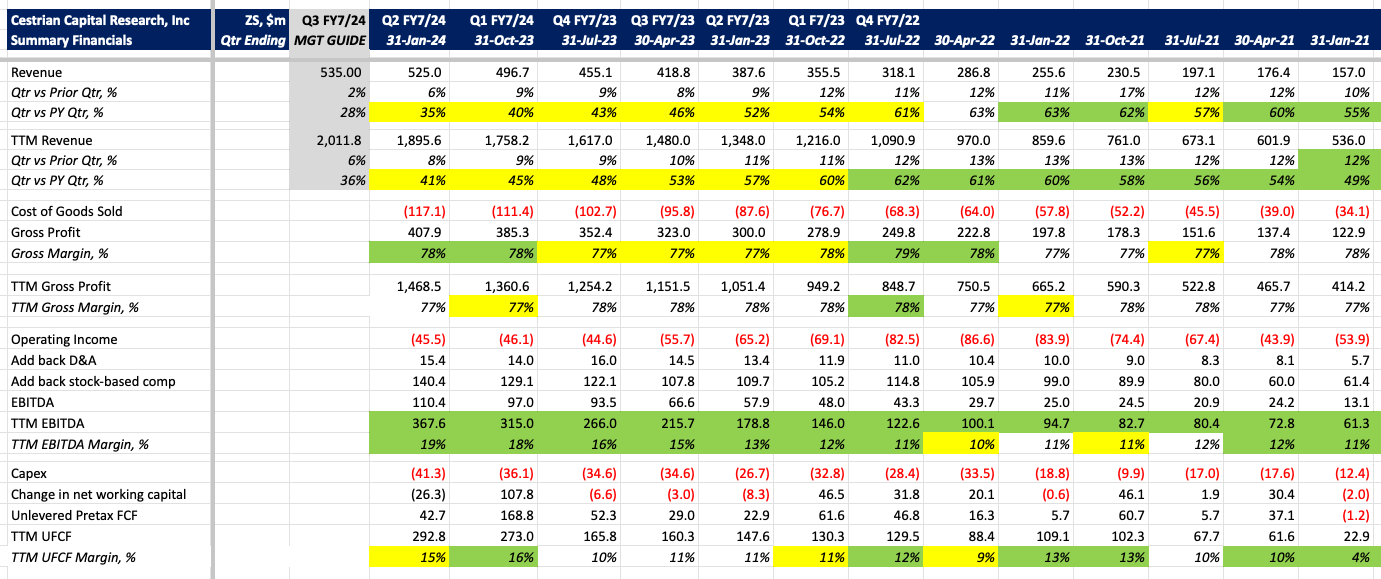

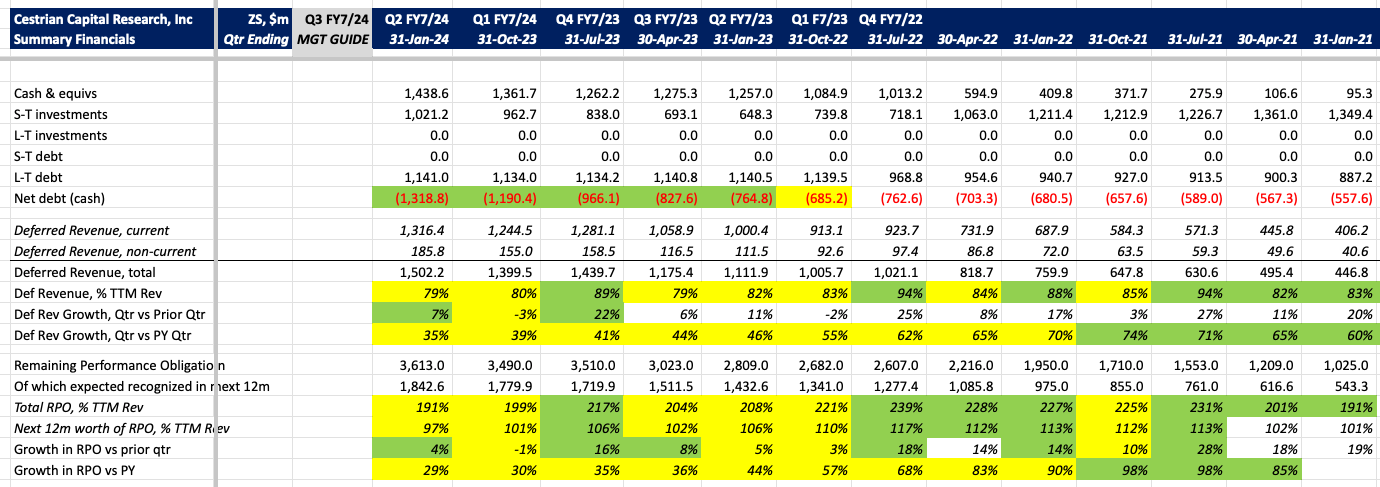

Here's our detailed take on Zscaler fundamentals.

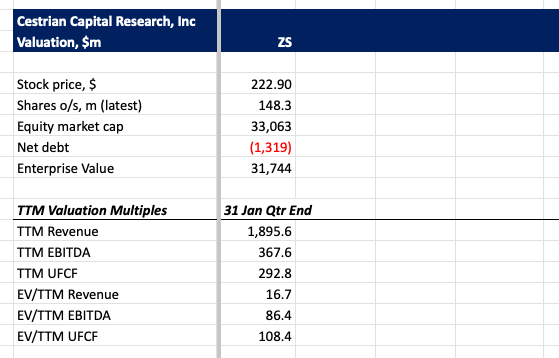

Valuation

The stock is expensive on any measure. For me personally that’s not a reason to sell.

Stock Rating

We rate ZS at Hold. We had this name at Accumulate between $85-166. Now $220.

I bought a new SHORT TERM long position in the name just before the close on March 01, 2024.

Members of our Inner Circle Service get real time trade disclosure alerts. To learn more about the Inner Circle Service, click here.

Questions?

If you have questions about any of the numbers, charts, anything, reach out in chat.

Cestrian Capital Research, Inc - 4 Mar 2024.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in ZS.