ZScaler Q4 FY7/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Back Into The Accumulation Zone - Again!

by Alex King, CEO, Cestrian Capital Research, Inc.

ZScaler printed perfectly good numbers yesterday after the close, but since the market is once again self-harming using the Vix as its weapon of choice, the stock decided to take one almighty dunk. Down about 18% by the close today, which means we move back to Accumulate rating from our prior Hold rating.

$ZS remains our #1 pick in cybersecurity.

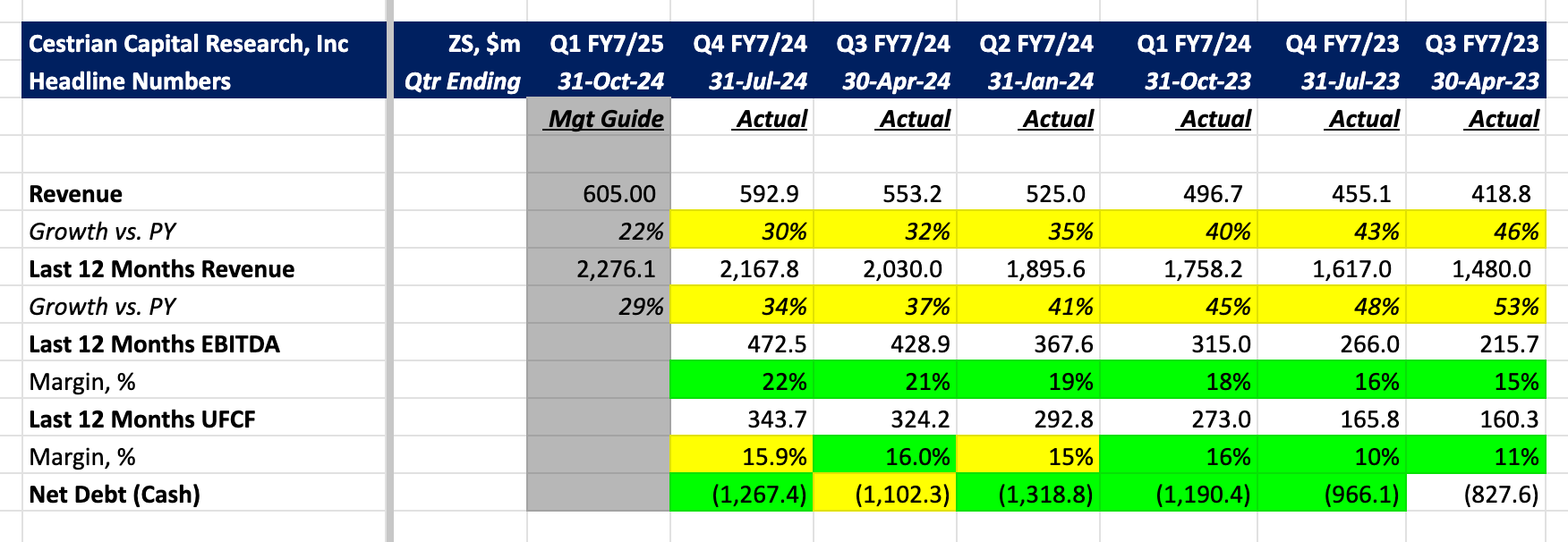

Here's the headline numbers.

So, read on!

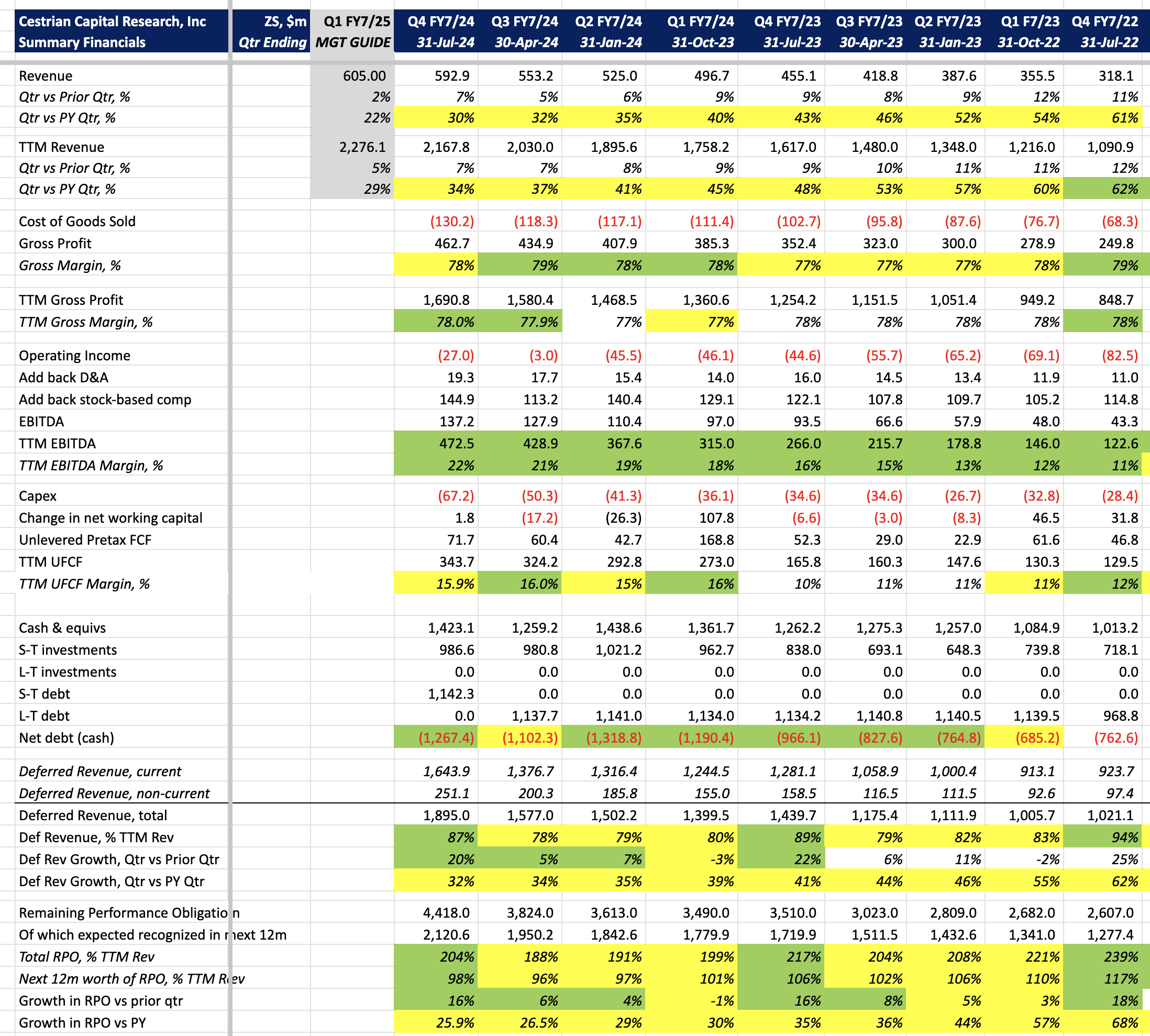

Financial Fundamentals

The company continues to see modestly decelerating revenue growth and, indeed, order book growth. Cashflow margins are flat at around 16%, with revenue growth in the 34% range (both on a TTM basis). The company has some $1.3bn of net cash on hand and generates positive unlevered pretax free cashflow every quarter. The order book ("remaining performance obligation") now stands at >2x TTM revenue, and it continues to grow at +26% vs. prior year.

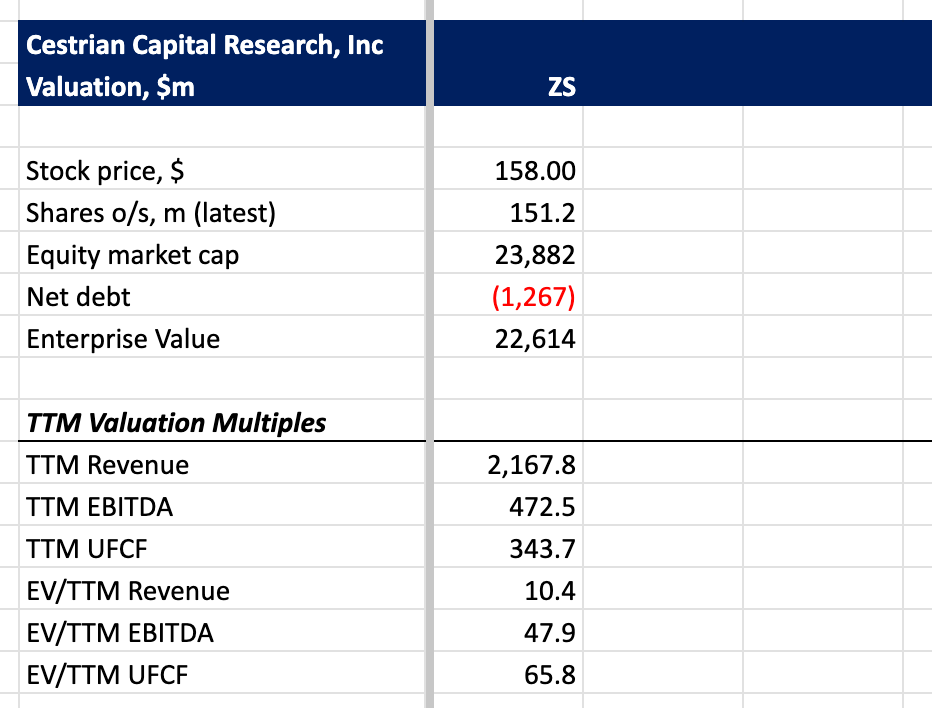

Fundamental Valuation Multiples

At 66x trailing TTM unlevered pretax FCF I really don't think this thing is all that expensive. Nvidia is cheaper - but then Nvidia is cheaper than most things as a function of cashflow growth (even though everyone thinks NVDA is in a giga bubble!).

Technical Analysis

Here’s our longer-term chart on ZS. You can open a full page version, here.

Rating

We rate $ZS at Accumulate between $74-167/share.

Cestrian Capital Research, Inc - 4 September 2024.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in $ZS.