Zscaler Q1 FY7/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Full of Promise

By HermitWarrior a.k.a. Richard Iacuelli

To look at Zscaler ($ZS) is to see seemingly boundless potential. As a leader in Zero Trust security, with - by their own calculations - an addressable market of $96B, it is perceived as one of the biggest beneficiaries of the eventual demise of legacy firewalls, more so given the backdrop of ever higher numbers of high profile cyber attacks that penetrate those same firewalls, and compromise the personal information of millions of people. What's not to like?

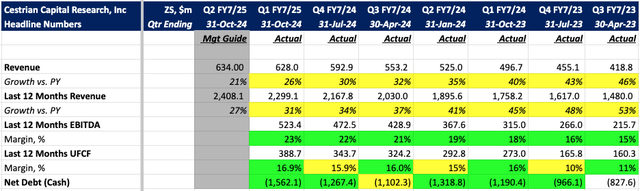

For now at least, ZS is not living up to that promise. Q1 revenue growth was a relatively sedate 26%, compared to 30% in Q4, and 40% in the year ago quarter - with guidance pointing to further deceleration in Q2. In comparison, CrowdStrike ($CRWD) managed 28.5% yoy growth, and Cloudflare ($NET) 28.2% in their most recent quarters (you can read our earning reports for CRWD here and NET here).

The initial 10% post-market dip softened to just under 5% at the close the next day (and recovered much of that today) substantially better then the 18% drop after Q4 earnings. In effect, the market responded with a shrug, despite a valuation that has ticked up considerably in the intervening months.

Here are the headlines.