What If ... ?

Don't discount this possibility.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

What FinTwit Isn't Saying

After a long week spent creating stock charts, what I like to do at the weekend is to watch videos of other people creating stock charts. One practitioner who is far from perfect but is way more entertaining than most chartists is the YouTuber PuppyTrades. If you haven't found this guy yet, you could try watching his latest video, here:

Personally I can live without the occasional conspiracy theory that Pup shares in his work, though I do love the rants against his own subscribers, Boomers, bears and the general "they" who are out to kid us all.

Anyway, aside from sharing this indulgent pastime the reason I mention Pup is that in the above video he posits a Nasdaq (and by extension S&P500) scenario which is outrageous to contemplate but may actually be on the cards, and if so, it would resolve a head-scratcher in our own work here at Cestrian.

The head-scratcher, and we've posed it many times in many places, is that younger, pureplay high beta cloud software stocks seem to be in a larger-degree Wave Three up. And yet Big Tech appears to be in a larger-degree Wave Five up.

This caused many Scooby-Doo style head swivels around here.

Why? Because it implies that Big Tech will be correcting hard after the end of a final larger degree Wave Five up, whilst high beta New Cloud Generation names will be rocketing upwards in a Wave Three up. We've considered and reconsidered this but every chart since has said the same thing - Wave Five up in Big Tech, Wave Three up in high beta. And that doesn't make sense.

Usually folks are only buying the scary names when the Big Tech names don't offer enough of an adrenaline rush anymore, so they go chasing the dragon with your $NET and your $ZS and so forth whilst $MSFT and its peers just keep on truckin. Folks don't generally buy scary tech if they're selling comfy tech. As 2022 taught us once more, if even Big Tech is tanking, literally nobody wants to buy minnows with a shouty CEO and a big EV/TTM revenue multiple.

But that's what our charts said. Big Tech to reach a W5 high and fade, whilst New Cloud Generation motored upwards in a W3.

And the only way we could make sense of this was to say, well, tech is due a generation change - remember our DNA here is three-decade pro tech investor, this isn't our first rodeo - so maybe it's time for tired old Apple and Google to move over and let the consumer choose something else for their phone, for Microsoft to allow the enterprise to go its own way, and for Amazon to fade away as e-commerce becomes fully immersive and less like a catalog. So you've seen us say, expect Big Tech to fade as it groans under the weight of its own monopolistic bloat, and expect the New Cloud Generation to move to the fore in the quest to define themselve as the new temporary monopolists. Because, we've said, regime change is in the air.

Now, this could be true. But revolutions generally take longer to succeed than anyone expects. The initial putsch in the town square is rarely the decisive moment.

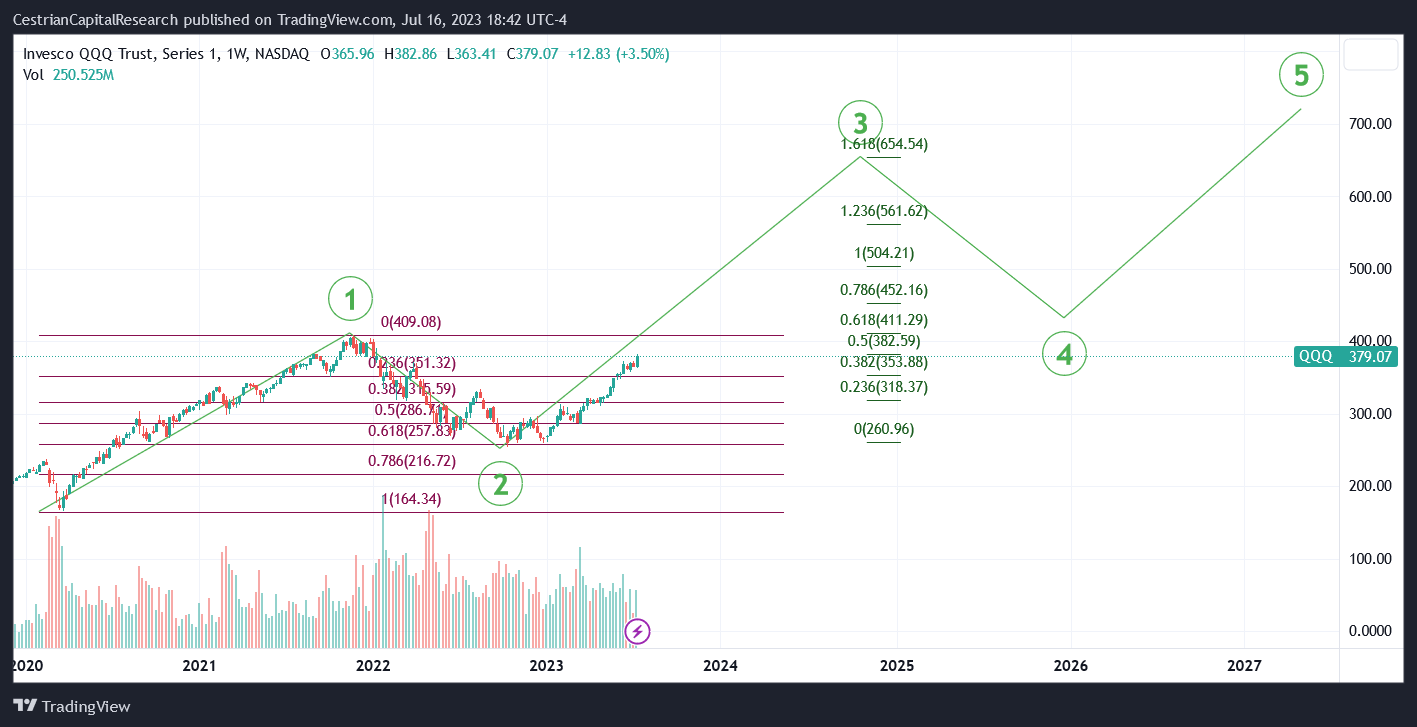

Puppy in that video (the YouTube guy, not the handsome four-legged chap above) made a point though, one which resonates with us and may square the circle. If you look at his older videos, his index charts and ours use similar methodology with similar conclusions. Our QQQ chart, for instance, looks like this (click here to open a full page version):

Textbook Elliott Wave & Fibonacci extensions / retracements - right? So the Qs are in a Wave 5 up that ought to finish somewhere in the mid to high $400s before a significant correction of that whole move up since the 2018 lows. What would cause that correction? A deflationary bust? A war with China over Taiwan? A tactical nuclear event in Europe? Who knows. Something big.

You see therefore why it's hard to reconcile that chart with say this chart:

DataDog, a poster child of the New Cloud Generation, in a Wave Three up.

Or this chart:

Cloudflare, the company whose mission statement may as well be, Pwn The Internet, in a larger-degree Wave Three up.

Well, this is one way that it could be reconciled, and this is the point in the Puppy video. And that is, if the QQQ chart looked more like this.

Which is to say, what if the Covid lows were the start of a new Wave 1, not a Wave 3? Certainly the 2022 retracement, a perfect 0.618 of the move up from Q1 2020 to the final quarter of 2021, can pass muster as a Wave 2 down. And if true we may see QQQ continue to climb to the $650 zone as the Presidential election approaches. Certainly the current Nasdaq behavior 'feels' a lot more like a larger degree Wave Three (unstoppable) than it does a Wave 5 (last hurrah before a selloff).

We'll know in due course - if the current move up in the Nasdaq doesn't terminate in the mid-400s then sell off, we may well be in a proper larger-degree Wave 3 up until the end of 2024 or so. So we would say this - it is possible that the Nasdaq - and therefore the S&P - is going to keep surprising to the upside, so you have to think about how to manage this.

In staff personal accounts we are heavily long tech in our retirement accounts; and we flip long, short, long, short in our index ETF trades. That's been working out pretty well save for a stranded long SQQQ (3x short Nasdaq) position - a hedge against a long TQQQ (3x long Nasdaq) - which is underwater and which we've had to overhedge using UDOW and TNA in order to generate realized gains in the Dow and Russell indices such that SQQQ owes us a lot less. We'll get there with this, but it has been hard work. It certainly feels like shorting a Wave 3. (Again, we have TQQQ to enjoy the Wave 3; we just don't like selling index ETFs in the red, so for now, we will be keeping SQQQ and chipping away at it).

We'll keep you posted on this stuff. Just be as ready for the Nasdaq to moon as you must be for the Nasdaq to be doomed.

Alex King, Cestrian Capital Research, Inc - 16 July 2023.

DISCLOSURE: Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, SQQQ, DDOG, NET, SDOW, TZA, SPXU.