Welcome To The Family!

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Good Job We’re Not Proud

In the last month we’ve launched three new low-cost paid services, providing short-term swing trading opportunities in (1) futures (2) equity and commodity ETFs, and now, (3) single-name stocks. These services are each led by people who don’t work for Cestrian Capital Research, Inc. They are, in fact, independent services that we’re delighted to host on our Cestrian Stock Symposium platform. And together they’re off to a wonderful start; one of our most popular moves yet. Good job we have no ego about this stuff - in fact we’re delighted, it means we can spend less time worrying about securities pricing and more time ordering mojitos.

Anyway, the point of today’s note is to introduce you to Adam Santana of L2T Securities, LLC. Adam is a lawyer by training, and a trader by choice. For some time now he has been posting very compelling swing trade ideas in our various chatrooms; we’re delighted to host Adam’s new pay channel, Trader’s Perspective.

Adam’s focus is on finding long- and short- swing trade opportunities in single stock names and in equity index ETFs. The work is purely technical and unemotional in nature. We’ve seen Adam time and again calmly make great calls when euphoria or despair was washing over many market participants. NVDA at $500 following Q2 earnings? Adam called a local top. Righteously so, as it turned out. about to break out prior to its sale to $CSCO? Adam correctly called a long opportunity. Like that. Long, short, all just a chart. Unemotional.

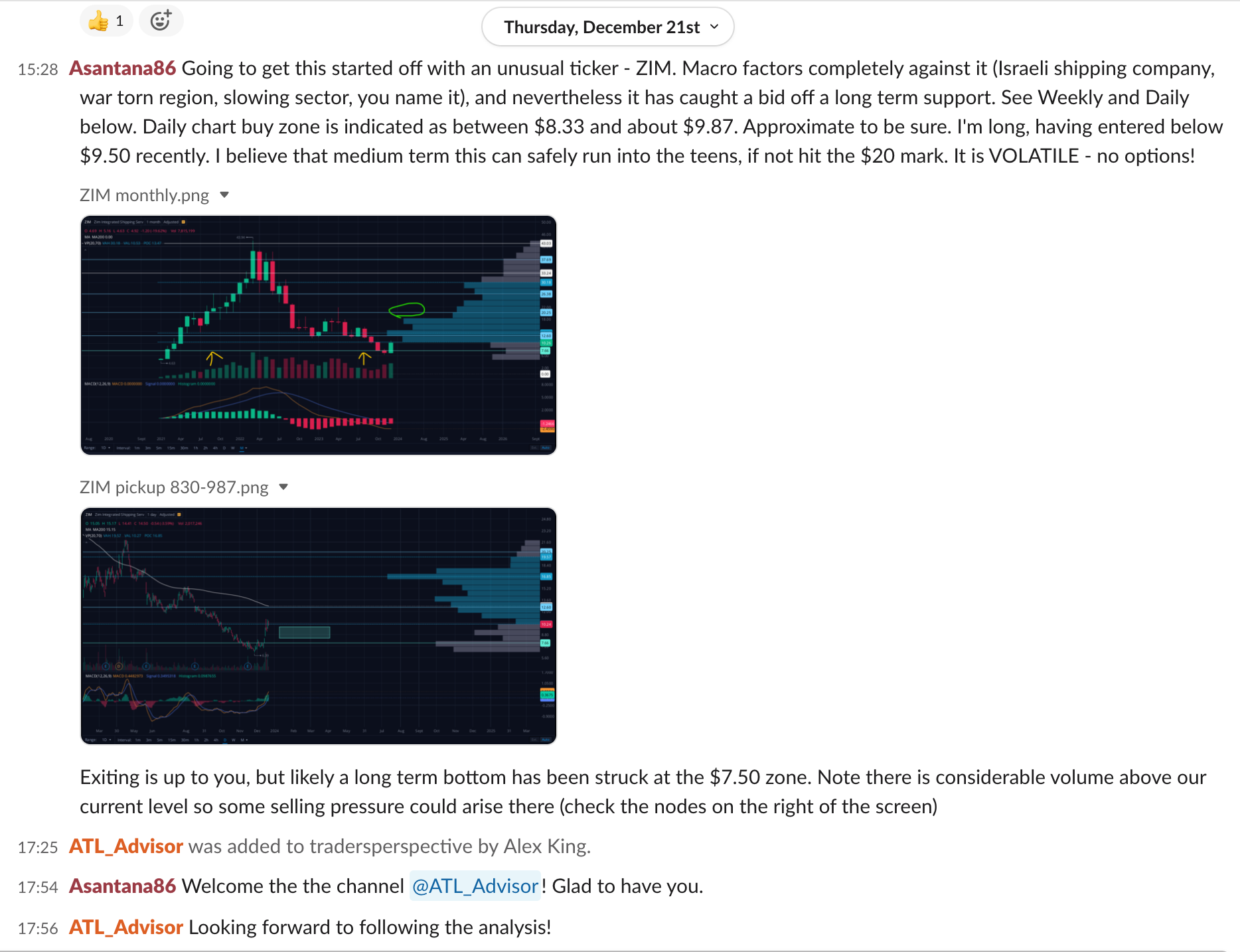

This is what the service looks like:

Here’s a handful of Adam’s successful 2023 ideas. Note that in each of his published ideas, risk management is built in; this isn’t a hero-or-zero service; this is a ‘try to spot attractive risk/reward entry points, take profits when we can, close out small losses when we have to’ approach.

--August 15-18th: called long buy zone at around $95ish; closed out this trade by 30 Aug for a +21% gain.

--Feb 28th – long day trade alert via calls on 5 minute chart (inverse head and shoulders analysis post). Hit within hours and closed.

--May 16th – called a long trade to fill gap from 51 to 57, then turn that into support; this played out well.

--May 31st – long calls trade which hit within 6 days….then posted again on 7/13/23 showing percentage gains. Again on 7/31 (150% gains).

--August 29th – analysis identifying LT price buy zone in low 412-416.5 area with green line at 410 (chart was posted). On 10/3 reposted the same chart and on 10/26 indicated “adding to positions across the board” in SPY and IWM - both are up very significantly since then (IWM +24% since 26 Oct; SPY +15% since the same date.

---Sept 14 – $PINS called a long trade at $25ish, with support at $21 with a price target of $37 (target hit on 12/14).

--Sept 26 – $DIS … pointed out long term price support and indicated “buy” at 79/80 area on posted chart. It then double bottomed at same price in early October, again in late October, and has risen since. This trade remains open; stock is up +12% since that buy call.

We could go on.

If you’d like to learn more about Trader’s Perspective, just click here.

The service is priced at an introductory $497/yr if you sign up before 15 January 2024. Thereafter it will be $797/yr or $97/month. If you sign up at the introductory $497/yr rate, you’ll keep that price for as long as you remain a subscriber.

Any questions, hit us up in comments to this article.

Cestrian Capital Research, Inc - 28 December 2023.