We Initiate Coverage Of Micron At Hold

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Think Different.

by Alex King

If you are going to follow Micron ($MU) stock, you have to think differently. This is a semiconductor business, but it's not like AMD or Nvidia or Texas Instruments or Analog Devices or any of these kind of names, and that's for two reasons.

- One, it's an integrated device manufacturer, meaning, it owns and operates its own factories producing chips. This is a nightmare of a business to run because it eats capex and belches out toxic waste in any number of physical states from solid to gas and probably plasma too on a bad day.

- Two, it produces memory - DRAM and NAND - exclusively, and this is a nightmare of a business to run because it is both commoditized and highly price competitive and yet still requires incessantly huge levels of investment in R&D and capex to stay ahead of the other two or three global competitors.

In short it is a nightmare of a business model. Predictable subscription software business this is not.

In addition the chart alternates between being so rangebound even a Jedi master would doze off, and being so volatile that you wouldn't put your keep-safe money anywhere near it.

Apart from all this though, it's no trouble at all.

Oh. One more thing. This:

So, we commence coverage of this name at what appears to be a pivotal moment in the stock's story. Wedge patterns like that tend to resolve violently; in my experience it is difficult to predict in which direction. Looking at it another way though, that $98 all-time high that has proven rock-solid resistance for, yup, 24 years (!) - this is a decisive level and it's very close to the current price - today's close was $94. Sometimes with technical analysis, simple is best. In the short term we can say that for MU, >98 = bullish, and <98 = bearish. One way to trade this kind of setup with a long position is as follows:

- A buy-stop order above the key level - say $99, 100, 101, whatever.

- With a sell-stop order placed a little below the key level - say $95, 94, 90, whatever.

This way if the stock never clears the key level, your buy order never fills. If the key level is cleared and you buy order fills, your downside is limited to just a few dollars per share before your sell-stop kicks in. If the stock starts moving to the upside and you are (quite reasonably) freaked out by the volatility in this name, you can always move up the sell-stop order or place a trailing stop order (probably not too tight given the volatility).

This method would work to play IWM long too by the way - key level $200 - all the same logic above applies.

Anyway, let's take a look at the fundamentals, valuation, our more detailed and recent technical analysis, and so on.

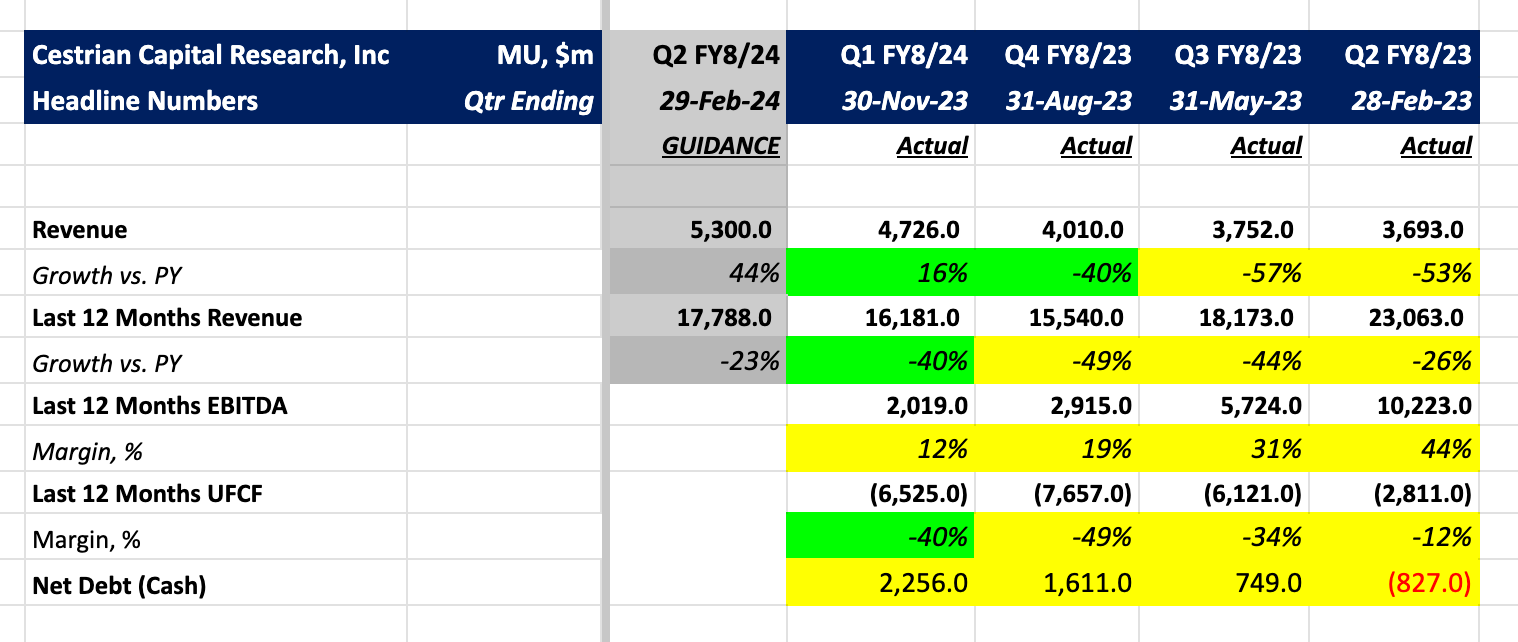

(Here's the headline numbers by the way. They don't tell much of a story. Want the story? Read on.)