Want To Know What's Happening In Semiconductor? Read Our Cadence Design Systems Q2 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Orders Good, Cashflow Not So Good

by Alex King

Cadence Design Systems ($CDNS) reported its Q2 of FY12/24 yesterday after the close.

Even if you've never heard of $CDNS, its numbers are market-important right now. The company is one of two primary suppliers of design software and design licenses to the semiconductor sector (the other is Synopsys, $SNPS). If CDNS is doing well, it means semiconductor companies are buying more design tools and more circuit design licenses. And that's good for semiconductor. And since semiconductor has led the market up since the Q4 2022 bear market lows, good for semiconductor means good for the market. The converse of all the above is also true.

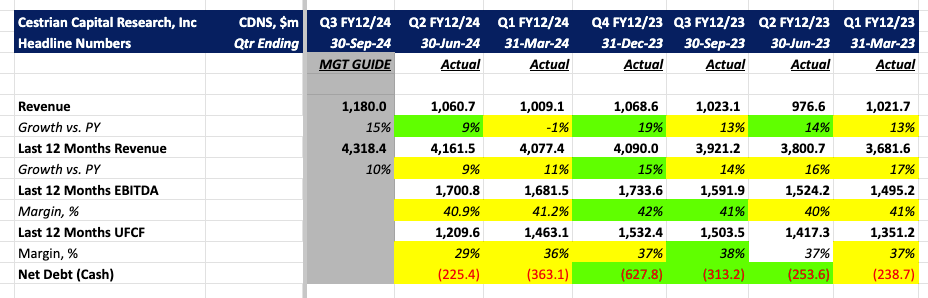

This quarter, $CDNS delivered:

- Accelerating revenue growth (+9% qtr vs. prior year qtr, compared to -1% qtr vs. prior year qtr in Q1)

- Declining cashflow margins (29% TTM unlevered pretax FCF margins, vs. 36% last quarter and a recent high of 44% in March 2022)

- Improving order book growth (RPO +13% vs. prior year compared to +11% last quarter and recent lows of -5% in June 2023)

- A modest weakening of its balance sheet, now with $235m net cash ($874m gross cash).

Here’s the headline numbers as of this quarter, including guidance for next quarter.

Paying subscribers, scroll down for our price target, rating, fundamental and technical analysis. Yet to join us as a paying subscriber? Choose your tier from the links below. If it's Inner Circle you're interested in, join up in July - prices rise 1 August.