Vertiv Holdings Q4 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Just Remember To Hop Off The Ride Eventually

by Alex King, CEO, Cestrian Capital Research, Inc

To state the blindingly obvious, datacenter spending is in a boom right now. And since everyone knows that, everyone is buying the stocks of all things datacenter related. The buying is fairly indiscriminate, which is why $SMCI is moving back up despite narrowly avoiding delisting, etc. Now, Vertiv ($VRT) is not SMCI, but it’s not NVDA either. You can see that in the gross margins and in the cashflow margins - oh and also in the growth. Vertiv’s business would not pass the Buffett / Munger quality test; it has gross margins in the 30%s, meaning that it buys in a lot of stuff from other people, bolts it together and sells it on to still other people. When animal spirits are riding high, none of this matters - the stock can still moon - but when the tide goes out, VRT will most certainly in my view be found lacking in sufficient protection of its modesty. Absolutely everyone will see those 30% gross margins and say “oh well, this is a low gross margin company, I don’t want to own that!”.

Understanding where the market’s risk appetite lies is a critical element in knowing which stocks to own when. In the thick of a screaming bull market you can pretty much buy any liquid stock that is going up and which is issued by a reasonably solid company; use stops to protect your gains, move up the stops as the stock goes up, don’t expect to sell at the top, don’t convince yourself that you are an Investing Genius, take profits when things falter and your moved-up stop trips, then move onto the next name. Don’t re-visit the scene of the crime. VRT is a perfect example of this. When everyone is fussy about which company issues stock and how that company makes money and whether if Graham & Dodd were to be reincarnated they would post their approval on X … not such a great time to own VRT in my view.

VRT stock dumped bigly of late. We had set a “distribution” (sell) price target in the range $114-144/share. The stock topped out at $155 and is now at $108. Let’s take a look at the company numbers and where the stock may move to next.

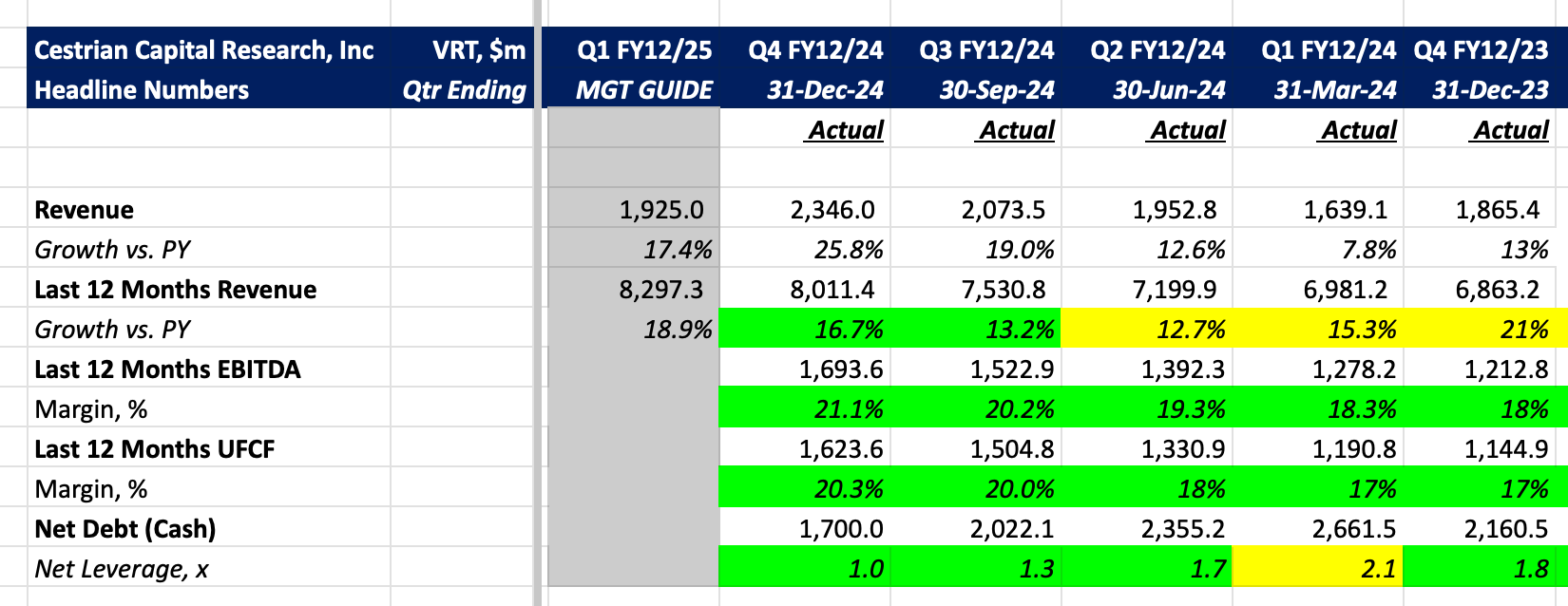

Here’s the headlines.

Now for the rest.