Vertiv Holdings Q3 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

It’s A Meme Stock Jim, But Not As We Know It

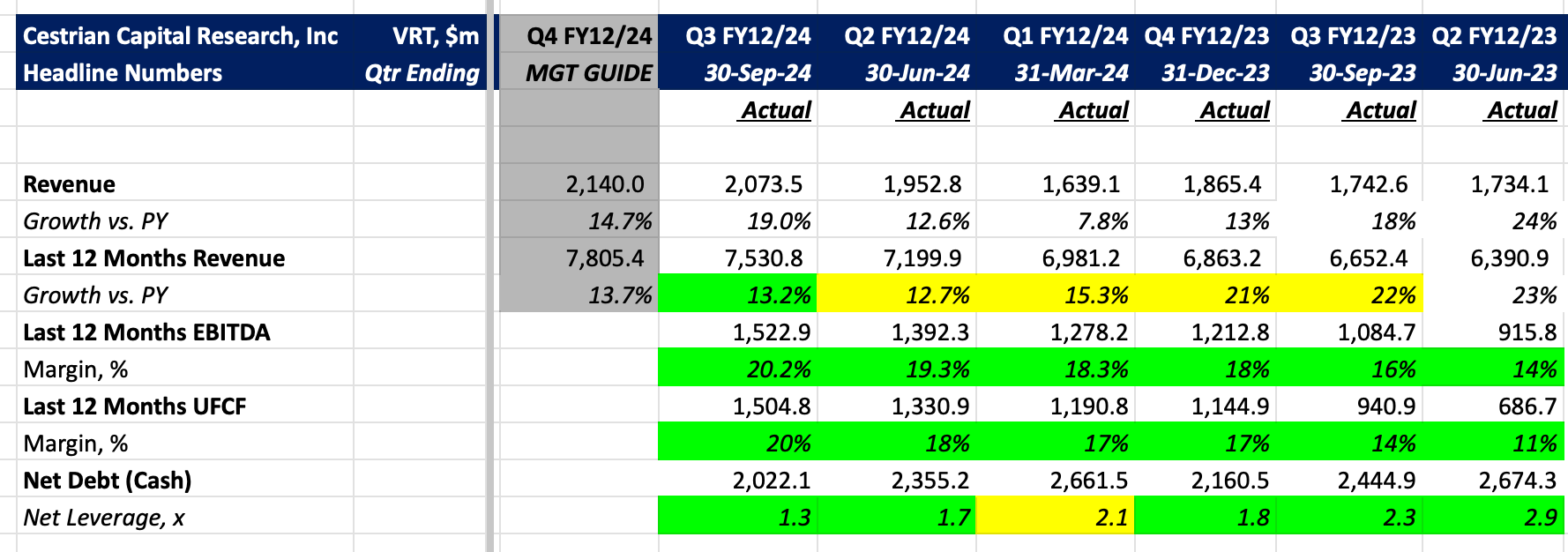

First up I should say that I have not participated in the runup in $VRT; the same is true of $SMCI. Both stocks have been major beneficiaries of the AI capex boom and the AI stock boom - they are analytically different things by the way - because the companies that issue these stocks are major datacenter suppliers. They are not, however, particularly good quality businesses. SMCI has had its own travails and we don’t need to revisit those here. Vertiv isn’t a terrible business - it’s currently clicking in 20% TTM unlevered pretax FCF margins on 13% TTM revenue growth - it is just a highly levered play on datacenter buildout.

If datacenter capex slows or more competition enters VRT’s segments, the negative impact to VRT’s growth and margins will, I believe, be disproportionate. Why? Because the company is a low-gross-margin assembler of components into subsystems. The company operates to low/mid 30%s gross margins, which is less than half that achieved by Nvidia or other silicon or software companies shipping proprietary products. Systems - assembly of third party components - is just not a very high margin business. This is not to say the stock cannot run higher, but I don’t believe there is much in the way of fundamental support at this level. Guidance for Q4 is for growth to slow vs. Q3; cashflow margins can rise of course but 20% is already high for this kind of business.

So, for me at least, VRT can best be played as a sort of meme stock. The volume up at these prices suggests limited institutional buying. I think this is probably a retail plaything at the moment, with a soupçon of grownup momentum traders in the mix too.

Here’s the headlines - more for subscribers below, including our rating, stock chart, and full financial / valuation analysis.