Veeva Systems (VEEV) Q1 FY1/2025 Earnings Review

Summary

- Veeva's financial performance continues to be good; however, a revenue guidance cut has resulted in overall pessimism about the stock.

- The stock appears to be under accumulation at current levels.

- Overall macroeconomic headwinds and a generally depressed Pharma/Biotech sector seem to be weighing on the company.

- Read on for detailed financial and technical analysis, as well as ratings.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Guide Lower – Beat – Repeat

By Abhishek Singh

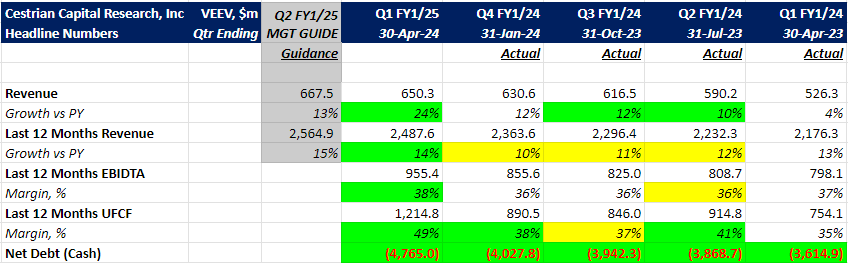

Veeva posted another decent quarter with all financial metrics coming in ahead of guidance.

- Revenue Growth increased by 24% year-over-year. Adjusted for a one-time impact related to the standardization of termination for convenience (TFC) rights, total revenue increased by 13%. This could indicate that the decline in revenue growth may have bottomed out.

- Both EBITDA and Cash Flow margins have shown improvement.

- Balance Sheet remains strong with $4.8 billion in cash.

However, despite these positive results, the market reacted negatively, with a 10% drop in stock price post-earnings. The trigger for this decline was another cut in full-year sales guidance. The company reduced its FY'25 total revenue guidance by $30 million to $2.7 billion, primarily due to a decrease in its services revenue stream.

Let’s delve into the details of the company's revenue streams.

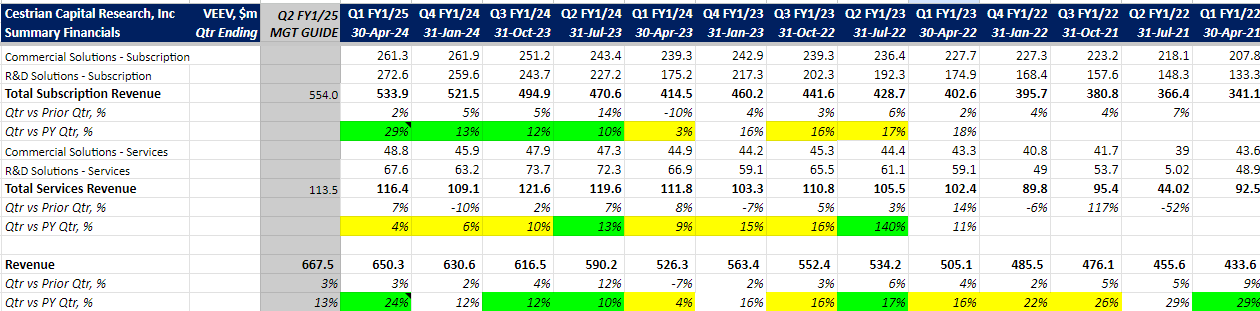

- Subscriptions: Fees from customers accessing cloud-based software solutions and data solutions.

- Professional Services: Fees for assisting companies in implementing their cloud and data solutions, along with training and business consulting services.

Veeva derives a relatively small fraction of its revenue from professional services, which has been declining steadily, as indicated in the table above. This decline can be attributed to macroeconomic headwinds, global conflicts, and a generally depressed Pharma/Biotech sector (the $XBI chart speaks for itself). Any positive changes in these factors could potentially boost Veeva’s revenue in the future.

On the execution side, Veeva won new customers, and the transition to its Vault CRM was reported to be on track. The company launched Veeva Vault Basics for companies with fewer than 200 employees. This solution allows smaller companies to use preconfigured, industry-standard processes managed by Veeva with no implementation cost. As these companies scale up, they can easily transition to the full Development Cloud. This strategy could further enhance the stickiness of Veeva’s products.

Veeva management is taking a cautious approach to Generative AI. They do not plan to develop or acquire GenAI solutions unless they are confident in providing differentiated value to their customers.

Despite some market pessimism, Veeva's financial performance and execution remain solid.

For our paying subscribers, we now dig into the full fundamentals, the stock price performance, our price target and rating. If you've yet to join the pay side, you can choose from three tiers of service from the button below. "Market Insight" gets you the basics, "Inner Circle" is our best work - and our new "RIA Insight Pro" is for you if you're an RIA focused on growing your assets under management.