Veeva Systems (VEEV) posts another decent quarter- here's what we think now

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Boring is not bad

By Abhishek Singh

Often, there are businesses that are talk of the town – everyone you know has an opinion about them, and the media hypes them up. These are the securities that often elicit a FOMO response from retail investors, resulting in the purchase of the stock at unreasonable prices, only to see the stock plummet shortly after to the depths of mordor.

Then, there are stocks that may not frequently make headlines, but consistently deliver decent performance quarter after quarter, quietly solidifying their position in their industry. Veeva Systems ( $VEEV ) is one such company - a leading provider of cloud solutions focused solely on the global life sciences industry. The company recently posted another decent quarter, with results surpassing guidance.

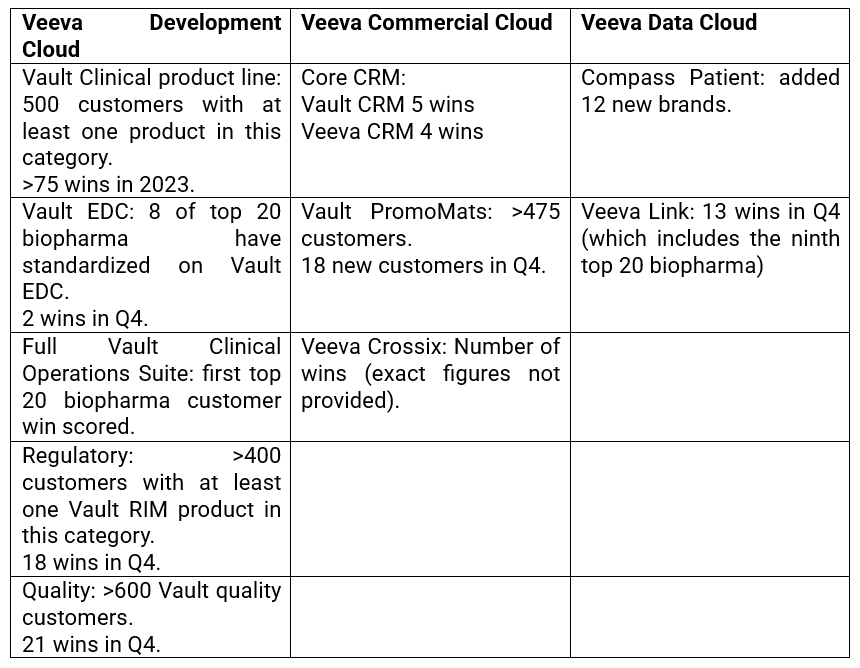

VEEV scored several wins in 2024, as summarized below:

Abbreviations: EDC- electronic data capture, RIM- regulatory information management, CRM- customer relationship management

Enterprise-wide adoption of products, such as the Full Vault Clinical Operations Suite, takes time to implement and ramp up. You may also not want it to happen any differently, as these solutions are mission-critical, and any failure is unacceptable. Therefore, for such deals, the revenue contribution ramps up over several years to reach a terminal value.

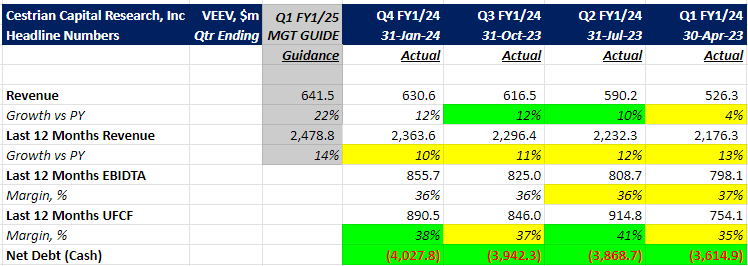

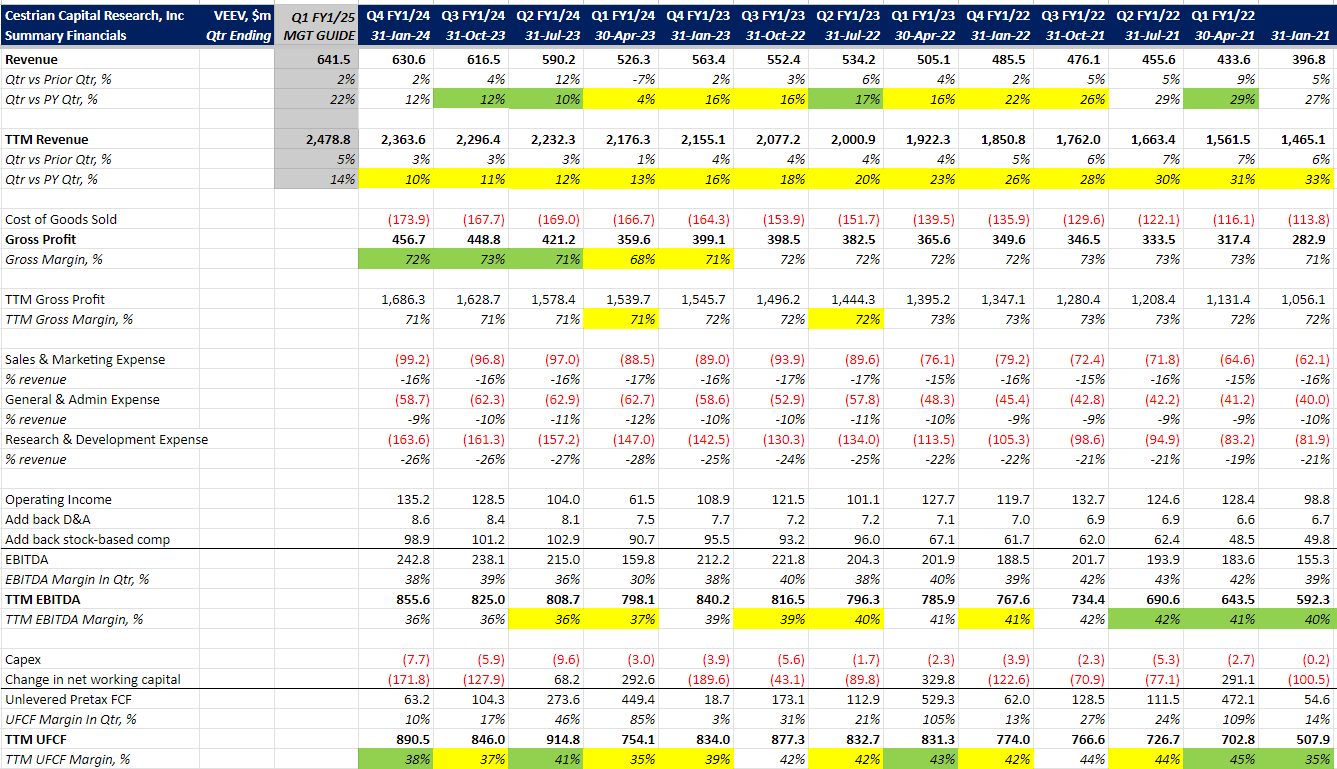

Now to the headline numbers:

- Revenue growth remains stable. On a trailing twelve-month (TTM) basis, revenue growth may have plateaued and we may see an upward trend moving forward, especially if the quarterly and yearly management guidance plays out.

- EBIDTA margins stable, Cash flow margins ticked up.

- The company holds $4 billion in cash.

If current UFCF margins and business trajectory hold, Veeva FCF might exceed $1 billion in FY 2025, further bolstering their cash position. Based on comments made during the earnings call, Veeva is considering M&A as capital allocation strategy and may not shy away from pursuing acquisitions of significant size.

Read on to get our valuation analysis, our take on the stock chart, the full set of fundamentals, and stock rating.

If you haven't already become a paying member of the Cestrian Tech Select Newsletter, now is the perfect time to join! Simply click the button below to subscribe. As a member, you'll gain access to comprehensive fundamental and technical analysis, stock valuations, our insights on stock charts, and ratings for over 40 tech stocks.

Discover the exclusive benefits of our Inner Circle Service, including real-time trade disclosure alerts and much more. Click below to learn more about this service and access discount links.

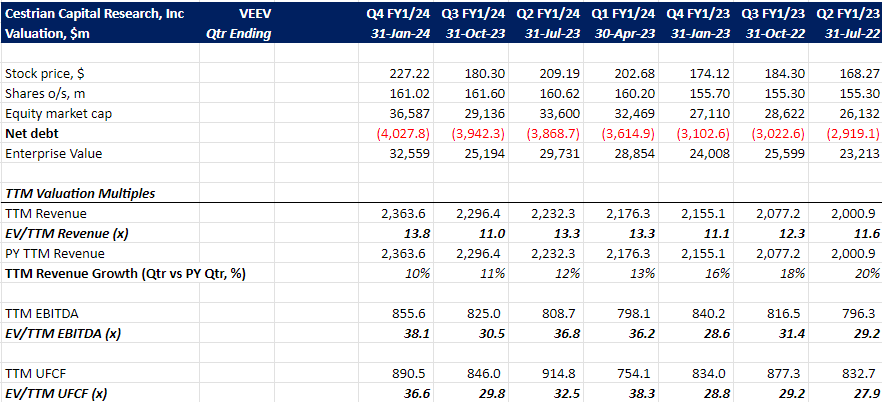

Valuation Analysis

13.8x TTM revenue / 36.6 TTM unlevered pretax cashflow: not cheap.

Technical Analysis

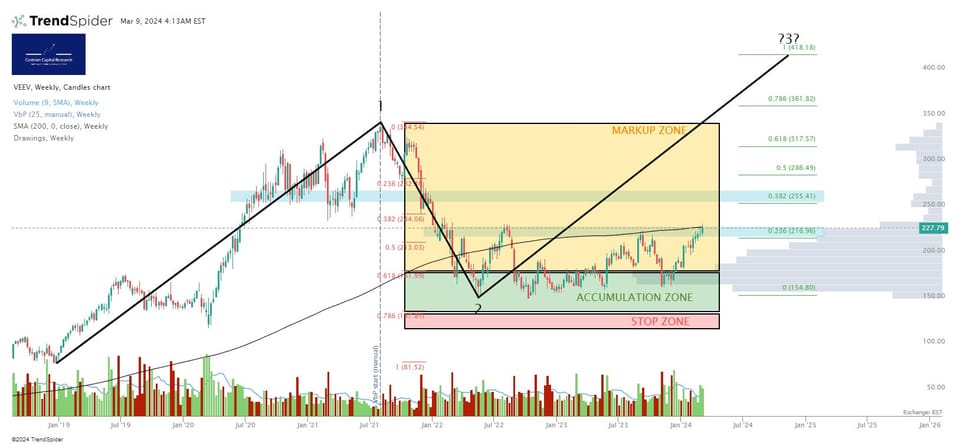

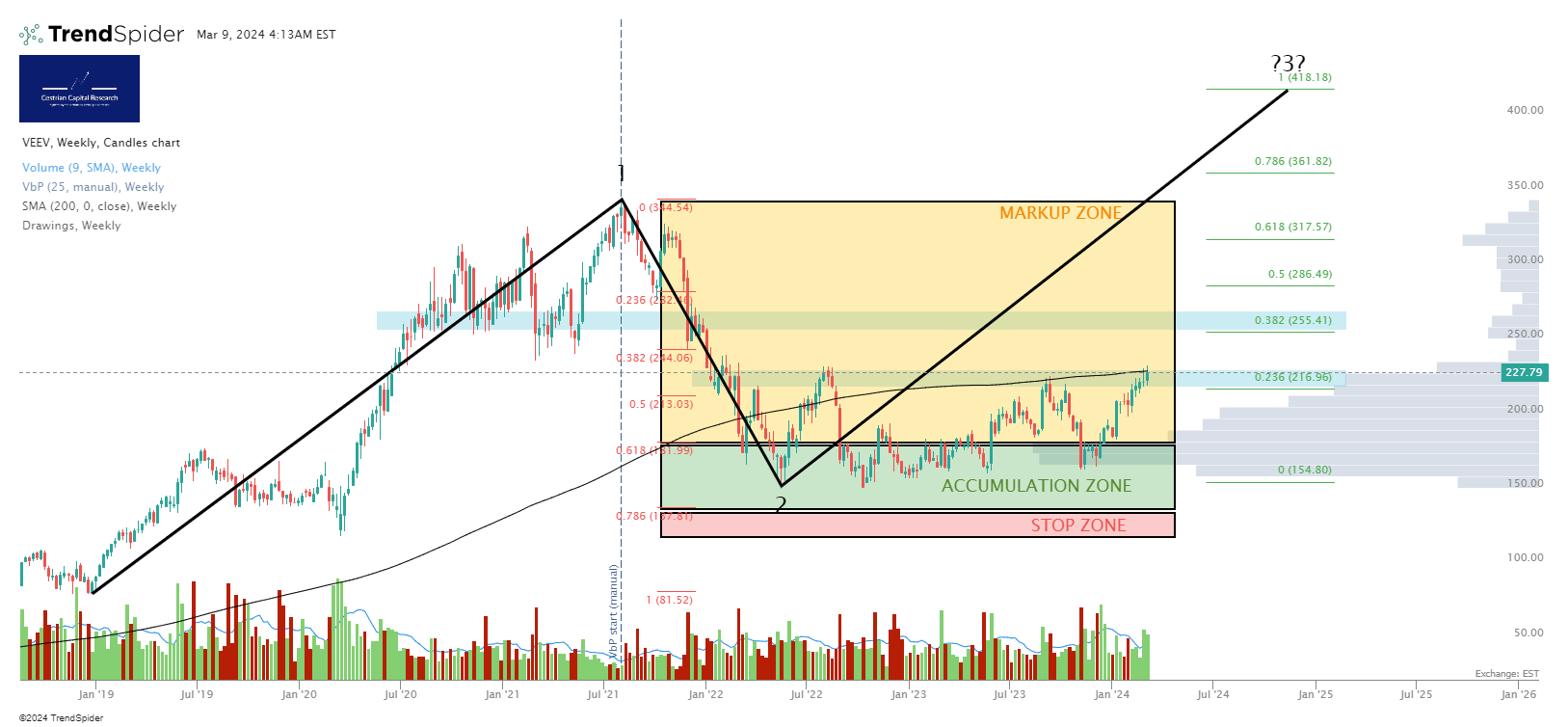

Here is the longer term view of the chart (full page version - Link).

- From the low of $80 in Dec 2018, the stock put in a Wave 1, reaching $340 in August 2021.

- Subsequently, the stock corrected, with Wave 2 low at $150, which falls between 0.618 and 0.786 retracement levels of Wave 1.

- The stock has since been range-bound between $150-$220. If the stock materially breaches $215-$230 range, it could potentially reach typical Wave 3 targets of $418 or $580, determined by Fibonacci extension of Wave 1 placed at the Wave 2 low.

- Potential resistance levels are indicated in the chart as blue horizontal bars. Note that I personally do not treat resistance and support levels as single $ values. Instead, I view them as zones that need to be materially breached in either direction to prompt any action on my part, whether it's buying or selling.

- Currently, the stock resides in the Mark-up zone.

Stop Zone: < $135, Accumulation Zone: $135 - $180, Markup Zone: $180 - $345.

Note : 1.) The dollar limits within the Wyckoff zones serve as guidelines rather than strict rules. They aid in maintaining disciplined buying and selling decisions, removing emotional impulses from the equation. Be like big money and not like chad. 2.) Zone boundaries may change over time, adjusted according to evolving price dynamics, Elliott wave analysis, Fibonacci levels, and volume-by-price data.

Here is the shorter term view of the chart (full page version - Link)

Zooming out a bit on the short term chart (full page version - Link), you'll notice potential resistance zones.

Fundamental Analysis

Here's our detailed take on VEEV fundamentals.

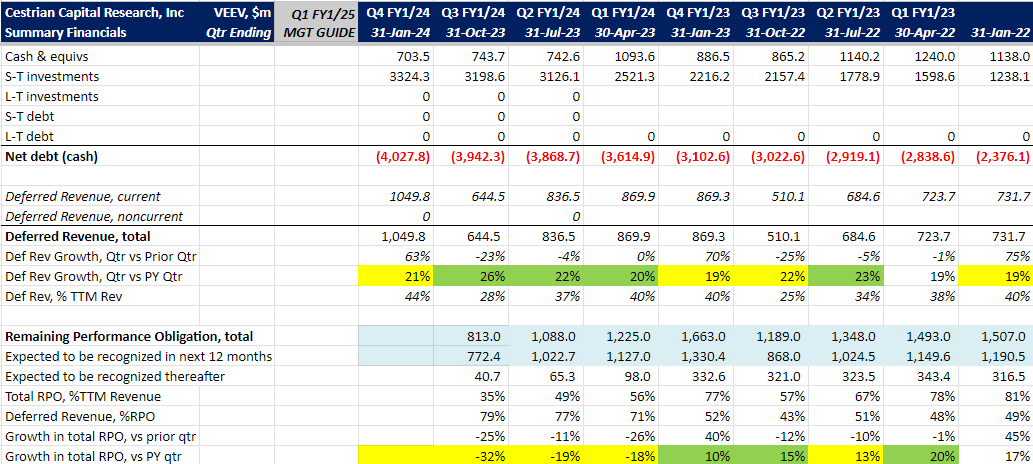

Deferred revenue stands at 44% of TTM revenue. Company has not published the RPO numbers yet.

Rating

We rate at Hold since stock is in the Mark-up zone.

Things to watch out (Update Q4 FY1/2024)

Sometime back we started to track some of the factors that we believe maybe important for VEEV. Here's an update on those:

1. The switch from Veeva CRM solution to the Veeva Vault Platform has the potential to bump up the margins. But this will be a long drawn and technically challenging process for customers already on CRM solution. Watch out how Veeva handles it.

- Company had five wins for Vault CRM. Company’s current focus is on transition from Veeva CRM to Vault CRM, hence CRM area revenue maybe stable (= will not grow) for next few years.

2. Until now it appears no one is materially threatening Veeva’s almost monopolistic position as pharma cloud solution provider- there is nothing in financial statement which suggests so. Moving forward, lets focus on if some of the market share is getting encroached upon by IQVIA Holdings Inc. and Salesforce.

- No major news on this front. I checked latest 10Q and earnings call of Salesforce for mention of healthcare and biotech, and there is nothing worth mentioning.

3. Veeva has nailed Life sciences industry. It would be interesting to see how it fairs in other industry segments where it has offerings: consumer Packaged Goods products, Food & Beverage industry and Specialty Chemicals.

- No news on this front.

4. Those RPO numbers !! We will watch them very very closely.

- Company has not published RPO nos at the time of writing of this article.

Huh?

Any questions whatsoever about this earnings analysis, our methods, conclusions, opinions, anything - reach out in chat. Remember the Second Rule Of Chat - There Is No Such Thing As A Dumb Question.

Cestrian Capital Research, Inc - 10 March 2024.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in VEEV.