Veeva Systems Q3 FY1/2025 Earnings Review

Summary

- Veeva posted a good quarter, delivering results ahead of guidance.

- Revenue and margins are up, with a solid balance sheet.

- The stock recently experienced a news-driven sell-off, but the medium-term chart looks bullish.

- Read on for detailed financial and technical analysis, as well as ratings.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Another Good Quarter

By Abhishek Singh (Abhisingh_86)

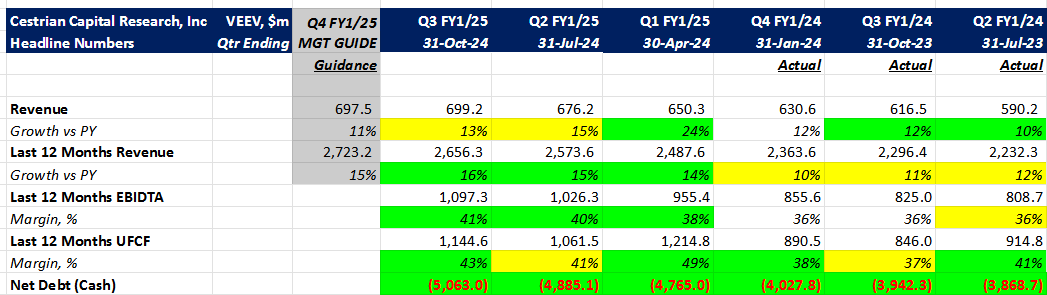

Veeva ($VEEV) posted a good quarter, delivering results ahead of guidance. Here are the headline numbers:

- Revenue Growth for Q3 FY1/2025 vs the previous year’s quarter is 13%.

- TTM (Trailing Twelve Months) revenue growth increased by 100 basis points to 16%.

- TTM EBITDA margins increased to 41%; meanwhile, TTM Cash Flow margins also increased to 43%.

- The balance sheet remains strong with $5.0 billion in cash.

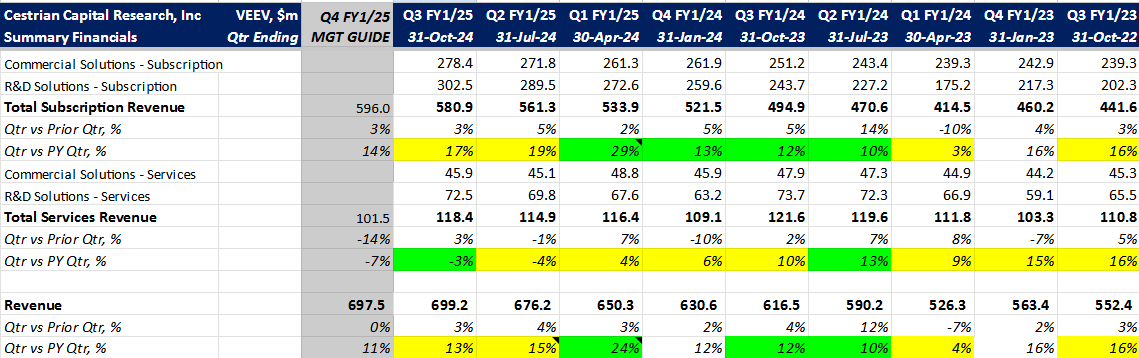

Subscription revenue in Q3 increased by 17% year-over-year, whereas the professional services revenue declined by 3% year-over-year.

Key Business Updates

A key strategic focus for VEEV has been the shift from Veeva CRM to Vault CRM. Veeva appears to be executing this transition well, as demonstrated by the continued successful migration from Veeva CRM to Vault CRM and securing commitment from a fourth top-20 biopharma company to use Vault CRM as their commercial foundation. However, one should remain cognizant of the competition from Salesforce CRM. Recently, a customer chose Salesforce over Veeva during a CRM migration process (read here), resulting in 5% drop during the trading session. Coincidentally (or not, depending on your view of fibs and waves), the news emerged when the stock was sitting right in the middle of typical impulse wave 5 termination zone (link).

Veeva also announced launch of three AI applications in Late 2025.

Read on for financial fundamentals, valuation analysis and our rating.