TSMC Q3 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Jeepers!

by Alex King, CEO, Cestrian Capital Research, Inc

I have two things to say about Taiwan Semiconductor’s Q3 numbers, published today before the New York open.

1 - Jeepers.

2 - Lol.

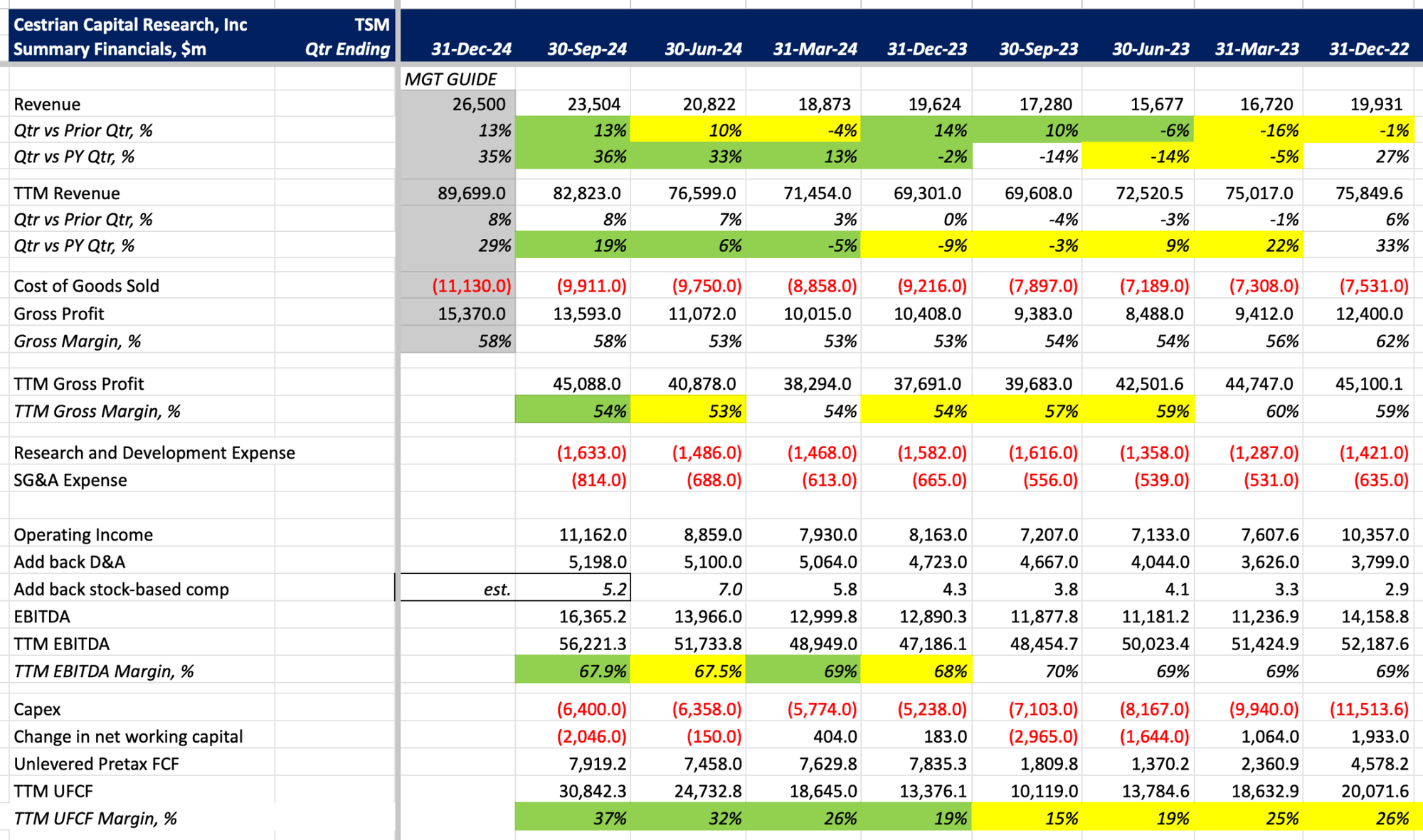

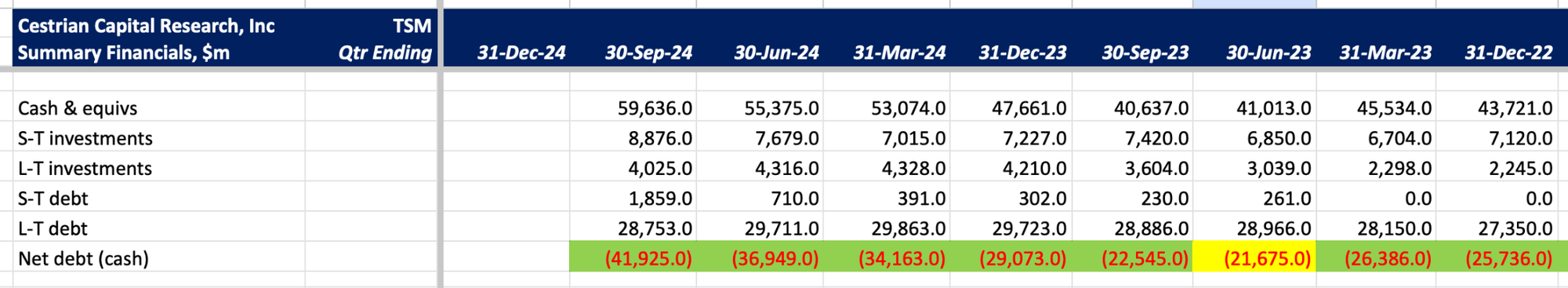

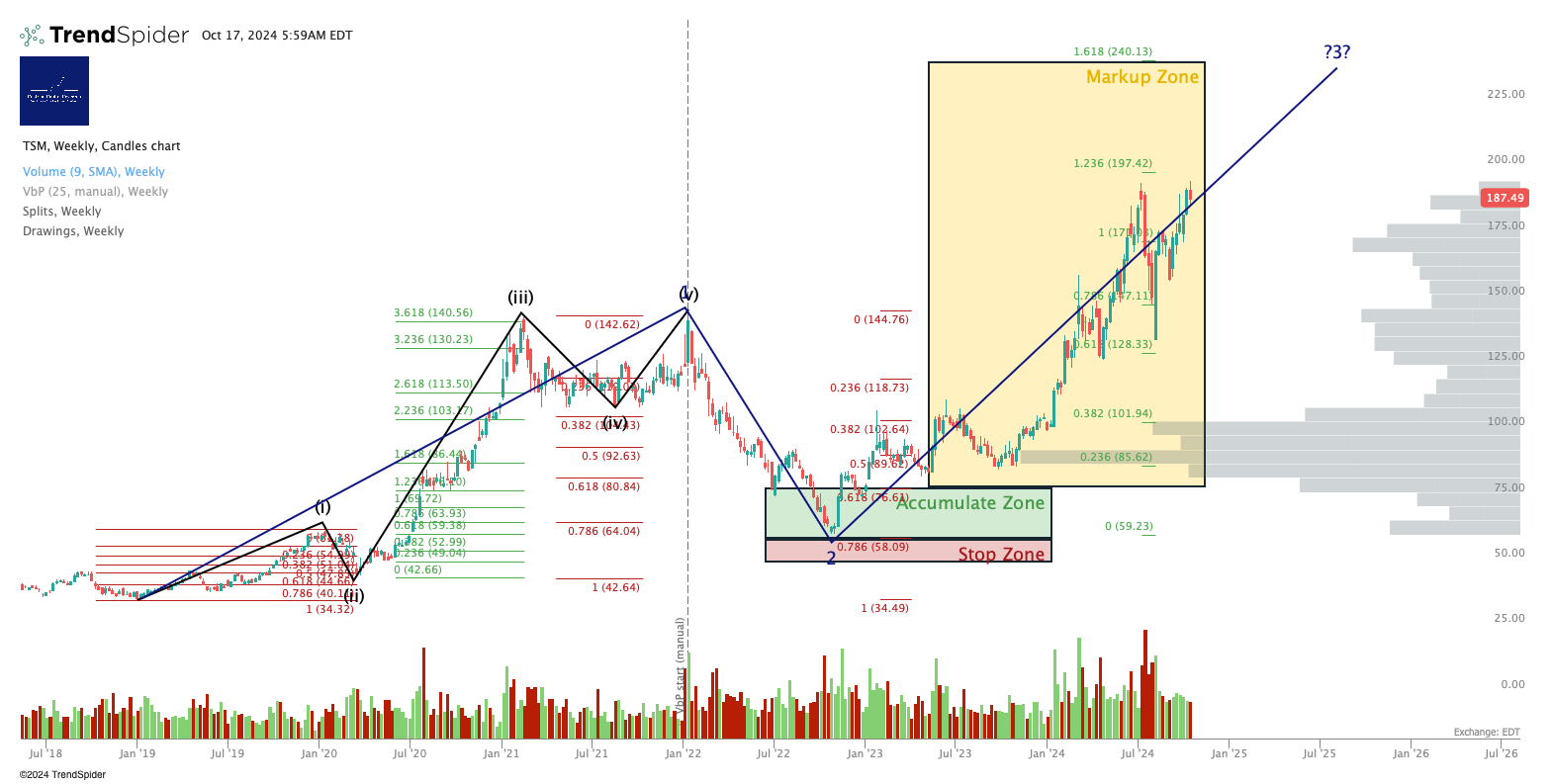

Allow me to explain. Firstly, the numbers were absolutely blowout in my view. Forget consensus this, estimates that, just look at the actual numbers. Here is a company with $83bn of trailing twelve month revenues, growing those revenues at +19% on a TTM basis and +36% on a quarter vs. prior year quarter. That same company is generating unlevered pretax free cashflow margins of 37% on a TTM basis. Yes that is after capex. And to round it all off, this same company has $42bn of net cash on its balance sheet.

I don’t even think the stock is particularly expensive, if that even matters (we always defer to technical analysis as regards when to buy and when to sell securities, unless fundamentals suggest something is so cheap it would be rude not to buy it). Would you pay 32x trailing twelve month unlevered pretax FCF for this, when you’ll pay 20-25x for an ex-growth defense contractor? Plenty of people are, it seems.

Well, that’s the Jeepers.

Now for the lol.

ASML, the monopoly provider of EUV lithography equipment, which is to say the only show in that particular town for companies like TSM or Intel or others that need to produce chips at tiny geometries, accidentally released its Q3 earnings Tuesday. Instead of Wednesday as planned and published. This is a $200bn+ market cap company. Obviously releasing earnings a day early because an intern hit SEND when they meant to hit SAVE is something that happens all the time at $200bn+ market cap companies.

Anyway ASML told a tale of doom and gloom and there was some stuff about competition in the fabrication sector that was bad for ASML. I stopped reading at that point, since competition in the fabrication sector is likely wonderful for ASML because the behemoths that ASML produces can’t be built any faster or in any greater numbers than they already do, at least not quickly, so when I last looked that meant … more pricing power for ASML. Yes, China is a problem but China has been a problem for semiconductor since the Federal government finally woke up (it took two Administrations to do this, one of each color) to the problem of leaking cutting-edge semiconductor design and manufacturing IP into the hands of the US’ primary competitor. I don’t think export restrictions will kill ASML today any more than it has killed NVDA to date.

Anyway, ASML’s woes killed the Philadelphia SOX and of course took $SOXX and $SOXL into the gutter also. Mainly retail selling I would think. Just in time for … WHOMP! SOXX is +2.2% at the time of writing after a flat day yesterday, TSM hit an intraday low of $184 Tuesday and is sat at $200 in pre-market trading today after that Jeepers Print. Lol. Want to play the game? You have to know the rules of the game. And guessing EPS next quarter has nothing to do with the rules of the game. Understanding security pricing and volume behavior and recognizing institutional buying and selling patterns - these are the rules of the game. We teach this all day long in our Inner Circle service, and we update everything daily in our Market On Open notes.

For what it's worth, let’s run through TSM numbers, valuation analysis, the stock chart as we see it, and our ratings.

Financial Fundamentals

Valuation Analysis

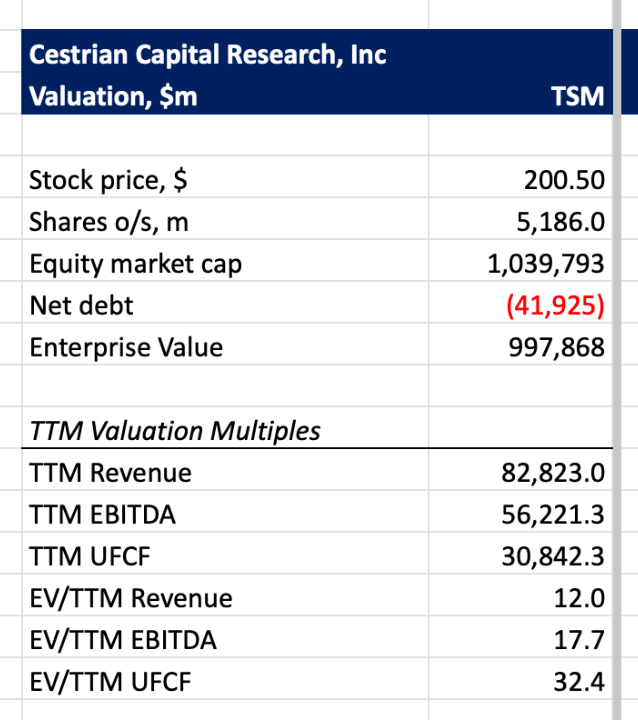

Technical Analysis

Here’s the longer term chart on TSM (click here for a full page version). We have a $240 price target on this name, that being the 1.618 Wave 3 extension of the prior larger-degree Wave 1 placed at the Wave 2 low. See - nothing to do with EPS, ROIC, ROE, WACC, consensus or anything else. Price is the best guide to where price may go.

Rating

We rate $TSM at Hold. We rated the stock at Accumulate between $58-77/share, so anyone who bought at that time may have gains of between 160% - 245%. Not too shabby.

Cestrian Capital Research, Inc - 17 October 2024.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, $ASML (a new position purchased today), $NVDA, $MRVL and $SOXL.