The Trade Desk Q4 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Entropy, Captured

by Alex King, Cestrian Capital Research, Inc

In a world of increasing dispersion, where the open internet is growing at the expense of walled gardens, the ad-tech business you want to own is The Trade Desk ($TTD). To oversimplify, the company provides a centralized place where brands can reach consumers across a wide variety of online locations.

In a world of increasing centralization, where walled gardens are gaining share and using the monopoly rents to invest bigly in all manner of AI matters - LLMs, sunglasses (aka. live data ingestion devices for both training and inference), datacenter hardware &c - then the ad-tech business you want to own is probably one or more of META or GOOGL.

TTD printed earnings yesterday. The numbers look like a maturing business. The stock sold off hard in postmarket and remains down almost 30% in pre-market trading as I write.

We rate TTD at Hold because of the chart; there’s every chance it can recover from here. But I personally no longer own the name - I sold some time ago - and I have no plans to add. I think they need to reconsider their positioning.

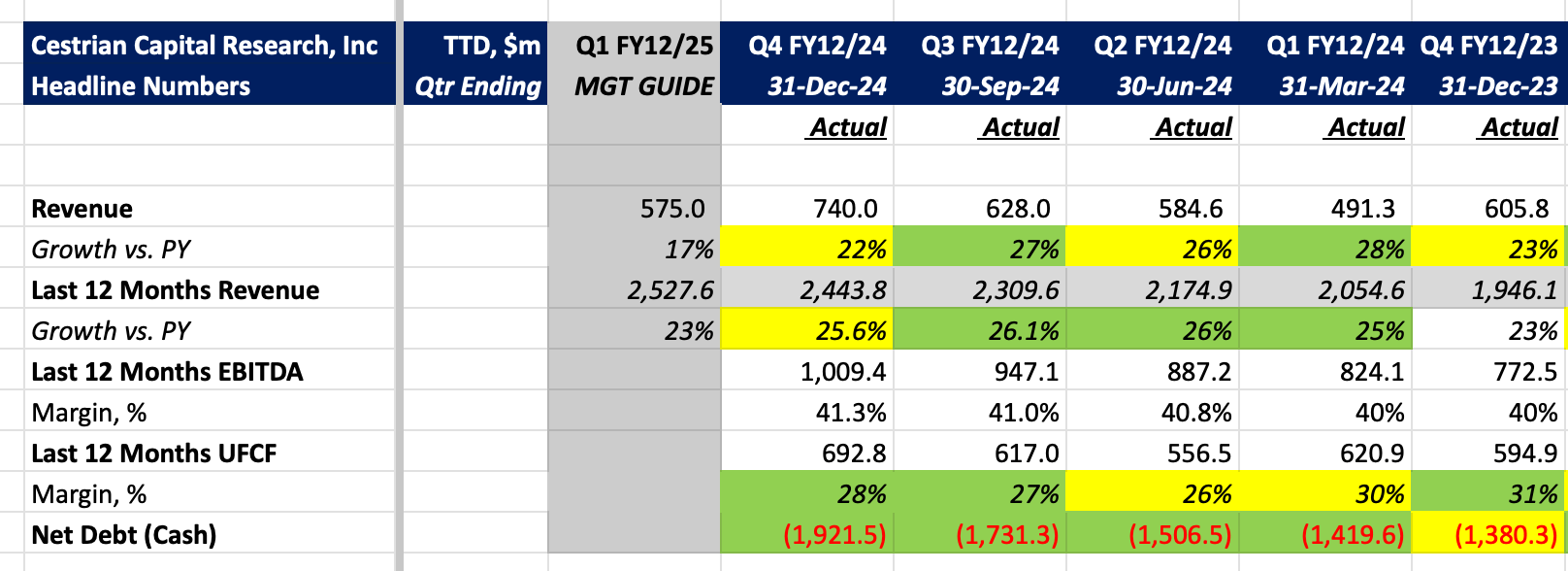

Here’s the headlines.

Now for valuation, stock charts and price targets, and full financials.