The Trade Desk Q3 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

A Comp Plan With A Company Attached.

By Alex King, CEO, Cestrian Capital Research, Inc.

Want to know why $TSLA went up so much after 2018-19? Because the board of directors handed its CEO a comp package which would make him richer than several Gods if the stock price went up enough. Want to know why $TTD has a shot of keeping on moving up? Same reason. Comp plan. Never bet against a CEO on a mission with a yuge pay packet in sight, if getting that pay packet depends on stock price performance.

TTD continues to do well.

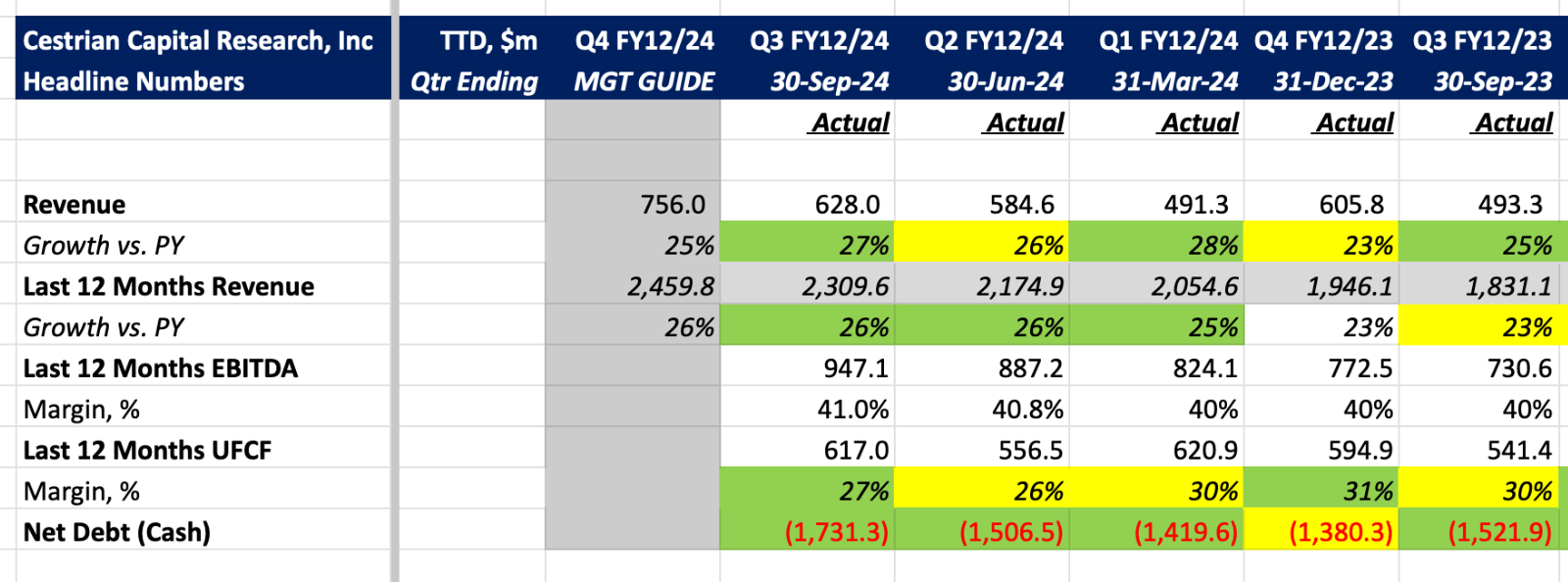

Financial Summary

Here’s the headlines.

Now, for our paying subscribers of all tiers here, we go on to look at financial fundamentals, valuation analysis, our rating and price targets.