The Trade Desk Q2 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

No Recession Apparent In Online Ads

by Alex King, CEO, Cestrian Capital Research, Inc

$TTD is now a large enough company that we can, I think, infer something about the state of the economy from how its revenues are holding up. Not in the same way as with Microsoft (a gauge of enterprise spending) or Apple (a gauge of consumer spending) but because if advertisers are confident, TTD revenue will be looking good, and if they are worried, it will not.

Right now TTD growth looks strong - accelerating even - the Q3 guide is for flat-ish growth rates on an “at least” basis - and profit margins are climbing. Cashflow margins took a hit this quarter which for now we can attribute to working capital timing (ie. how fast did they get paid in the quarter vs. make payments in the quarter). The balance sheet remains rock solid. I’m not aware of any particular market-share threats to $TTD; it seems to me that if the economy remains in reasonable shape, with ad spending growing and shifting inexorably online, then TTD fundamentals ought to benefit.

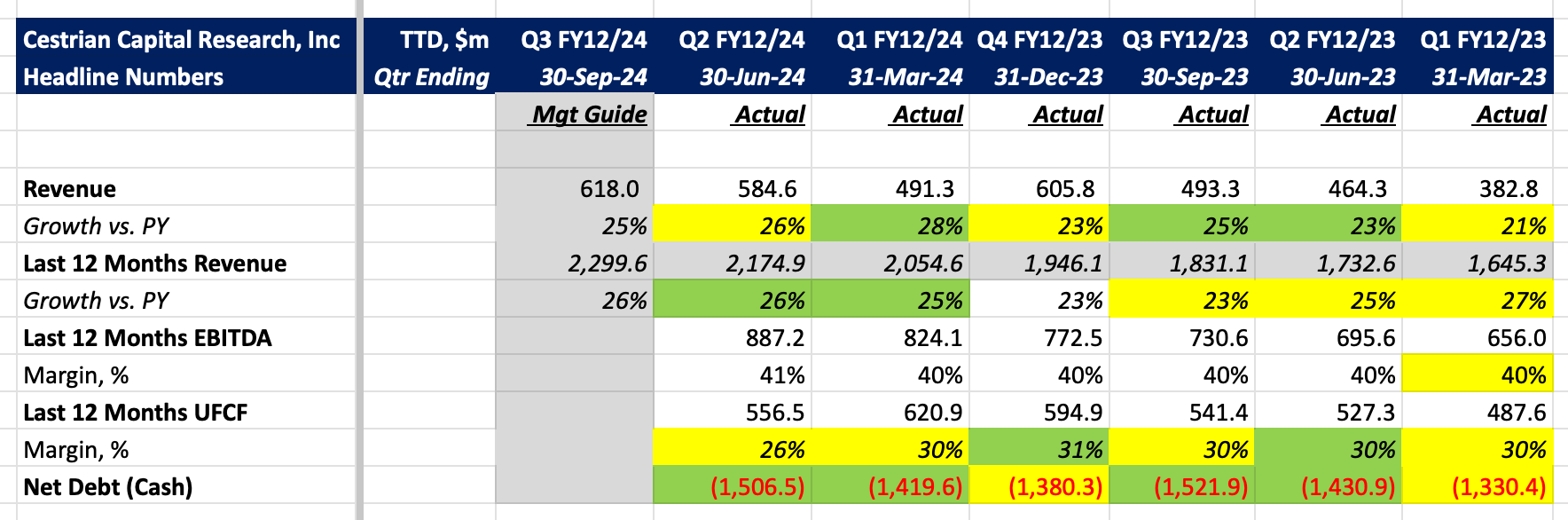

Let’s take a look at the numbers. Here’s the headlines:

Below - available to paying subscribers of all tiers here - we review the fundamentals, the valuation, the stock chart, our rating and price target. Read on folks.