The Second Coming Of Telecom

AT&T Q1 FY12/24 Earnings Analysis

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

May Yet Surprise To The Upside

If, dear reader, this isn’t your first rodeo, and you remember the fiber-rush of the mid to late 1990s, the upside potential at AT&T won’t surprise you. Nor will it particularly excite you, because (1) you know that telecom companies are not in fact dot-com (then) or AI (now) companies and (2) you know that in the end somebody has to pay for the capex, and last time around it ended up being bondholders and then shareholders and (3) you know that the easy money in AI is still probably in $NVDA. Yes really. Yes even now. BUT you may also take a look at what is happening to utility stocks right now (if that’s too boring, just take a look at $XLU as a proxy) and you might think about the wall of money that is likely to have to go into data systems beyond just the chips and rack servers, if AI-on-the-device (thankyou Apple) is ever to become a reality. The order-of-magnitude change in data capacity required to deliver the promise - and the need for Apple and others to deliver the promise! - mean that demand for incumbent telco service is likely to continue to rise, and the limited amount of competition in the field means that margins may not get crushed along the way.

$T for now remains a solid dividend stock (forward yield a little over 6%); but the name has put in material progress on the chart and there are some technical features ahead which mean that if such progress continues, the future could well be optically illuminated.

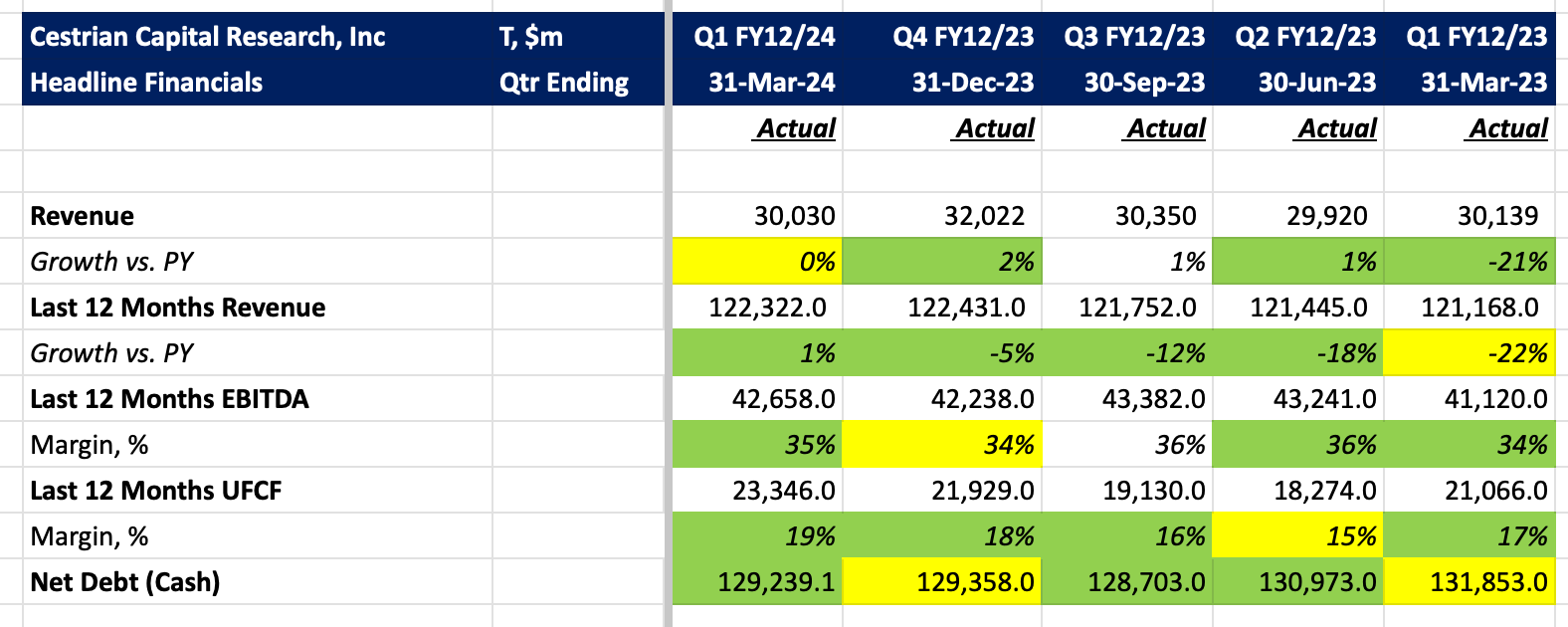

Below we lay out the headline numbers (before the paywall) and then take a look at the detailed financials, valuation analysis and our stock price projection, technical analysis and rating (after the paywall).

If you’re a free reader here, and you’d like to access the post-paywall stuff, you can sign up below either for our entry-level ‘Market Insight’ tier, or our full-monty ‘Inner Circle’ service. If you have any problems doing so, or you’d like to know more about what the pay services offer, you can reach us anytime using the contact form on this site, here.

AT&T Headline Financials