The Money Machine Rolls On

BlackRock Q1 FY12/24 Earnings Analysis.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

An Easy Name To Own

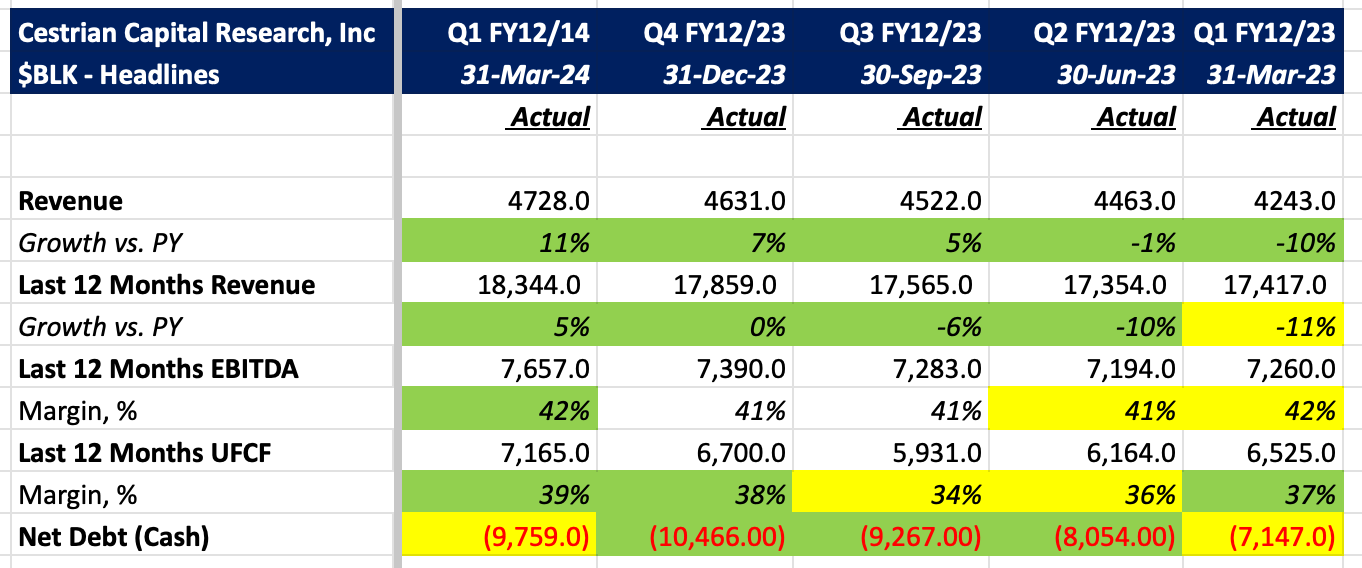

BlackRock is the biggest Big Money in town, the Grand Poobah of Matters Fiscal. So when times are good in risk assets - and times are good in risk assets - it’s usually a good time to own $BLK stock. The name has been a high performer within our Inner Circle Financial Sector Model portfolio since June 2023; this quarter’s numbers look strong too, with revenue growth accelerating for the last five quarters at the same time that EBITDA and cashflow margins have also ticked up a little. The balance sheet remains a tower of strength even after factoring in pension liabilities. On fundamentals this is an easy name to own. Below we lay out the headline numbers (before the paywall) and then take a look at the detailed financials, valuation analysis and our stock price projection, technical analysis and rating (after the paywall).

If you’re a free reader here, and you’d like to access the post-paywall stuff, you can sign up below either for our entry-level ‘Market Insight’ tier, or our full-monty ‘Inner Circle’ service. If you have any problems doing so, or you’d like to know more about what the pay services offer, you can reach us anytime using the contact form on this site, here.

BlackRock Headline Financials