We're delighted to host Yimin Xu's premium service, YX Insights.

Welcome to YX Insights!

YX Insights delivers focused, actionable investing and trading insights built on macro-driven, quantitative analysis, with clear, concise trade setups.

What We Cover:

We concentrate on a tightly curated set of core instruments:

- Macro & Rates: Daily Quant Model Signals and Chart Analysis of US Treasuries (TLT), Federal Reserve actions, global liquidity indicators

- Crypto: Daily Quant Model Signals and Chart Analysis of Bitcoin (BTC),

- Magnificent 7 Stocks: Quantitative signals, valuations, and technical setups for each of AAPL, AMZN, GOOGL, META, MSFT, NVDA, and TSLA.

Additionally, we provide opportunistic trade setups in:

- Precious Metals (GLD, SLV)

- Energy (USO, Energy Stocks)

- Financials (Banks, Exchanges)

- Software (Consumer, SaaS)

- China (KWEB, Technology)

How We Deliver Insights:

- Daily Quantitative Dashboards: Quick, actionable insights covering key macro indicators, market liquidity, and technical setups.

- Daily Analysis Of Core Instruments: A winning combination of quantitative signals, market fundamentals, macro drivers, valuation and technical analyses

- Regular Macro Updates: Clear and concise tracking of market-moving macroeconomic themes, keeping you aligned with unfolding trends.

- Trade Setups: Clearly defined entries, exits, and risk-reward profiles when significant opportunities emerge.

Why YX Insights?

Our unique strength lies in connecting macroeconomic fundamentals to precise, actionable trade ideas. We strengthen our edge by combining daily quantitative modelling with macro insights on liquidity cycles, interest rates, and global money supply.

YXI’s TLT and BTC Quant Signals Deliver A Compounding Edge

For TLT, our backtests indicate that buying TLT when the signal is 1 and shifting to cash when it is 0 could boost daily success rates by about 5% compared to a “Buy and Hold” approach. This edge might compound significantly over time. (These results are based on historical data and may not predict future performance.)

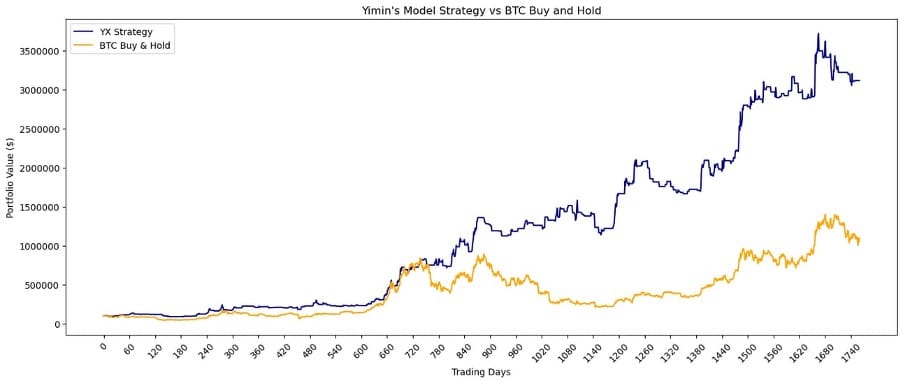

For Bitcoin, our backtests show that buying when the signal is 1 and moving to cash when it is 0 could improve daily success rates by roughly 3% versus “Buy and Hold.” The strategy also exhibits about half the maximum drawdown. (These results are based on historical data and may not predict future performance.)

Subscriber Testimonials

- “Macro coverage around rates, liquidity, and money supply is where YX Insights truly stands out.”

- “YX Insights clearly demonstrated how global liquidity impacts stocks and Bitcoin. This was genuinely eye-opening for me.”

- “The TLT Signal is very interesting (and I will be following it from now on with a pool of capital) and am excited about the Mag 7 with the way you are outlining potential chart paths, etc and the opportunity that brings for actionable trade set-ups.”

- “The daily macro updates help me stay calm and focused, particularly during turbulent markets.”

- “YX Insights’ macro research is something I rely on heavily.”

- “The Perfect format for a morning read to prep for my day.”

- “YX Insights provides unique perspectives on Mag 7 stocks and Crypto that I haven’t found elsewhere. The trade setups with clear entry and exit points are especially helpful.”

- “The educational insights into macroeconomics and detailed charts are highly informative and helpful. This service has significantly improved my understanding of the market.”

- “I appreciate that YX Insights delivers high-quality ideas suited perfectly to my investment timeframe of 1 to 12 months.”

- “YX Insights’ clear and thoughtful macro projections ahead of key data releases form a core part of my investing strategy.”

- “YX Insights’ timely analysis of precious metals has been especially valuable when considering stagflation scenarios.”

- “Regular, concise updates from YX Insights tracking ongoing market developments keep me well-informed without having to dig through lengthy articles.”

About Yimin Xu

Yimin brings deep experience in global macro, interest rate markets, and liquidity analysis. His professional background includes working as a market-maker in short-term interest rates and FX swaps at a global investment bank, complemented by his Chartered Accountant qualification. Since 2022, Yimin has provided dedicated commentary on FOMC decisions and macro developments for Seeking Alpha News.

Pricing and Subscription

We offer YX Insights in two pricing tiers.

If you are an Investment Professional per our terms & conditions (here), then the Investment Professional tier of YX Insights is for you. It is priced at $745/month or $5995/yr, a 30% discount on the monthly. This is a single-user license. Contact us (here) to discuss multi-seat or site licensing.

You can start your free trial of the Investment Professional tier here.

If you are an independent investor - ie. not an Investment Professional - you can sign up for YX Insights on a single-user basis. The Independent Investor tier of YX Insights costs just $345/month or $2995/yr (a 30% discount on the monthly), and of course you can start with a 7-day free trial.

You can start your free trial of the Independent Investor tier here.

Our prices rise over time for new subscribers - we don’t raise prices for existing members. The sooner you join, the less you pay.

Yimin Xu - 15 April 2025.