Taiwan Semiconductor Q4 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

All Good Things

... must come to an end. But not yet, it seems. $TSM just printed another superb set of earnings, strong on every measure including guidance. This is bullish for the economy and bullish for equities in general in my view. TSM is the fulcrum around which pivots most all of the high-end part of the semiconductor industry. If you have a fancy product built to a small geometry there is a good chance you have to have TSMC make it for you. When the semiconductor industry slows, you'll see it in TSMC guidance first, most likely, since they report very early each quarter. For now though, all is good.

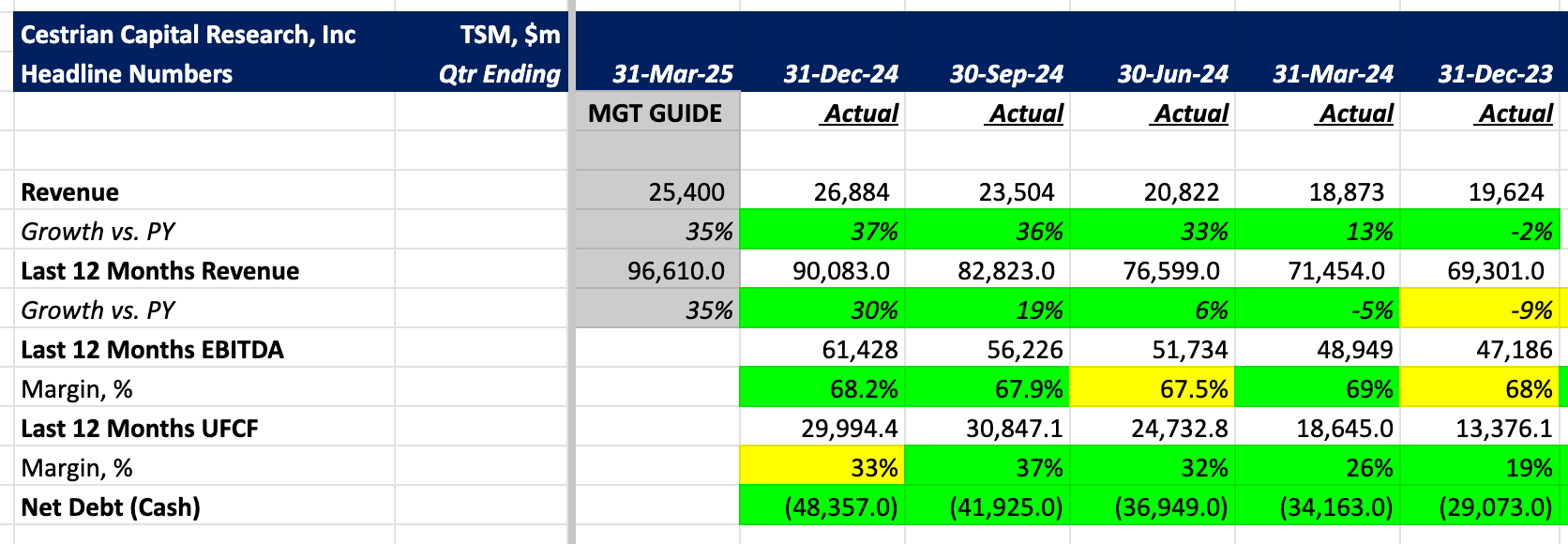

Here's the headline numbers.

Yes, even with $30bn of capex in the last twelve months on revenue of $90bn (capex 1/3 of sales, yikes) this thing still managed to turn in >30% TTM unlevered pretax free cashflow margins. Which tells you they have some serious pricing power with their customers. Revenue growth of 30% at this scale is remarkable and $48bn of net cash on the balance sheet says that the company could weather a storm or four.

Detailed financials, valuation, our rating and price targets follow for subscribers.