Taiwan Semiconductor Q1 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Wait, Wut? (Episode 707)

by Alex King, CEO, Cestrian Capital Research, Inc.

So the most remarkable thing about TSM earnings today, in my opinion, is the confidence with which the company has declared guidance. Not even the number itself, which oh by the way indicates revenue growth acceleration, but that they have guided at all. Since semiconductor is the heart of darkness in the present War On Trade, and since TSM is to all intents and purposes Kurtz, you would think that the company would take the opportunity to throw its hands up in the air and say, well, we have no idea what shipments or revenue can be next quarter, because tariffs. This is a move I would expect many US semiconductor companies to make in the coming earnings season - at a minimum follow the airline playbook which is to give a number of scenarios depending on, you know, tariffs. But nope, here you go, +38% revenue growth guide for Q2, which would be the company’s fastest growing quarter since Q1 2020. I am guessing there is a good deal of pull-forward revenue in there as customers move to get ahead of tariffs, but I am just speculating here. The earnings call will likely illuminate this point.

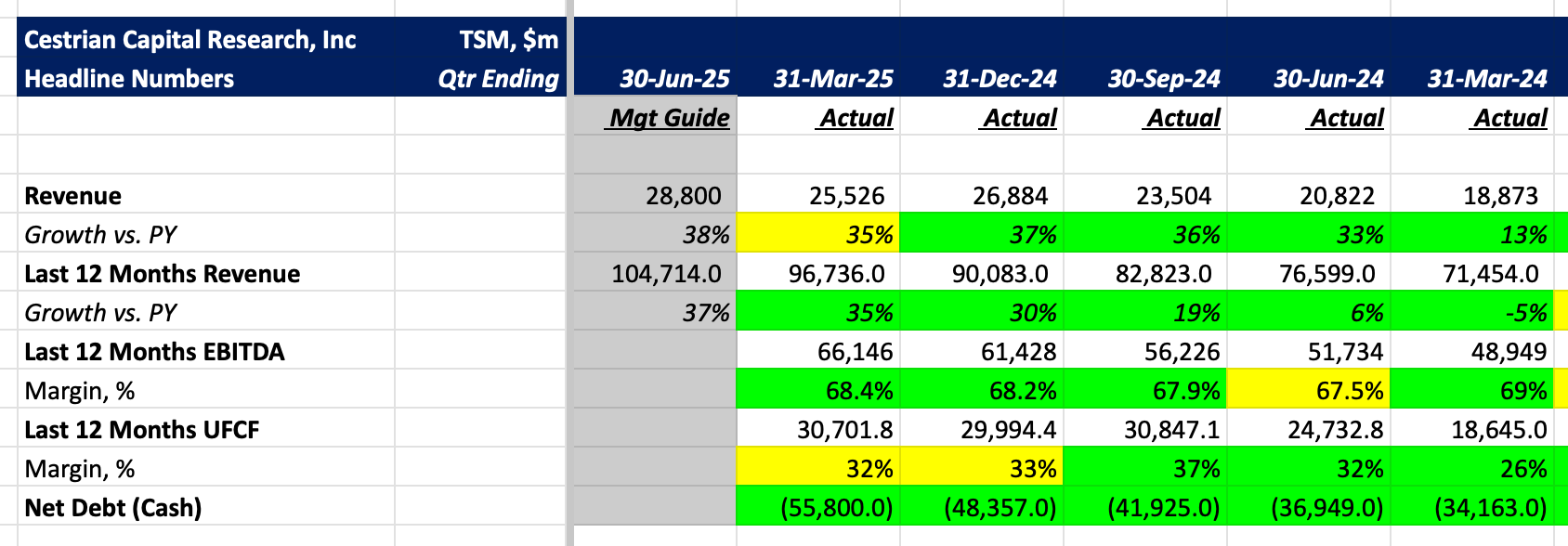

Anyway. Here’s the headlines, and after the paywall you’ll find our valuation analysis, stock price target and suggested swing trade ideas, and full financials.