Synopsys Q3 FY10/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Nobody Likes Semiconductor Anymore

by Alex King, CEO, Cestrian Capital Research, Inc.

Institutional sector rotation usually does have the desired effect, which is to say, when a little selling takes place and capital moves to another hotter sector, the investing community at large gets the message, and decides that [fill in the blank] sector is So Over Right Now and then, once institutions have quietly accumulated down there at the lows and released the newsbots to talk up the sector once more .. then as it approaches new highs you can find those self same investors declaring We Are So Back etc. Happens everywhere like clockwork.

Well, nobody wants semiconductor stocks right now. You conclude what you want from that. Personally I am long $SOXX $SOXL $NVDA and $MU.

Synopsys sells two things, (1) software which can be used to design semiconductor devices and (2) intellectual property licenses for bits and pieces of larger semiconductor devices. You could think of this as fancy circuit diagrams. If semiconductor is up, so too will be SNPS; and if down, so too will be SNPS. Synopsys is a solid business, big and getting bigger with the acquisition of Ansys (formerly $ANSS). Together with Cadence Design Systems ($CDNS) it has most of the chip design market cornered.

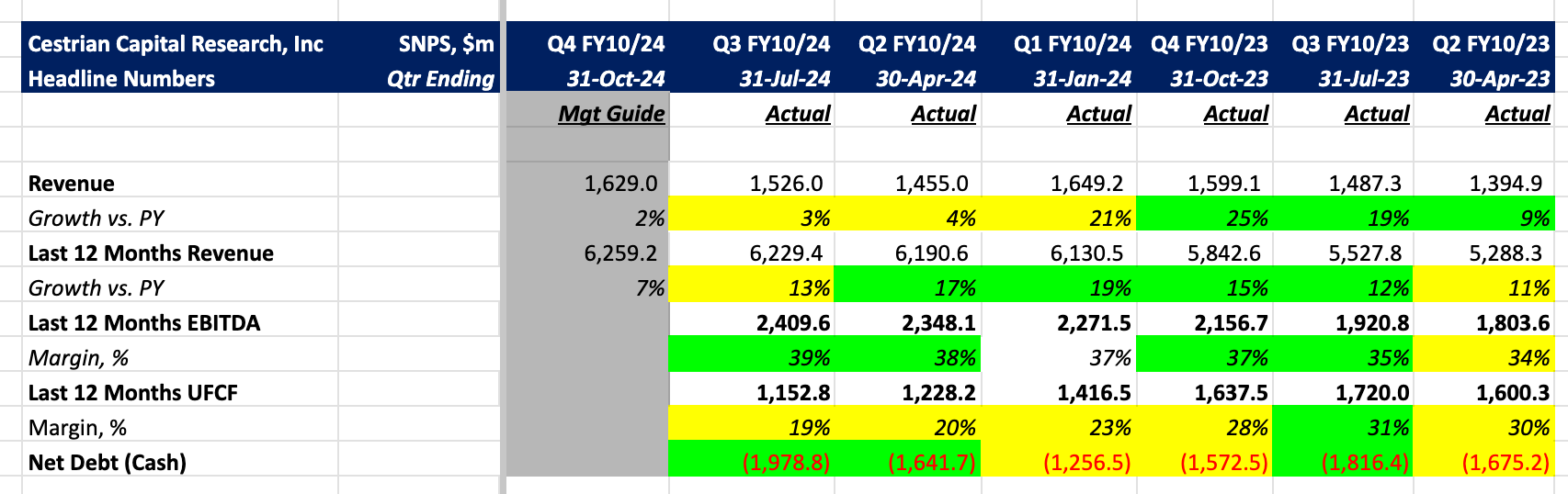

Here’s the $SNPS headlines for the quarter ending 31 July. Absent a level of pro-forma analysis that won't be possible as an outsider - you would need to be sat in the CFO's office to do this properly - it's probably as well to pay not too much heed to the reported fundamentals in the coming quarters, as the company (i) digests ANSS and (ii) divests one of its business units to a financial buyer. Yes I know it is heresy to ignore the numbers. What I would do if I were an SNPS shareholder, or thinking of becoming one, is listen to the earnings calls to see how much pain the integration and divestment is causing them. Look to Okta / Auth0 for what bad looks like, and Northrop Grumman / OrbitalATK for what good looks like. Ask in Inner Circle chat for more on this.

Read on for the financial detail, valuation, our stock chart and rating.