Snowflake Q3 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Flywheel Spinning Up

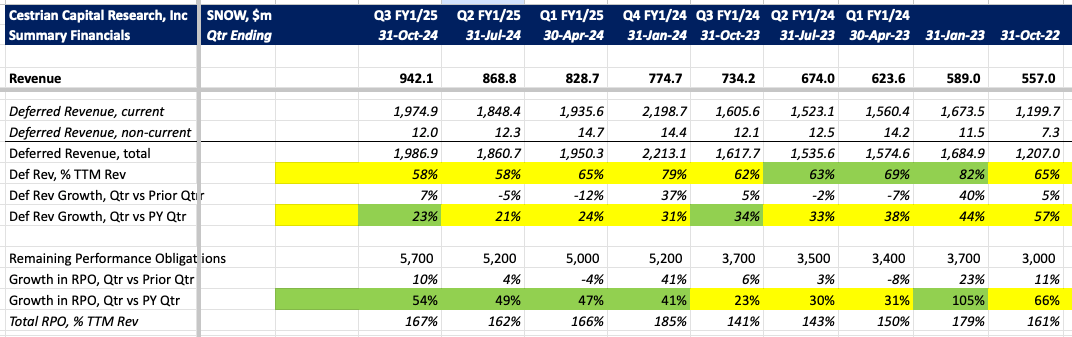

OK let’s just cut to the chase. The good part about Snowflake ($SNOW) earnings is the the order book - the growth rate of the “remaining performance obligation” in 10-Qspeak - is trending up, and that probably means that recognized revenue growth will trend up in the coming quarters. You take that, and a general level of misery on the stock (charismatic former CEO gone fishing, a nagging doubt that maybe the reason Swiss Toni went fishing in the first place is because maybe Snowflake technology is a little bit not cutting edge, not legacy exactly but a little bit more like yesterday than tomorrow, etc), and you get a ginormo +20% move in the thinly-traded post- and premarket sessions.

We have $SNOW rated at Accumulate between around $120–160/share. Right now the stock is sat at the top of our Accumulation Zone and is threatening to break out. Woot. But the thing is still trading at twice the cashflow multiple that NVDA demands. So it’s hard to get too excited about this name if you ask me. It definitely looks to me like it will become Officially Legacy in a couple years. So, charts don’t lie and the RPO is moving up and growth may follow suit. The company also executed a too-cute convertible note raise and used some of the money to buy shares back in a private deal from selected shareholders at $112 before earnings. I imagine the CEO will be getting calls from a couple of those shareholders today. Probably not happy calls.

Let's look at the numbers first. Then we'll do charts and suchlike.

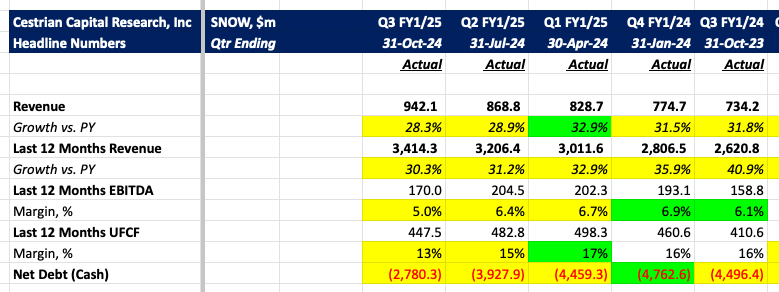

TL:DR - Headlines

Nothing good here except that RPO growth. So anyone getting all excited about the numbers is assuming that RPO growth feeds into better revenue growth. Which might happen, but it won’t definitely happen.

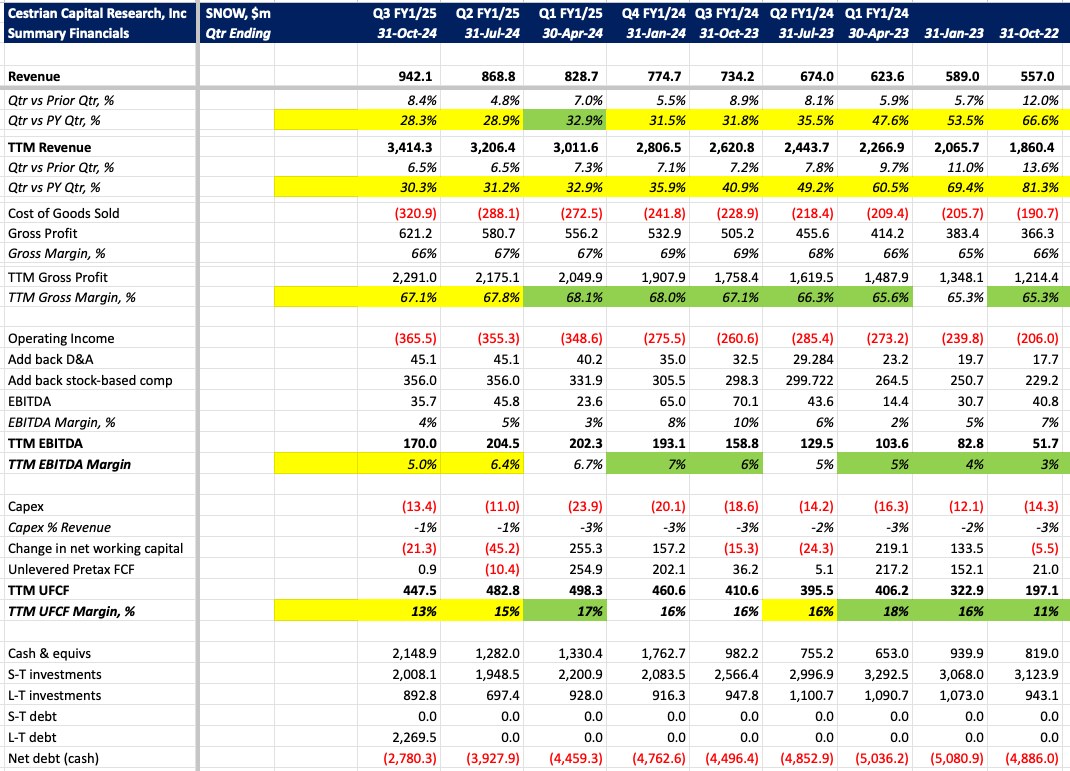

Financial Fundamentals

If you have any questions about the numbers by the way, post them in Slack Chat (Inner Circle members) or in comments to this article (everyone else).

OK let’s be fair. Deferred revenue saw accelerating growth too. Which is a little more concrete than a swelling forward order book.

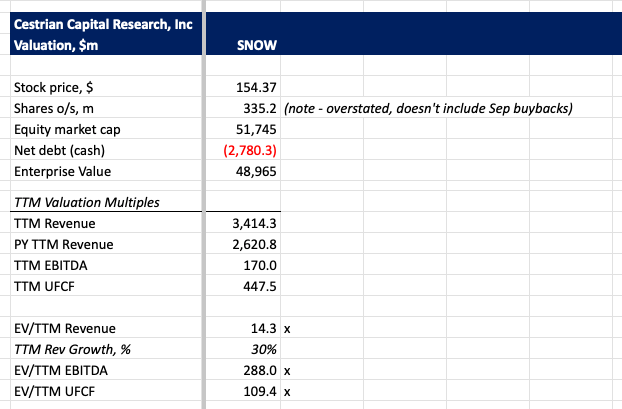

Valuation Analysis

NVDA, 50x TTM cashflow. SNOW, 109x TTM cashflow. Yes I can see that SNOW cashflows might grow at a faster rate than do Nvidia’s, but that hasn’t happened yet. Yes I also know valuations look to the future. But I also know valuations don’t much matter. Here’s the numbers anyway.

Longer-Term Stock Chart

You can open a full page version of this chart, here.

Short-Term Chart

I think the stock could reach $170-185 in the near term with a fair wind behind it.

Full page version, here.

Stock Rating

We rate at Accumulate at present but note proximity to our Markup Zone ie. we will be moving to Hold if the stock moves up much more.

Get More From Cestrian Capital Research

Yet to join us? You can sign up right here:

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long position(s) in SNOW.

Alex King, CEO, Cestrian Capital Research, Inc. - 21 November 2024.