Snowflake Q2 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Not So Pretty When It Melts

by Alex King, CEO, Cestrian Capital Research, Inc

$SNOW stock is at the present time more flaky than it is crystalline. Want to lob rocks at this one? Easy. It was an overhyped IPO that hit the market during an overhyped time for growth stocks (September 2020), growth rates have just declined with no sign of arrest, and the fat cashflow margins aren't enough to compensate for the revenue multiple compression that the valuation has suffered with the combination of a cooling in appetite for high growth, EPS-negative names and that deceleration in the company's own growth. Oh also the level of stock-based compensation is bordering on the absurd, and I say this as someone whose critique of massive stock based comp schemes is usually, meh, that's the cost of entry to tech stocks. The dump post this earnings print has put the stock back down to its post-IPO-lows-zone. You could be forgiven for dropping this one entirely.

So why bother owning this at all, or planning to do so? Well, three reasons I think.

- Enterprise software peaked in Q1 this year and has had a rough ride since. It has begun to recover, as evidenced by our Enterprise Software Model Portfolio in our Inner Circle service.

SNOW may be a laggard but in the end the rising software tide may lift this one too.

- AI. For now, the AI boom has really only benefitted chip stocks and the major tech players like Microsoft. The spending implications of AI - more software, more data storage and analytics, more comm, more everything - has yet to really dawn on investors in my view. SNOW provides data analytics and can process very large datasets. In the end I would expect both the revenue line and the stock price to benefit as the AI theme broadens out.

- The chart. At a fairly interesting risk/reward level right now where a sensible stop loss is not too far below, but the technical upside is material.

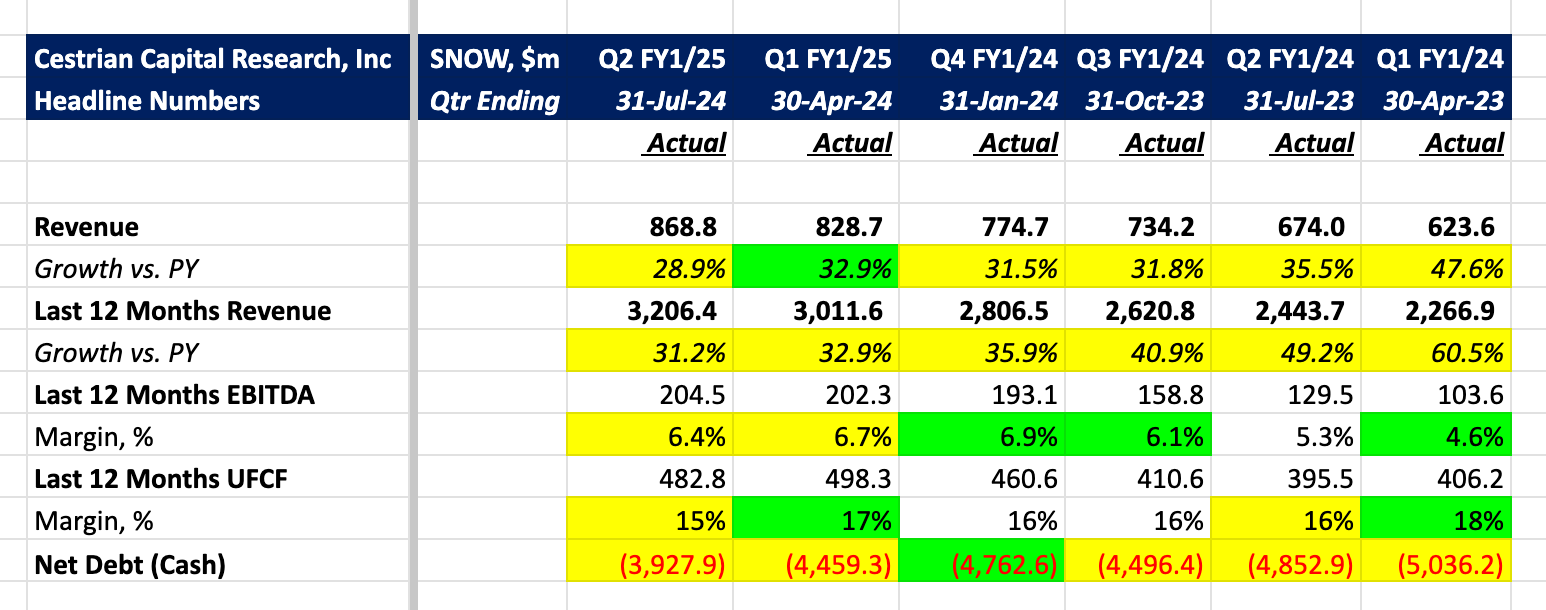

Here's the headline numbers just printed.

Below - available to paying subscribers of all tiers here - we review the fundamentals, the valuation, the stock chart, our rating and price target. Read on folks.