Looks Cold, Isn't.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Snowflake Q1 FY1/25 Earnings Analysis

As everyone knows, the dearly departed Frank Slootman Esq was the Savior Of Enterprise Software and once he walked, SNOW was doomed. Right?

Well, we said not. We said that a new CEO, any new CEO, usually has a big ole point to prove, and we said that with the new guy taking the reins at Snowflake, we might expect good things to follow.

They just did. Nothing to set the world alight yet, but the fact is that revenue growth accelerated for the first time since October 2021, and RPO (order book) growth is the highest in over a year. So something good is afoot.

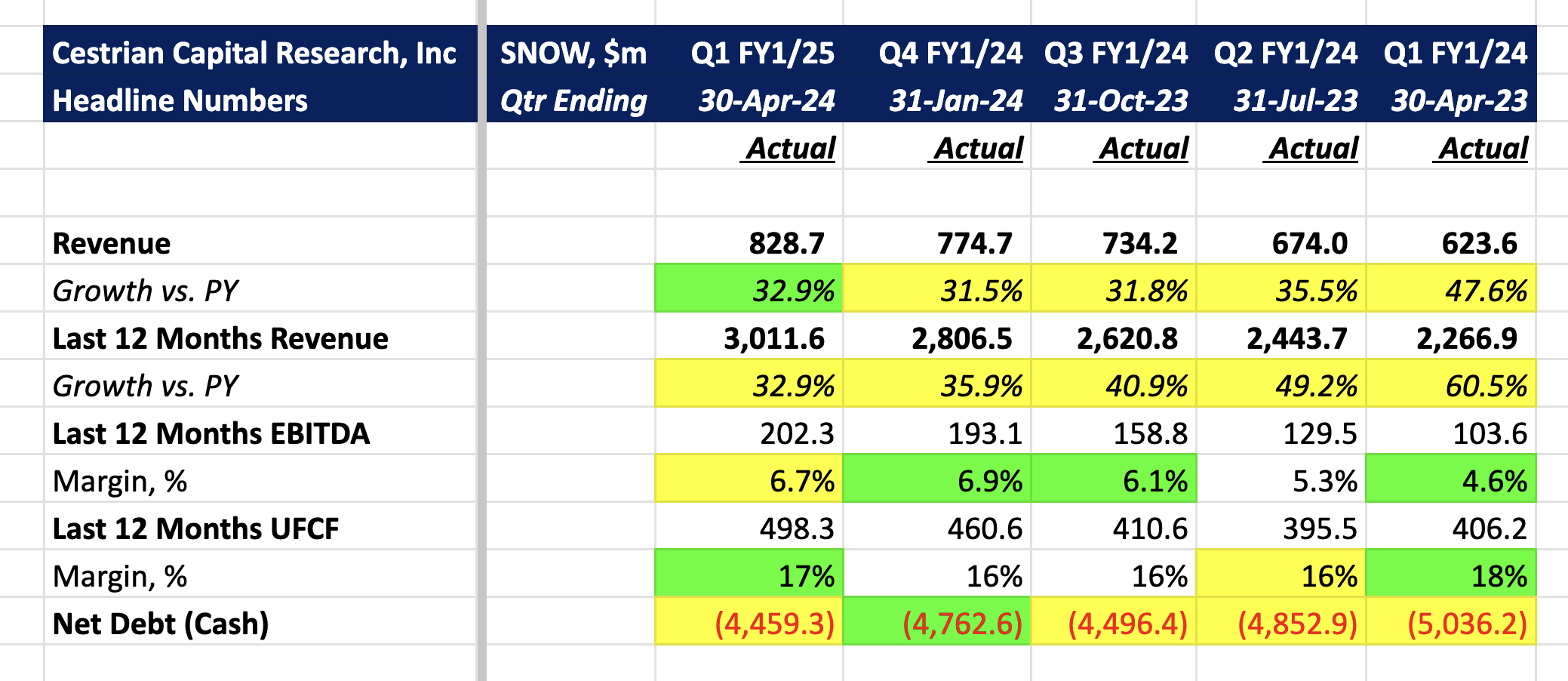

Below you can see the headline financials, then for members only, we go deeper into the numbers, we look at the stock chart, our rating and price target.

Snowflake Headline Financials