SignalFlow AI - Nasdaq Edition

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Part Deux.

by Alex King, CEO, Cestrian Capital Research, Inc

We launched our SignalFlow AI S&P500 service in the middle of October this year. It has been a rip-roaring success, and here I am speaking about both the quality of signals it has generated and the number of folks that have signed up for the service. Jay and I are delighted with how it's going - thankyou if you've joined already, and if you haven't, please consider doing so (here).

Today we launch the next Signal Flow AI module - for the Nasdaq-100. The service uses the same underlying machine learning technology as our S&P module, but is trained on and provides risk on / risk off signals for the $QQQ ETF.

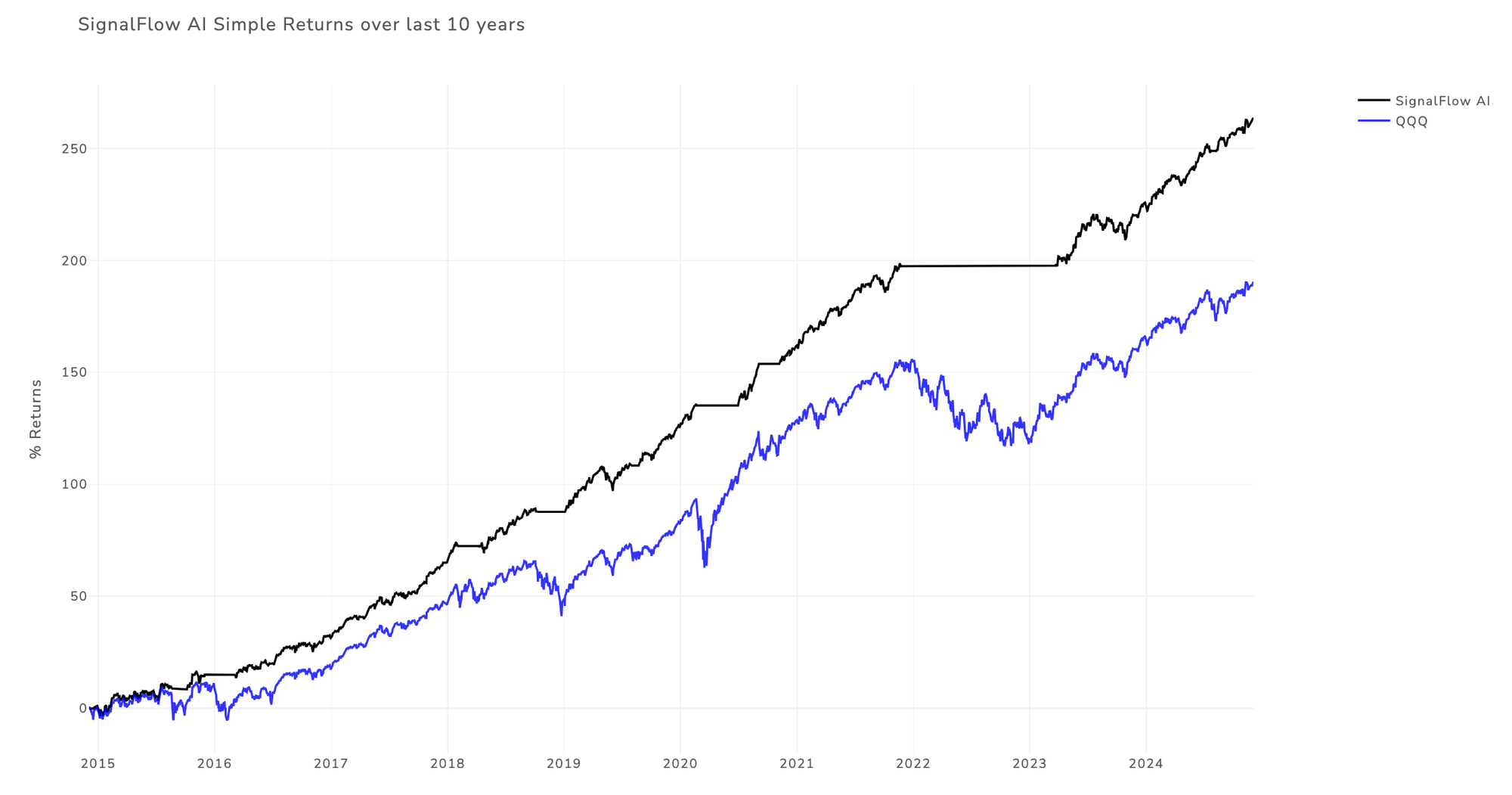

Here's the backtested results for the $QQQ signal service.

The model is complex but the signal output is simple. One, or zero. Risk On, or Risk Off. Risk on means the model thinks there is no material correction inbound in the QQQ. Risk off means the model thinks there is a material correction coming. When the model thinks the correction has happened and upwards direction is re-established, the model goes back to 1, Risk On. The chart above shows what happens in backtesting if you had put your capital to work in QQQ when the model said Risk On, sold it when the model said Risk Off, then put it back to work in QQQ when the model said Risk On again.

In essence the model is designed to help you avoid material corrections in the QQQ. Missing these corrections in the backtest generates that QQQ-beating performance.

Now, reality isn't backtesting but I can tell you as a real live user of the SignalFlow AI SPY service that it is working out very well for me so far. I use the service exactly as designed and I find it a low-stress way to put capital to work in the S&P500. I will be using the SignalFlow QQQ service in exactly the same way.

We will launch more signal modules over time but now we have two - SPY and QQQ.

You can sign up here for QQQ.

If you already subscribe to the SPY service, ask in Slack chat and we'll give you a half-off coupon for the QQQ service.

Similarly if you join up for QQQ only, and you want to add SPY, you get half off.

This applies whether you're an Investment Professional or an Independent Investor.

Join us!

Cestrian Capital Research, Inc - 2 December 2024.