SignalFlow AI

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Introduction - Real Simple AI.

by Alex King, CEO, Cestrian Capital Research, Inc

We are delighted to host SignalFlow AI, a family of very simple trade signal services based on a quantitative analysis model developed by Jay Urbain, Ph.D.

The basis of SignalFlow AI is straightfoward. What if you could use a machine to take the fear and emotion out of investing and trading? A machine that is tasked with pursuing upside, but which is unemotional about how to do so when market conditions change?

This is a task which human investors and traders should be able to do, but usually don't, because emotion - greed and/or fear - takes control of their trade execution, often in a manner at odds with perfectly sensible analysis that they just prepared.

SignalFlow AI uses machine learning and extensive backtesting to identify periods where the model believes markets are stable to the upside (ie. ‘bull market’ conditions), stable to the downside (ie. ‘bear market’ conditions), or unstable (ie. choppy conditions with no clear direction).

We provide a family of services arising from this same quantitative analysis.

Let’s go deeper.

Concepts Behind Our SignalFlow AI Model.

The original concept behind SignalFlow AI was to develop a model to identify the state of the market to avoid painful drawdowns. If we can identify periods where we should exit the market or go “risk off,” we should be able to significantly improve returns.

We were also looking for a trading edge since almost any trading strategy will work better when applied in the right market state.

Moving averages tend to be late getting you out of the market, and late getting you back in. In fact, you will underperform SPY when using the traditional 200-day moving average strategy.

A key insight to our approach was recognizing how market data can change and how relationships between different forms of market data can change in different markets.

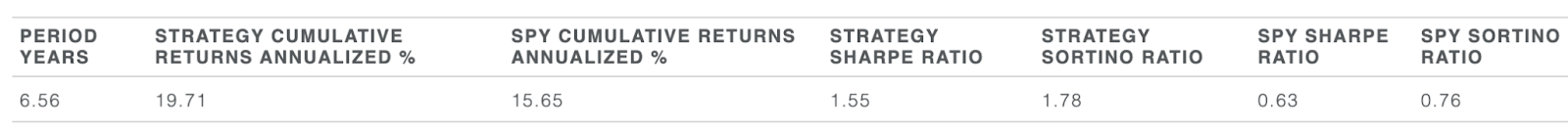

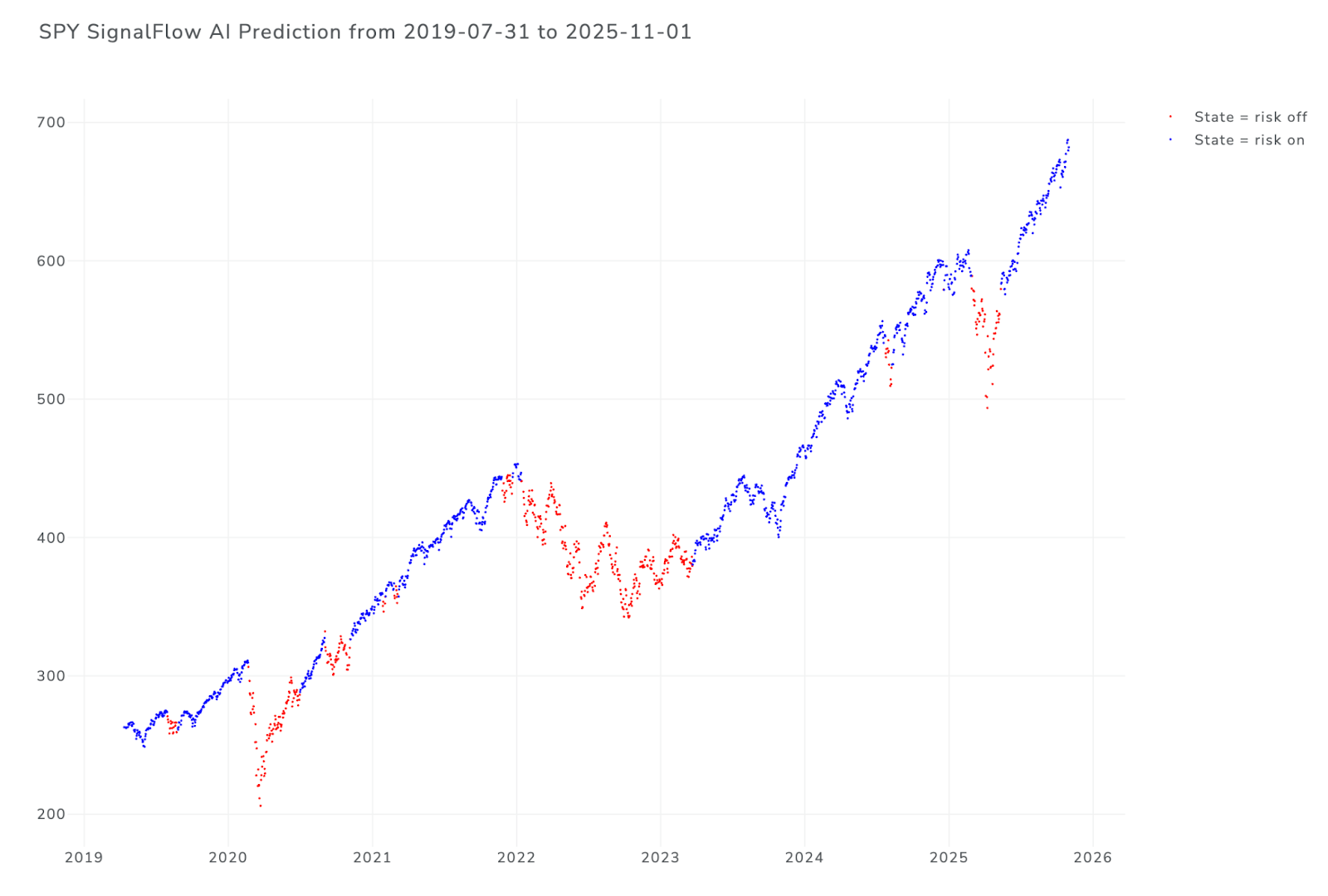

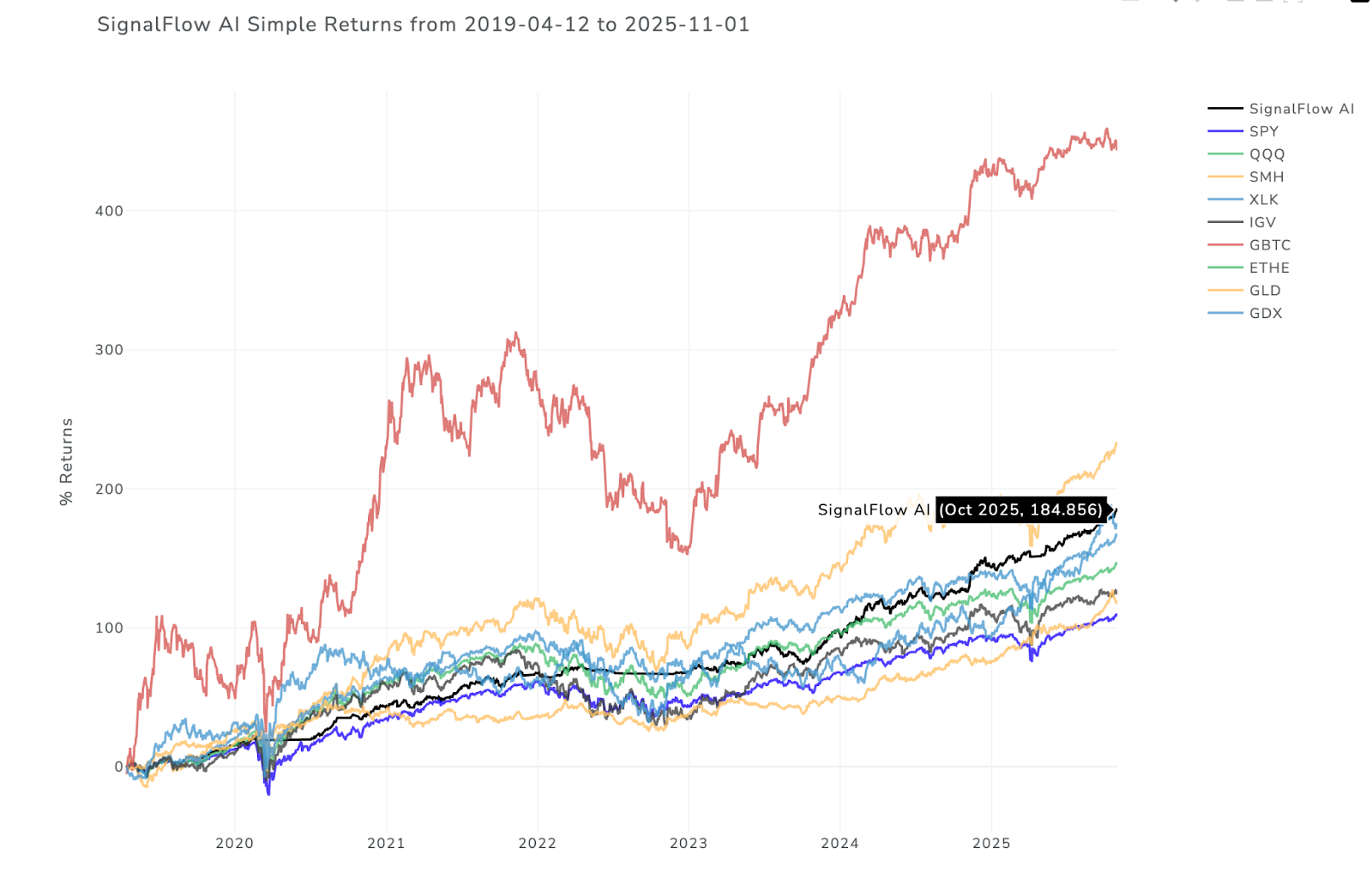

To capture this insight, we developed SignalFlow AI, a machine-learning AI model that identifies risk-on and risk-off states for markets, ETFs, and stocks. Note how SignalFlow avoids dramatic downturns.

Not only does the SignalFlow strategy outperform SPY buy and hold, it significantly improves return on risk measurements such as the Sharpe and Sortino ratios.

Using SignalFlow, you’ll have a valuable risk-on/risk-off signal that can help you improve almost any trading strategy.

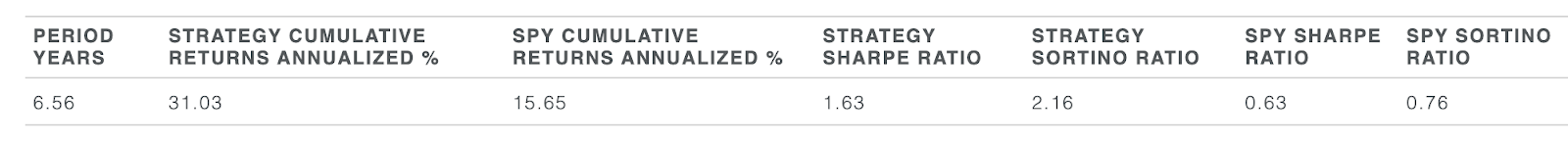

Once we became confident in the performance of our “risk on”/ ”risk off” state model, we added a relative strength model. The idea here is to use a portfolio strategy that invests in the strongest assets that are “risk on.”

For example, here is the SignalFlow ETF Growth Strategy that invests in the top 3 growth oriented ETFs.

Whichever SignalFlow AI service you choose - SPY, sector rotation, bonds, long/short - we provide daily signals after the close each day and a discussion channel too.

Here’s the range of services to choose from - you can subscribe to one, two, three or all of them.

Equity - Long Only

- SignalFlow AI For $SPY provides a simple S&P500 ‘Risk On’ / ‘Risk Off’ signal daily at the close. A ‘Risk On’ signal means the model believes the S&P500 is not at risk of a material selloff; the implication being that the $SPY ETF can be bought or held. A ‘Risk Off’ signal means the model believes the S&P500 is at risk of a material selloff; the implication being that it believes owning cash is preferable to owning $SPY.

- SignalFlow AI - Growth Edition takes this risk calculation to the next level. Using the S&P500 as the “carrier wave” to determine risk on or risk off status, the service provides the following outputs daily at the close. Either ‘Risk Off’ (implying holding cash) or ‘Risk On’ - and if ‘Risk On’, it selects what it believes are the top 3 growth ETFs from a list of 10 or so names including SMH (semiconductor), IGV (software), Bitcoin, etc.

With the obvious rider that future results may be different to the past, here's the 10 year backtested result of using a strategy based on the SignalFlow AI model to decide when to buy, when to hold, and when to sell $SPY, vs. simple buy-and-hold.

If you look at the chart you can see the risk calculation of the model very clearly. When the market weakens, sell and move to cash. When the market strengthens, redeploy that cash. Rinse and repeat.

And here’s how the SignalFlow AI - Growth Edition model backtests. If you look at the third chart below, which compares the cumulative returns of the Growth Edition model vs. SPY - you can see how powerful it can be to be in the right growth names at the right time, and out of the market altogether at the right time.

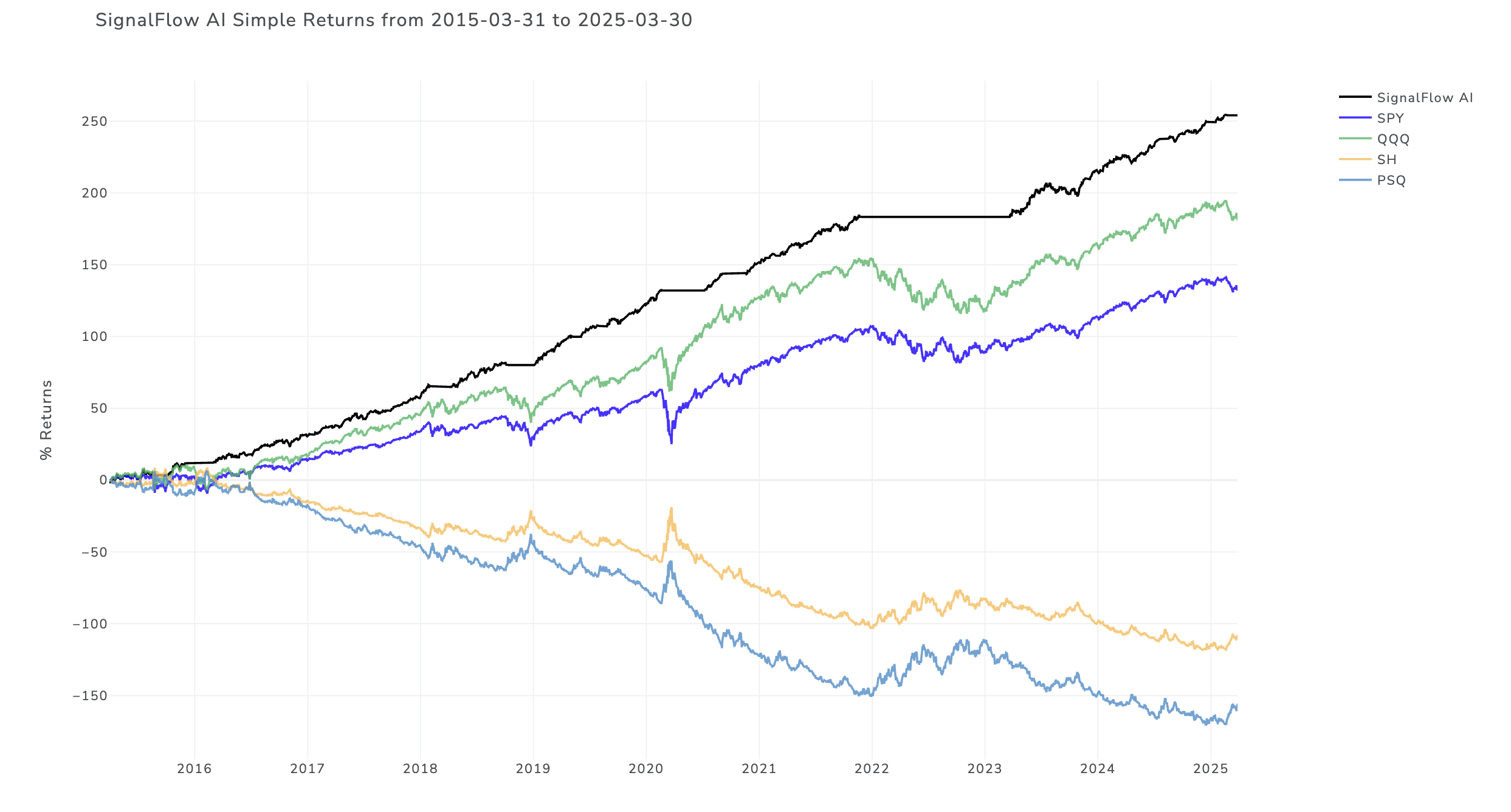

Equity - Long / Short

SignalFlow AI Long/Short provides a signal service, once daily at the close, stating which of the following ETFs the model believes is the most compelling to own:

- SPY (long S&P500)

- SH (short S&P500)

- QQQ (long Nasdaq-100)

- PSQ (short Nasdaq-100)

The model also considers when it believes it is best to own cash (ie. none of the above ETF positions).The goal of the model outputs is to enable investors to not just avoid, but to benefit from any periods of market weakness - in addition to benefitting from periods of market strength.The backtested returns in the last ten years, shown here, illustrate the benefits of this approach.

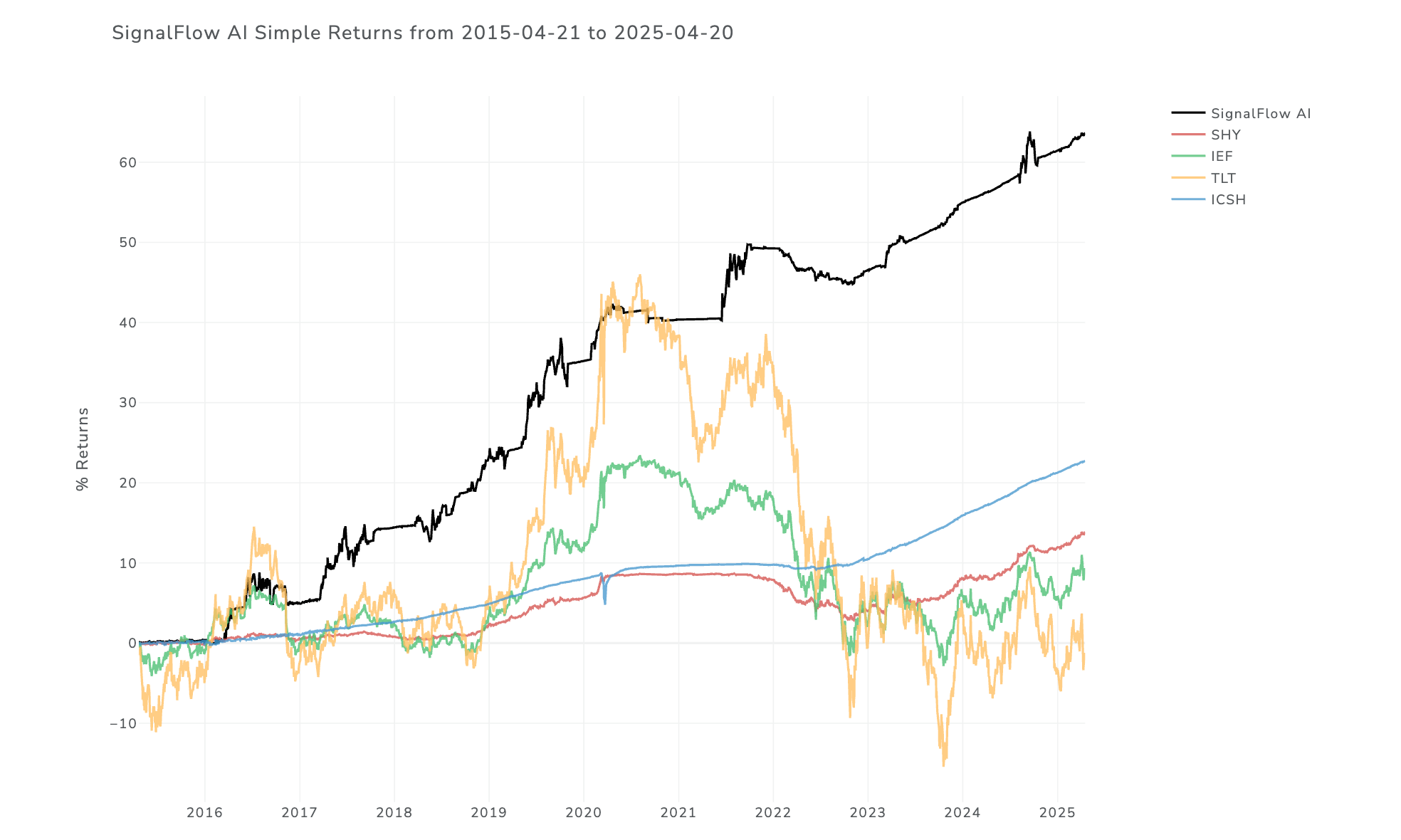

Bond ETFs - Long Only

SignalFlow AI For Bond ETFs provides a signal service, once daily at the close, stating which of the following ETFs the model believes is the most compelling to own:

- ICSH (ultra short term bonds)

- SHY (2yr bonds)

- IEF (7-10yr bonds)

- TLT (20+ yr bonds)

The goal of the model outputs is to enable investors to avoid periods of market weakness in any one of these bond ETFs. The backtested returns in the last ten years, shown here, illustrate the benefits of this approach.

Testimonials From Paying Subscribers

"I am wildly thrilled with SignalFlow AI for $SPY! I have been following the signals and moved almost completely to cash with the most recent change to risk off. Absolutely incredible for me, mentally and financially. Thanks so much to the team for developing this service.” - April 2025

“The long/short service paid for itself in one day overnight by the way! Thankyou.” - April 2025

“Rather than a day that could have ruined the weekend, I was able to watch the market tank knowing that I had the knowledge to weather the storm and come out far ahead.” - April 2025

Choose Your Service Tier

We offer this service family with two pricing tiers - Investment Professional and Independent Investor.

Investment Professionals

If you’re an investment professional - as defined in our terms and conditions, here, then choose from the “SignalFlowAI Pro Edition” services. You’ll pay $2499/yr or $299/mo for the simple long-only SPY service; it’s $7999/yr or $999/mo for the Growth Edition service. The long/short service is $4999/yr or $699/mo.

Note that this is a single-user subscription. If you require multi-user subscriptions please contact us at minerva@cestriancapital.com to discuss discounted multi-user pricing.

Independent Investors

If you’re not an investment professional under our terms and conditions, choose “SignalFlow AI - Independent Investor”. This single-user subscription is for use only by independent investors - it is not available to investment professionals per our terms and conditions. Independent investors pay just $1199/yr or $149/mo for the SPY service, or $3999/yr or $499/mo for the Growth service.

Deep Dive

I want to turn this over to Jay himself now. Here's some background as to the original development of the SignalFlow AI quantitative model.

A Constantly Evolving, Growing Family Of Services

As with all our pay services, SignalFlow AI will expand in breadth and depth as time goes by. It will cover more tickers and different strategies. Join now to lock in your pricing - prices for the service will continue to rise for new joiners as the service evolves over time.

Cestrian Capital Research, Inc - 16 May 2025