SentinelOne Q3 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Set to Automatic

By HermitWarrior a.k.a. Richard Iacuelli

To read one cybersecurity vendor's earnings call transcript is to read them all, almost like someone 'cut & paste' between them. In the prepared remarks, management point to the same highlights: superior technology, large customer wins, displacing competitors' products, ARR on the up... oh, and of course the mandatory buzzword in the cybersecurity marketing playbook: platform.

Look a little closer though and we start to see shards of light between the same, closely packed talking points. For SentinelOne ($S) this is particularly striking in two distinct but related themes: AI and automation.

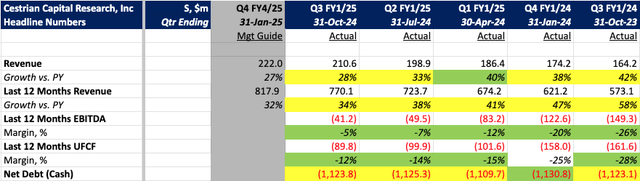

Before we look at these in detail, let's review the headlines.

Similar to their larger competitors, revenue growth continued to decelerate year on year, with Q4 guidance showing a further - albeit mild - slowdown, while EBITDA and unlevered pre-tax cashflow (UFCF) margins continued their slow climb towards positive territory. So far 'so what'?

The 'so what' factor boils down to those two themes highlighted earlier: AI and automation.