SentinelOne Q2 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

All Grown Up Now

by Alex King, CEO, Cestrian Capital Research, Inc.

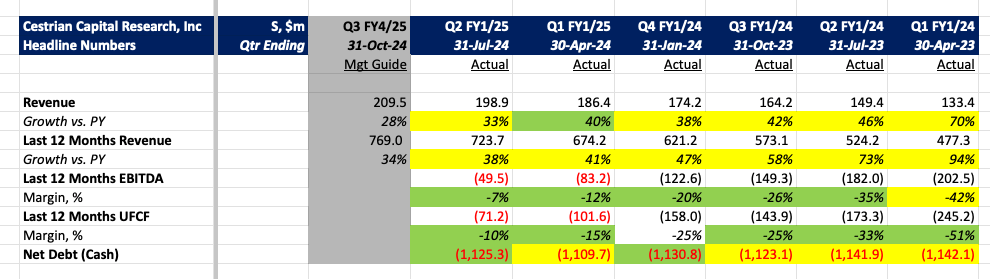

SentinelOne ($S) is now close to sustained cash generation and continues to grow revenues at a decent clip (TTM growth is +38%; this quarter vs. the same quarter last year, +33%). This is great progress by a company once notable mainly for chugging other people’s money at a grand old rate of knots.

Fundamentals overall look solid; the valuation isn’t silly; and the chart looks medium-term bullish to my eye.

Here's the breakdown.

Headline Fundamentals

Now the detail. Want to dig into this? Ask us in Slack chat if you're an Inner Circle member.