Sector Rotation Heading Into Q4

Our first actionable Sector ETF Rotation ideas here at Inner Circle.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

If....

Righto. The latest element of Inner Circle is Sector ETFs, specifically, we will be using sector ETFs to follow another Big Money rotation theme. The idea is that one could notionally allocate a pool of capital to do nothing other than follow Big Money into and out of sector ETFs as they roll through the Wyckoff Cycle. The usual method:

- Gradual buying sideways at the lows = Accumulation

- Rapid price moves up on low volume = late money buying = Markup

- Gradual selling sideways at the highs = retail buying and Big Money selling = Distribution

- Collapse, no more buyers = Markdown.

This is rather a long note on the topic because I'd like to share some of the thought process here. As always I welcome comments and thoughts on this. The goal here is that we all raise our game, not that some diktat is handed down from on-high here at Cestrian Towers.

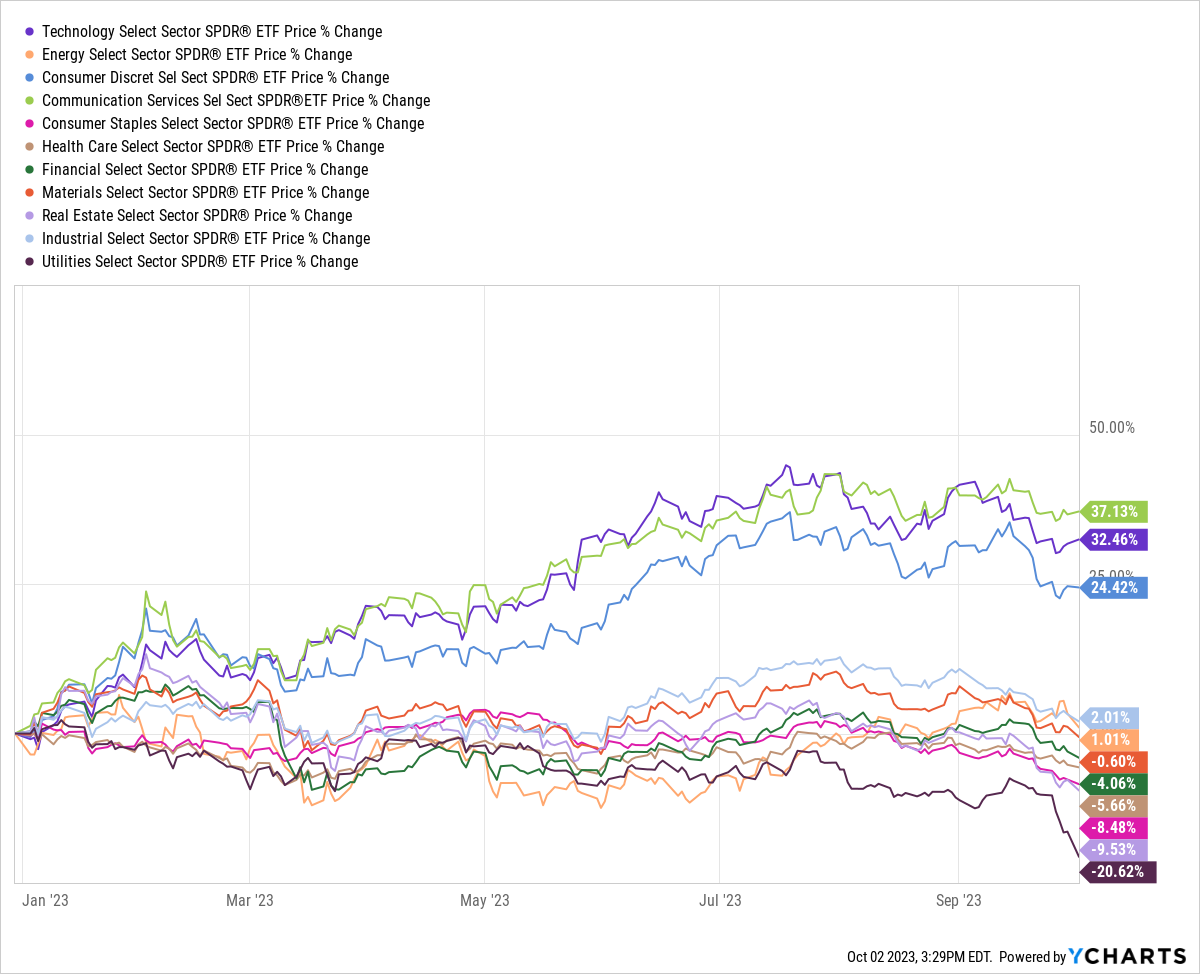

First of all let's go top-down on the sectors. In all cases we are using the SPDR family of sector ETFs. If you're new to our work what you won't know is that around this time last year we started studying thse ETFs and it seemed to us - and we said, loudly - that XLC, XLY and XLK (Communication Services, Consumer Discretionary, Technology), which had been beaten down all through 2022, were set to move up. And now if we look at the sectors on a YTD basis, we can see that those names did indeed rise to the top. Now, this is hardly thousands of data points, backtested trading strategy analytics, but it's enough to want to refine this method.

So let's go again. Let's use the same method we did last year to say, which names are riding high now, with the potential to drop, and which names are downtrodden and have the potential to move up?