MUST READ: Sector Rotation Bulletin

As tech moons, we check on the next set of accumulation opportunities.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Rotation As Of Friday 17 November

If you missed it, first read this note where we introduce the ETF sector rotation strategy here in our Inner Circle service.

Around this time last year, and indeed through to around the end of Q1 2023, we were yelling from the rooftops that tech stocks were under institutional accumulation and would, we believe, break to the upside. We posted note after note to this effect. Here's one of many examples that we published in the public domain.

And another:

There were a lot more of these in our subscription services.

We reached this view because (1) our single-stock work said so; company fundamentals were nowhere near as bad as sentiment, and single-stock charts looked to be exhibiting sideways-action-at-the-lows, a telltale sign of accumulation. And also, of equal importance, because (2) our ETF sector rotation analysis said that $XLK (tech), $XLC (comm services, think Meta Platforms and Netflix), and $XLY (consumer discretionary, think Amazon and Tesla) were also trending sideways at the lows and were woefully out of fashion. So, said we, XLK and XLC and XLY were the ETFs to load up on for a breakout play, and tech stocks were the places to put capital to work as the bear fought its last.

The nature of our business means we are wrong often; the success of our business is in no small part a result of our being right often. Calling 'buy' in XLK XLC XLY and a wall of single-stock tech names a year ago turned out to be a righteous call.

Well done us. But now what?

Well, now we look at what looks now as tech and comm services and consumer discretionary looked a year ago. And we look to see which stinkers, the things nobody on FinTwit wants to buy but which the volume profile says a lot of people on Wall Street are buying, ought now to be accumulated.

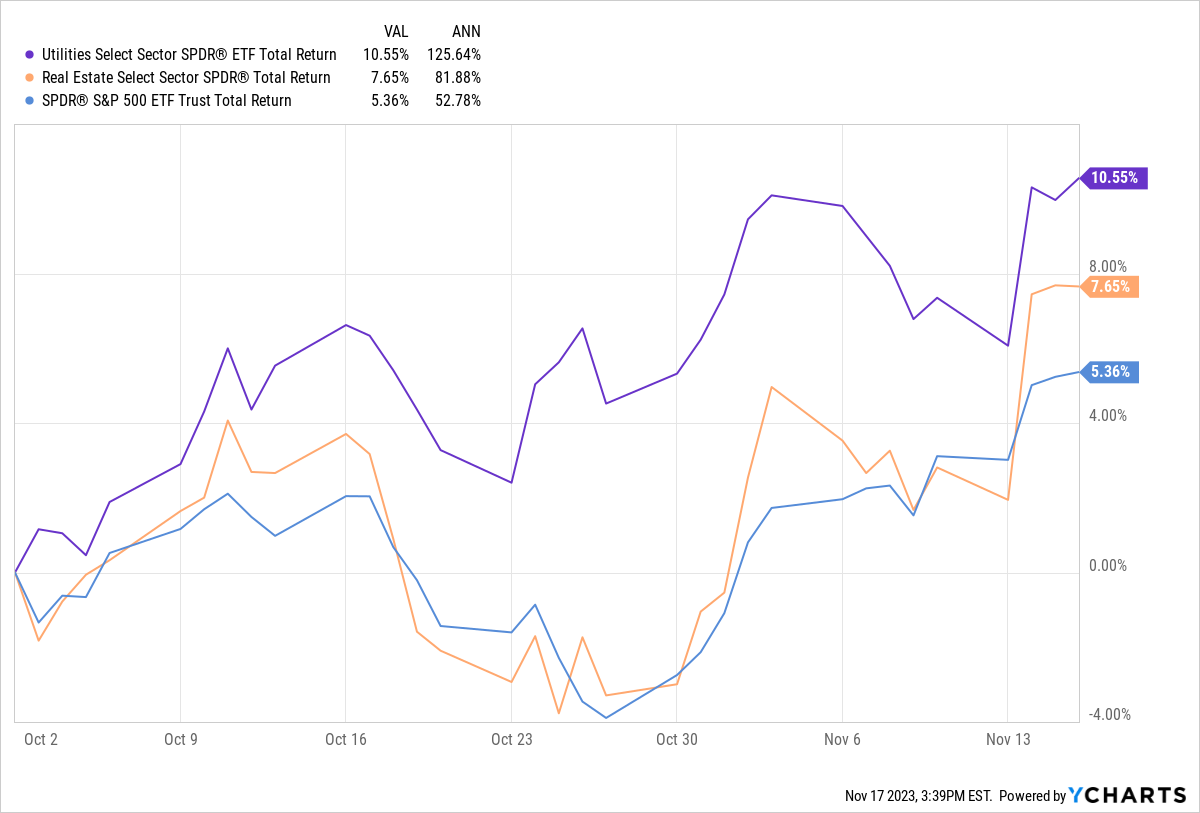

Before we do that, let's check in on the two ETFs we thought worth accumulating from early October - they were Utilities ($XLU) and Real Estate ($XLRE) - see the note here.

Not too shabby.

Let's see where we stand with opportunities right now. Read on!