Salesforce Q1 FY1/24 Earnings Review

Oracle, Salesforce, Salesforce, Oracle … So Hard To Tell Them Apart

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Old Software Companies Never Die

by Alex King

Salesforce ($CRM), once the enfant terrible of enterprise software, is now sat comfortably in the old folks’ home with pipe, slippers, and a “dang those yahoo youngsters” take on life. It has, in short, become its alma mater, Oracle ($ORCL). Although without the killer cashflow margins.

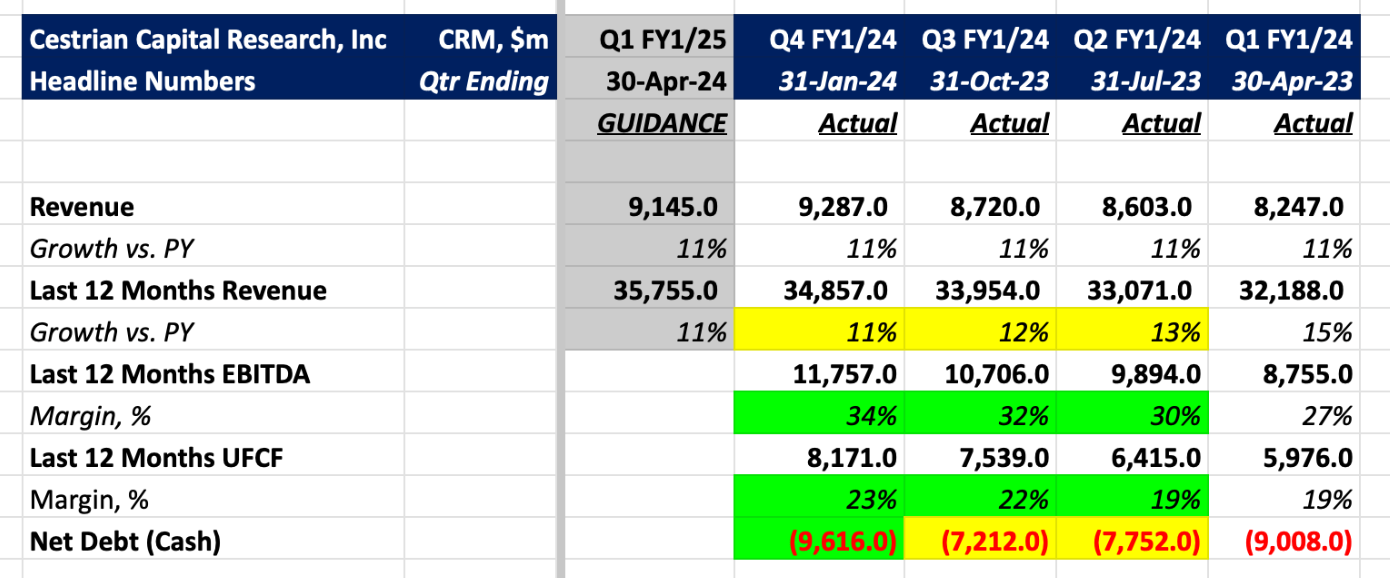

Here’s the headline numbers.

In short:

- Revenue growth remains at 11% vs PY this quarter … the same growth rate for the last three quarters … and the guide for next quarter is … you guessed it … 11%. That is an unusual level of consistency.

- EBITDA and cashflow margins are climbing nicely, but note the meaningful gap between them. For me this means I tend to disregard EBITDA and focus on cashflow; and those cashflow margins are rather low for the business model. Grandpa Larry will give you >40%, come rain or shine.

- The balance sheet is safe as houses, with almost $10bn of net cash now (if you deduct the value of their long-term equity investments, a more cautious measure, you can say there is around $6bn net cash).

Let's turn to the stock price outlook, more detailed financials, valuation analysis, and our rating.

Read on!