RIAs - Read This.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Rise Of The Machines

by Alex King, CEO, Cestrian Capital Research, Inc

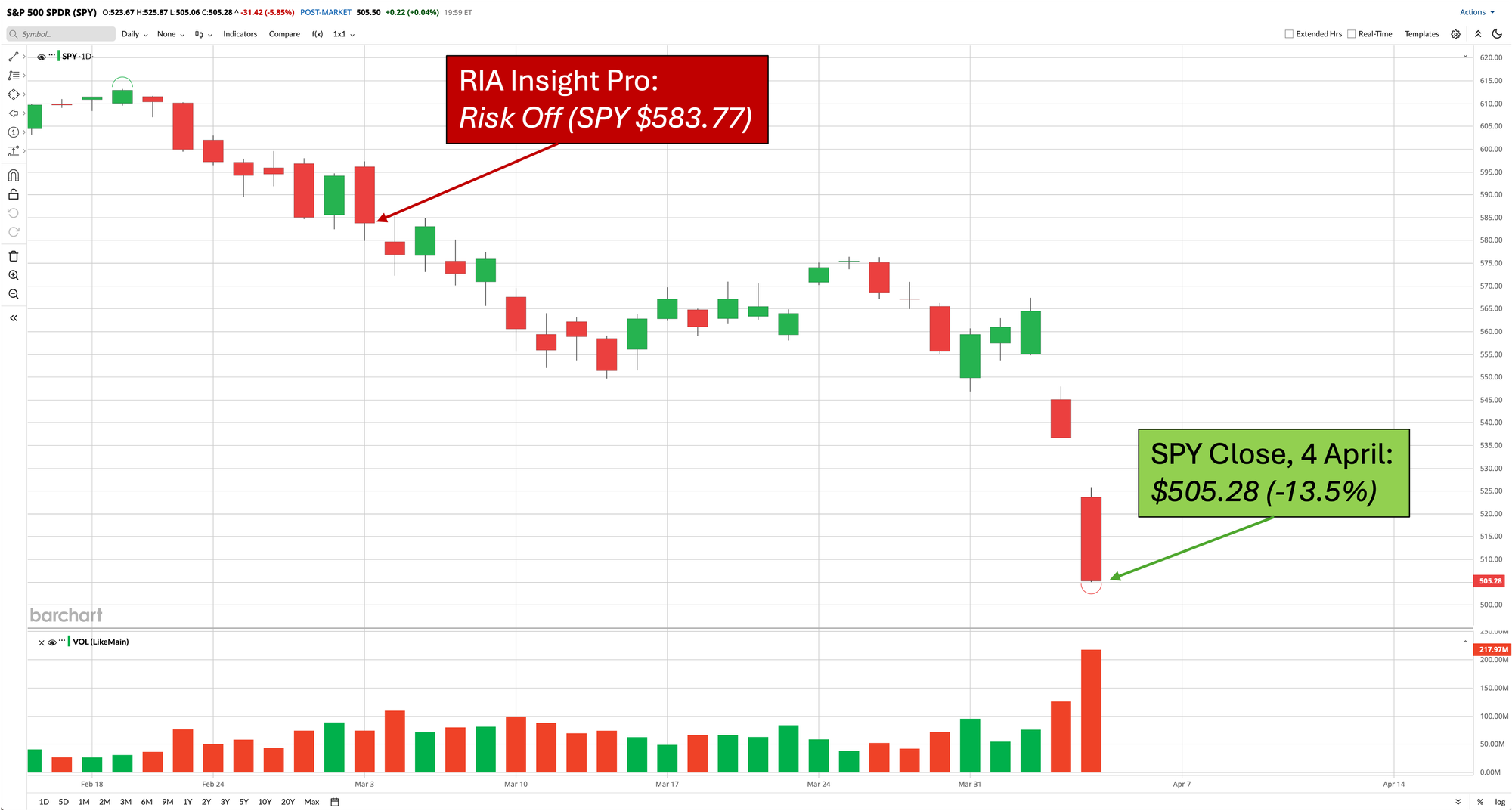

If you work for or own and operate an RIA business, I would like you to consider signing up for our RIA Insight Pro service. I can tell you that at the present time, RIAs who are using the service’s Sector Rotation Model Portfolio are having a number of very easy client conversations when those clients call to ask how their investments are performing in the current environment.

Inbuilt Risk Management

Our RIA service includes an ETF Sector Rotation model portfolio. This runs on a quantitative model that uses machine learning / AI techniques to do the following:

- Form a view on whether the S&P500 is likely to encounter a material correction, or not.

- If the model thinks a material correction is ahead in the S&P500, the model declares itself to be in a Risk Off state which implies holding cash alone.

- If the model believes calm waters are ahead in the S&P500, the model declares itself to be in a Risk On state.

- In a Risk On state, the model then considers which sector ETF from a list of 12-15 names it believes has the best prospects vs. the S&P500, based on a proprietary assessment of relative strength.

The idea is that this model portfolio has the opportunity to outperform the S&P500, without taking undue levels of risk - ie. without owning very high risk stocks, or options, or using margin or any other kind of leverage.

The model declared itself to be Risk Off on March 3rd at the close. Since then, the S&P500 has fallen 13.5% as of Friday’s close.

Sometimes, all one needs to do to beat the S&P500 is to avoid the worst of its corrections.

We know from a number of our RIA subscribers here that when their own clients have called, worried about their investments at this time, those who have followed the model portfolio have been able to say to their clients - “don’t worry - you have been in cash since early March and you have missed the worst of this drop”. And we know that has helped stand these RIAs in even better stead in the eyes of those clients.

We can’t know the future but I believe the sector rotation method will continue to deliver. At some point markets will level out and calm down and at that point I would expect the model to move back to Risk On and go back to sector selection.

Long/Short For RIAs And Their Clients

Now, I wanted to talk to you about another strategy we offer based on the same underlying quantitative model. Not all of your clients will want any short-index exposure or hedging; but some will. And for those that do, we think you can offer them a long/short index ETF strategy which works on the same proprietary relative strength basis.

SignalFlow AI Long/Short works by forming a view on which of these ETFs it believes is best placed going forward, based on long-run historic price analysis.

- SPY (Long S&P500)

- QQQ (Long Nasdaq 100)

- SH (Short S&P500)

- PSQ (Short Nasdaq 100)

These ETFs are all simple, unlevered instruments and based on our conversations with many of you, it seems it is permitted for many of your client accounts to hold any or all of these ETFs. We understand that hedging with options, or with leveraged inverse ETFs, is highly restricted, so we have sought a way to offer you hedging and long/short exposure using only these simple instruments.

The long/short strategy launched last week. The model selected “long PSQ” on Wednesday - in other words the model decided that a simple “short Nasdaq-100” strategy was its best idea.

PSQ was up some 8% from that call to Friday’s close.

I myself am running my own capital according to this long/short model. Anything can happen tomorrow, of course; but we’ve run this quantitative model for some months now, through periods of extreme market volatility, and it has performed well, keeping client assets safe in bad times and offering gains in good times.

You can read more about the service, and sign up, here.

If you have any questions at all, please reach out to me personally at alex.king@cestriancapital.com.

Thanks as always for reading our work.

Cestrian Capital Research, Inc - 7 April 2025.