RIA: Rotation - The Key To Making Money From Money Alone

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Introduction

by Alex King, CEO, Cestrian Capital Research, Inc.

I want to spend a little time explaining why we launched our RIA - Insight Pro service and where we think it can be helpful to your business.

The goal of the service is to help you grow assets under management. Not by helping you to set up new meetings with potential clients nor to help you convert potential clients into actual clients. That’s your core business and we assume you are pretty good at it already!

We know that much of your client work is focused on things not to do with securities markets - tax planning, estate planning, specific transaction advice, retirement planning, all that. And we know that doesn’t leave a whole lot of time in the day to research how to manage those parts of your client assets than can be put to work in securities markets. That may mean you simply follow standard 60/40 portfolios or other traditional methods. This has the major benefit of being widely recognized as a sensible way to place capital; if it goes well, great, everyone is happy; and if it goes badly because something bad happens to equities and/or bonds, well, that’s bad, but it’s happening to everyone so at least you can look your clients in the eye and tell them that markets sell off sometimes but, if patient, normally markets return to health. Which is true.

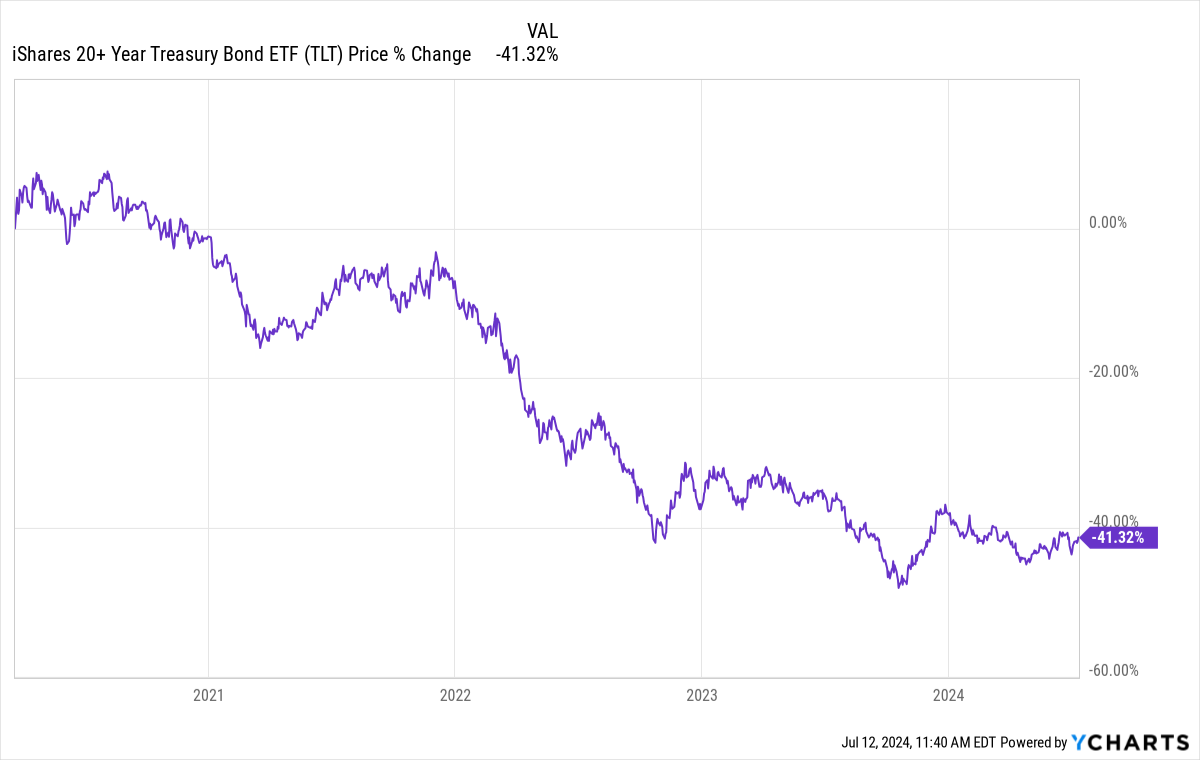

The problem is that sometimes it takes a long time for markets to recover, and this may suit the timeline of some clients - your younger folks who continue to pay money into their accounts and can enjoy the benefits later of buying at the lows today - but it may be very bad news for your already-retired or about-to-be-retired clients. Who, for instance, would expect US government bonds to perform this way in the last four years?

This kind of hit to a 60/40 portfolio - or, worse, to a more heavily bond-weighted portfolio for more risk-averse and/or older clients - is very painful and may take a very long time to recover. It makes for difficult conversations with clients. “Why has this account not kept pace with the market?” - they may ask, and “because I put it in US Treasury Bonds to keep it safe” isn’t a great answer when that safe is down 41% in a few short years.

We believe there is a better way to run client money; and we think that is to run their money in the same way that the largest investors of all run money. Which is to say, rotation.

What Is Rotation?

Rotation is a simple principle. Sell at the highs, buy at the lows. Easy to say but hard to do, because - when do you sell? What do you sell? What do you buy? Should you go to cash? What???

Large account investors - not the noisy hedge funds all over Twitter, but the very largest asset managers running long-dated quiet money - insurance companies, pension funds, sovereign wealth funds, that sort of thing - use rotation as their core business. They need to do this, because when you run truly huge money, you can’t go hunting for a breakout stock or an emerging market government bond that you think will run and run - because you have so much money that once you start buying that hot ticket, it will move up, and erode the opportunity. Frankly if you start piling into Nvidia in a hurry at scale, you’ll ruin your opportunity there too.

What rotation means for large account investors is more or less what Wyckoff identified a century or so ago. Take your time buying in small quantities regularly at the lows - accumulation. When the less-smart money realizes what your play is, sit back as they rush in to buy that security, moving up the price of the instrument you already finished buying - markup. Then when late bulls - retail, usually - come knocking, slowly and careful sell your stake over time - distribution. And then when there are no more buyers, but the late-to-the-party bulls are still selling, and the security is in freefall? Sit back and do nothing, because you already cashed your gains - distribution.

How RIAs Can Employ Rotation To Grow AUM

The reason large account investors use this method is because, executed correctly, it works. You can do this using major market instruments - an S&P500 ETF for instance - so that you are in position to make money on an upswing but sit out a downswing. If you learn to do this, you can beat the S&P500 using only the S&P500 - a neat trick if ever there was one. If you accumulated $SPY between April 2022-March 2023 (which is when the largest account investors were buying it), and then sat back whilst late money came to mark it up for you, your clients would be shaking your hand with vigor right now. This is easy to say in hindsight of course, but it’s also possible to say it at the time.

To make rotation work for you, you need technical analysis skills. Specifically, you need to understand (a) price movements in the context of prior price movements - just pattern recognition really, but an overlay and a measurement system that works with better-than-guessing accuracy and (b) volume behavior to spot when large accounts are likely buying, likely doing nothing, and likely selling. This sounds difficult - it isn’t really, it just takes time, repetition and practice. Anyone sensible can learn to do it if they have the time and space to do so.

Unfortunately, most RIAs don’t have the time to do this, because clients. Finding potential clients, meeting with them, converting them into actual clients, onboarding them, advising on all the things that aren’t stocks - that’s most of the week. If you live a solitary and ascetic life, perhaps you can spend all weekend working up stock charts, but probably you have something better to do.

So our proposal to you, and the raison d’etre of our RIA - Insight Pro service, is that we produce the rotation analysis for you. And we’ll be doing this in two ways.

Firstly, index ETFs. Over the longer timeframe - meaning months, years - we’ll lay out how we see US equity indices moving. Sideways at the lows - accumulation, buy. Moving up rapidly - markup, do nothing. Sideways at the highs - distribution, sell. Selling off rapidly, markdown, do nothing (because you already sold!) - or if you are set up to do so and have clients that want to you to do so, we’ll show you how short ETFs can help you make money for your clients on the downswing as well as the upswing. We’ll use simple unlevered ETFs to do this - $SPY, $QQQ, that sort of thing - the kind that you can explain easily and clearly to your clients why you have their capital in them. Executed correctly you can grow AUM consistently without having to take undue risk.

Secondly, sector ETFs. The S&P500 as you know comprises of a basket of sectors and each has stocks grouped together in sector ETFs. In our own work we like to use the SPDR series of sector ETFs, because they are highly liquid, institutionally traded (therefore technical analysis works), and own only high grade underlying issuers. Now, sector ETFs offer another dimension of rotation opportunities. Generally speaking, some are rising when others are falling. If consumer staples ($XLP) is in a rapid-up markup move, it’s likely that there is or is about to be some trouble in the economy, and that means that consumer discretionary ($XLY) is likely falling. If energy prices are rising, probably inflation is on the up and the price of money is high - that’s likely to mean energy ($XLE) is moving up and communication services ($XLC) is moving down. You see where the opportunity lies. If you can spot with only reasonable accuracy which sectors are under accumulation, which in markup, and which in distribution, you have a rotation method right there in front of you that can be used to augment index rotation. We will provide the analysis for you in this service, showing you where we believe each of the major sector ETFs (in the $XL… series) to be under accumulation, in markup, or in distribution. Again, executed well, this can allow you to grow assets under management using only simple, highly-liquid ETFs that are easy to explain to your clients.

We Get Started Monday

Paying members of our RIA - Insight Pro service will begin receiving our rotation analysis next week. Our goal is to make the analysis easy to understand and easy to use in your management of client assets - and crucially, easy to explain to your clients if you choose implement this method.

Yet to join the service? You can do so right at the button below. Launch pricing is just $499/yr or $99/mo. This price will rise materially over time for new joiners. The sooner you sign up, the lower a price you secure.

Any questions, you can reach me personally at alex.king@cestriancapital.com, or use this contact form on our website.

Cestrian Capital Research, Inc - 12 July 2024.