RIA - ETF Sector Rotation Update, Monday 14 April

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

How It Started … And How It’s Going

by Alex King & Jay Urbain, Cestrian Capital Research, Inc.

I hope you are finding this RIA Insight Pro service valuable in your quest to grow client assets under management. The core of the service is, as you know, the quantitative sector rotation model. The idea of this model portfolio is simple.

What if you could grow client assets under management at a rate in excess of the S&P500, but without taking undue risk? In other words without having to deploy client capital into high-risk stocks, and without having to use structured products like options or levered ETFs.

We think this can be done using sector rotation amongst a list of top sector ETFs, all of which in themselves carry only market-level risk. We developed a quantitative model to measure general market risk and then to select which of the sector ETFs offer the best prospects in its view; it’s a specific implementation of the SignalFlow family of models we employ in our other quant services (here).

The implementation in this RIA Insight Pro service is designed to take a safety-first approach. This is how the model resolves each day:

- Step One - does the model believe that the market - meaning the S&P500 - is at risk of a material decline? If yes, the model adopts a ‘Risk Off’ state. This means that in our RIA Insight Pro model portfolio we move to hold only cash.

- Step Two - if the model is in a Risk On state - meaning that the model does not believe the market is at material risk of decline - then it selects the top three sector ETFs by relative strength to the S&P500.

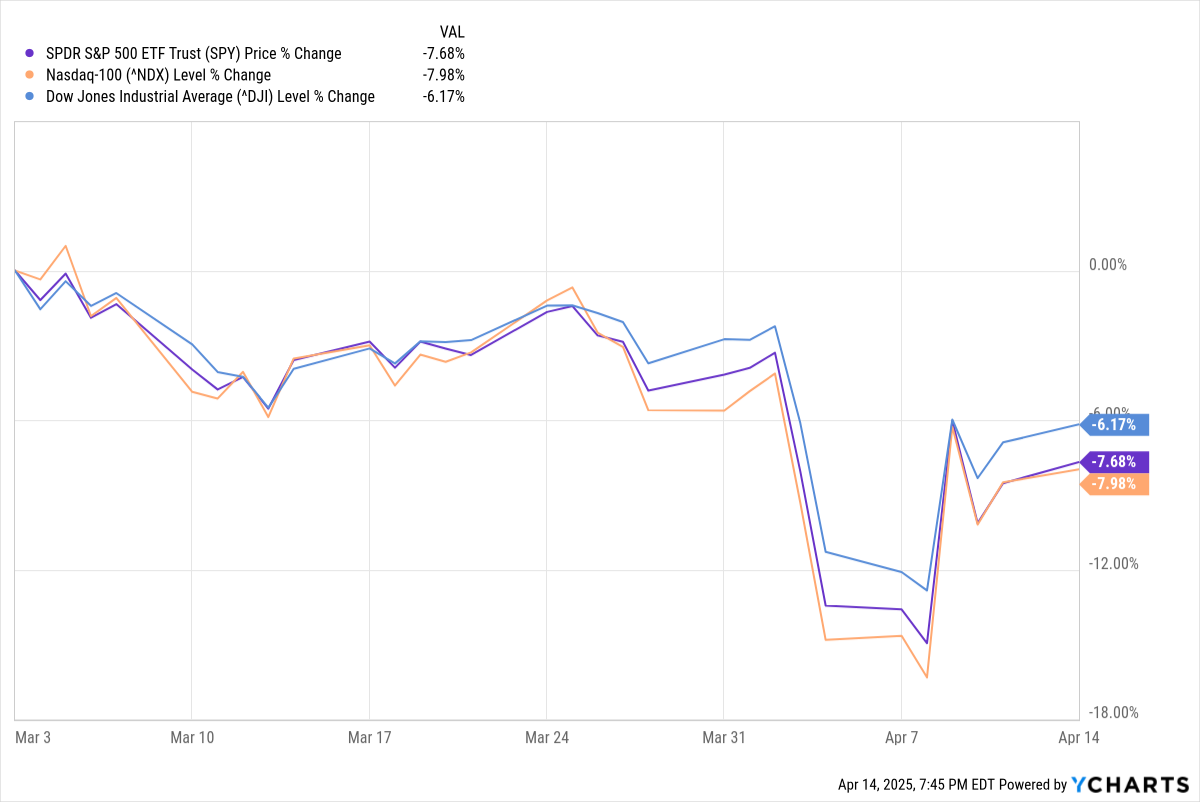

The Risk Off state is, we believe, critical to keeping client capital safe during turbulent times. The SignalFlow model went Risk Off on 3 March this year; here’s how the S&P500 has performed since then - we include the Nasdaq-100 and the Dow Jones to boot.

If you had followed the SignalFlow model you would have been holding cash since 3 March.

If you held the S&P or the Nasdaq, you would be down a little under 8% (indeed nearly 18% at the trough). If you held the Dow you would be down a little over 6%, having been down a touch over from 12% at the trough.

This risk-off move-to-cash signal we believe makes for an easy conversation with worried clients asking “how is my money doing” in this turbulent time in markets.

The latest model positions are as below, following today’s signal.