Qualcomm Q4 FY9/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Actually Cheap!

By Alex King, CEO, Cestrian Capital Research, Inc.

Most technology stocks today are valued at nosebleed levels. That doesn’t mean those stocks can’t keep climbing - it just means that at some point there is going to be pain for longs. Now, Qualcomm is maybe a different story. You can buy this RF behemoth for just 12.4x TTM unlevered pretax free cashflow. It has solid revenue growth and margins, a perfectly sound balance sheet, and a stock chart that looks like everything else in semiconductor (which is to say it looks to me that it’s poised to move up, but everyone else seems to think it’s all over - either I’m right or everyone else is right … hmmm … ).

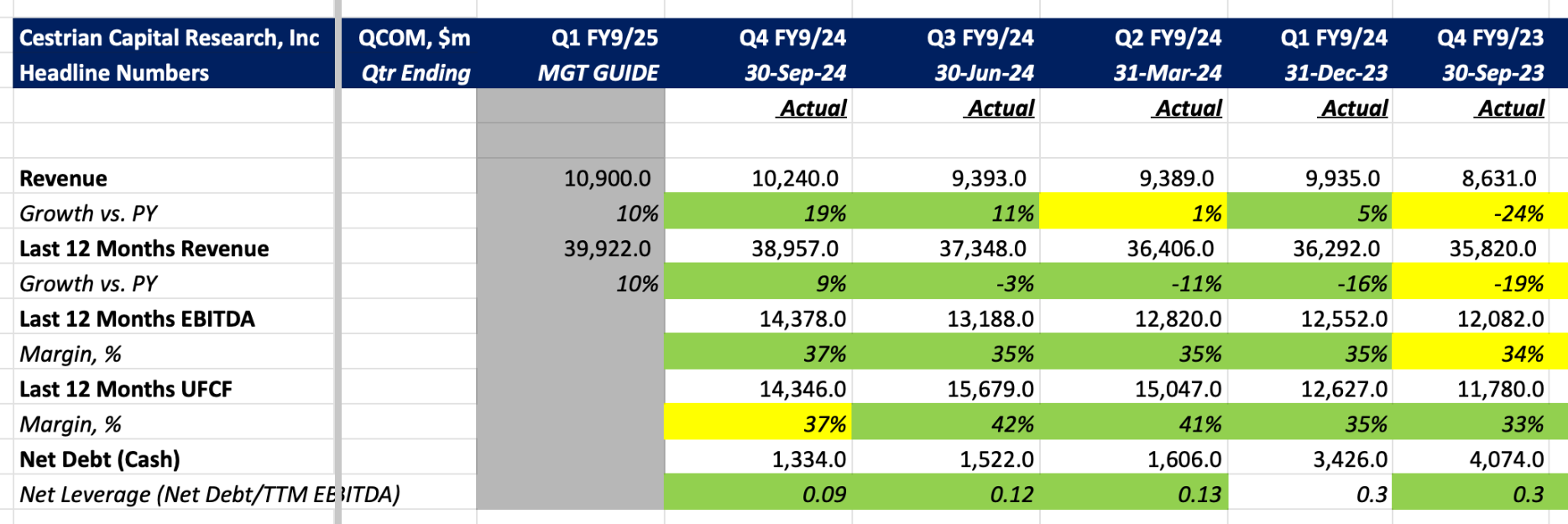

Financial Summary

Here’s the headlines.

Now, for our paying subscribers of all tiers here, we go on to look at financial fundamentals, valuation analysis, our rating and price targets.