Pretty Neat Grab Bag Of Stuff (AVGO Q2 FY10/24 Earnings Review) - No Paywall

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Let's Call It A Chip Stock

by Alex King

Broadcom, it should be said, is a pretty strange business. A kind of grab-bag of hot comm IC stuff, dying enterprise software stuff, and some other mush. There's not much point trying to invest in it based on fundamentals in my view, because you can't do the kind of fundamental analysis needed as an outsider. To really understand what's happening underneath the hood, you need to be sat with the management team constructing a pro-forma set of financial statements. This means stripping out the serial acquisitions and seeing how each is performing and what the return on equity and/or debt used to buy them is looking like. I can tell you that the sellside analyst community isn't doing that; but AVGO management probably are, and they probably manage to it quite closely. It most closely resembles a large technology buyout fund; except it can't lever up its investments as much as the folks at Silver Lake et al. Anyway, to cut to the punchline, I think this can only be invested or traded according to its chart. As regards fundamentals, the lines to watch are TTM revenue growth and TTM unlevered pretax free cashflow margins; net leverage (net debt / TTM EBITDA); and the share count. That's all you need as an outsider to check the thing is still running on rails and not starting to veer out of control, as grab-bag companies are wont to do from time to time.

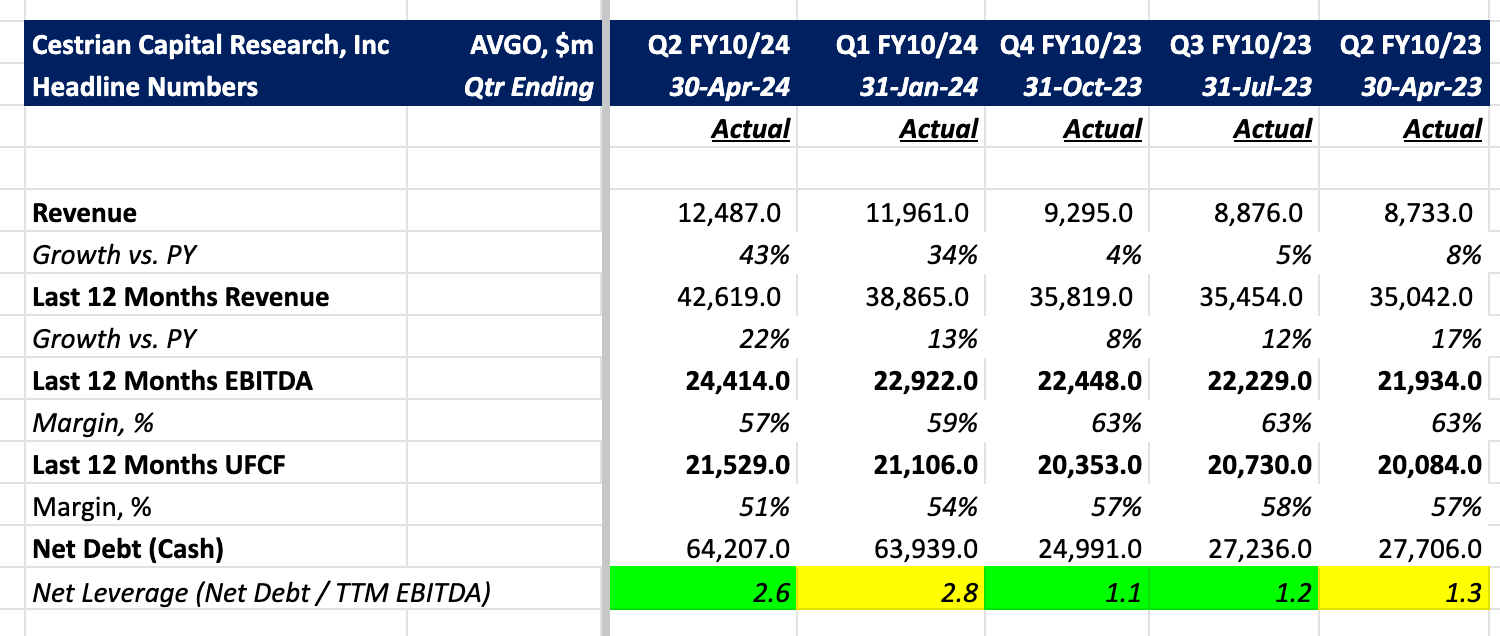

Headline Numbers

Growth looks high, but that's an acquisition effect. Cashflow margins remain very strong at 51%; the drop this quarter was due to a big working capital outflow which will likely reverse (buyout shops and acquisition-driven management teams that run their companies like LBOs are generally pretty good at managing working capital). Leverage ticked down to 2.6x TTM EBITDA which is nothing worrisome or even close to it. All fine here for now.

We now dig into the full fundamentals, the stock price performance, our price target and rating.

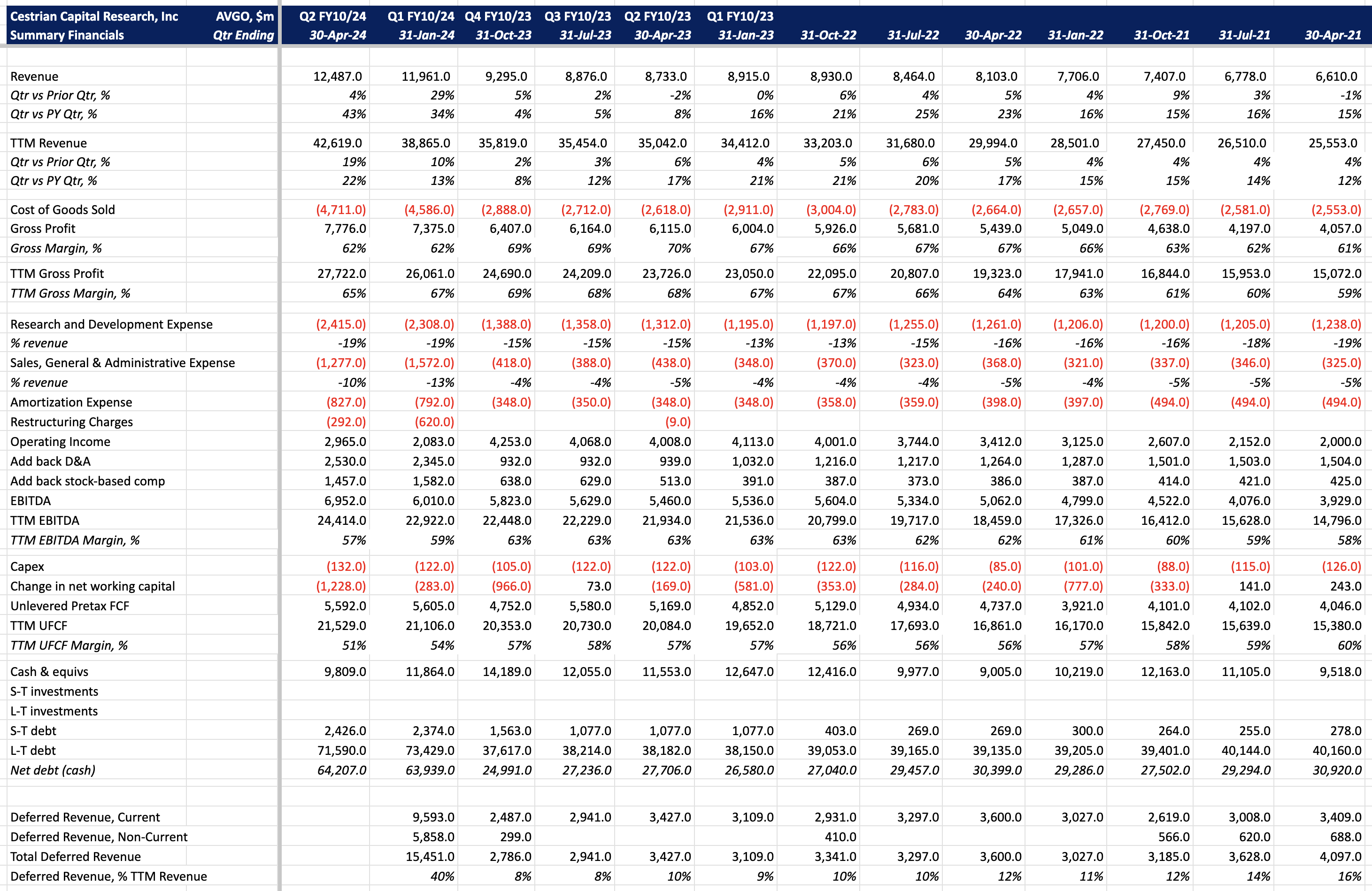

Financial Fundamentals

No deferred revenue data for this quarter yet - we have to wait for the 10-Q as the company didn't see fit to break it out in their earnings release.

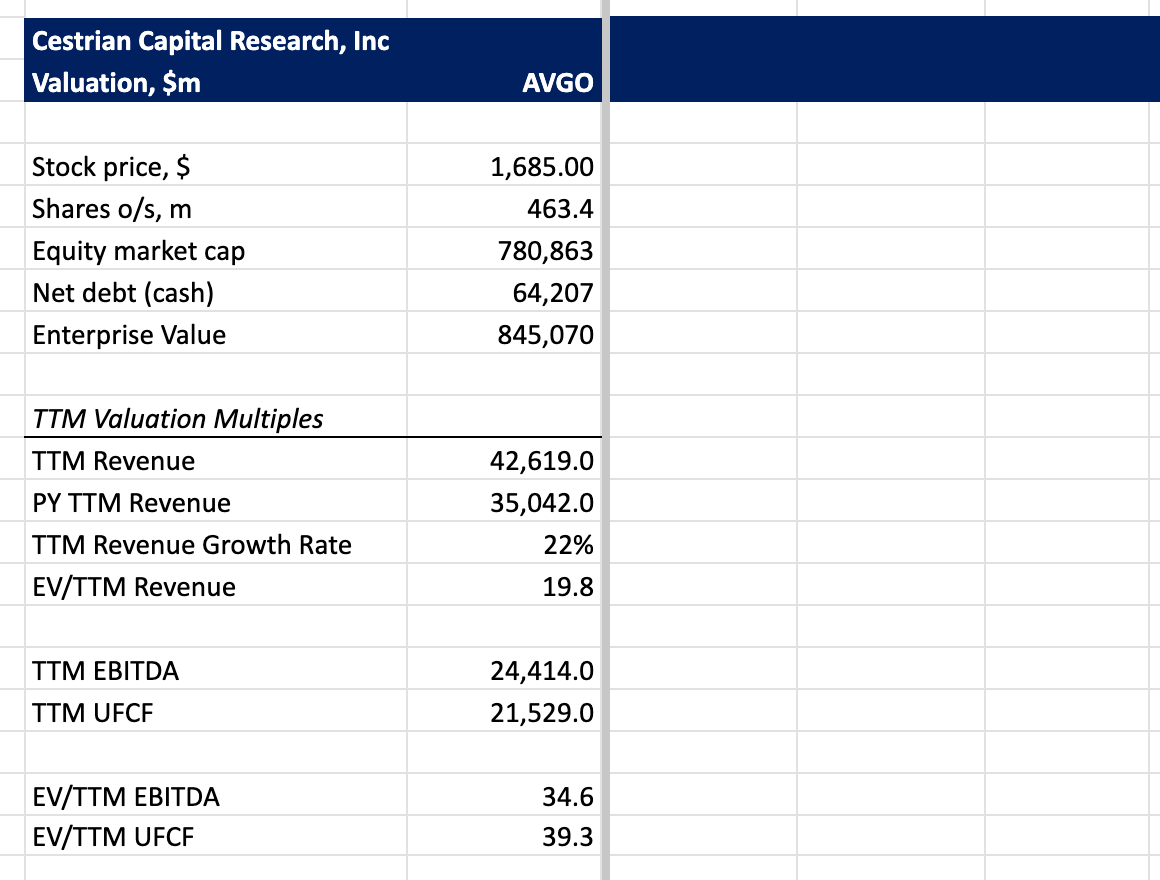

Valuation Analysis

Not cheap enough to buy on multiples alone, and not expensive enough to sell on multiples alone.

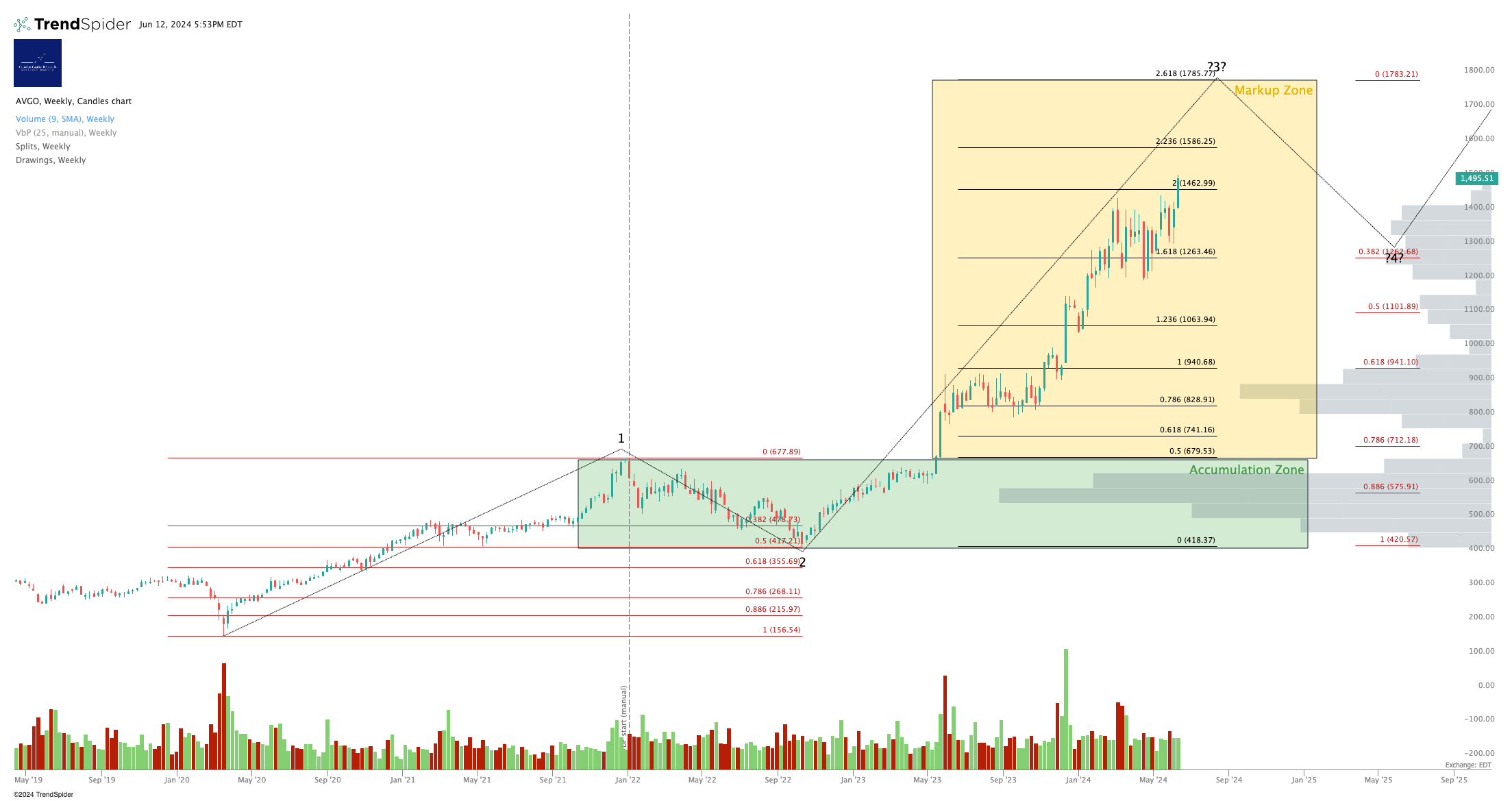

Technical Analysis

You can open a full page version of this chart, here.

Price target $1785 for now; could go higher but I would expect some resistance there first.

Stock Rating

We rate AVGO at Hold.

Cestrian Capital Research, Inc - 12 June 2024

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold no positions in $AVGO save through long positions in $SOXL.