Plenty Of Reasons To Own This One, None Of Them Good

LHX Q1 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Turns Out It Wasn’t The End Of History

Liberal democratic polities are not, it turns out, the undisputed end-state of civic evolution. A fact which will surprise nobody who has (1) read any history or even (2) lived long enough and looked around a little. The West’s overconfidence of the 1990s-2000s era meant that whilst academics and politicians alike were celebrating the end of the prior Cold War, a new one was quietly beginning. And it has now warmed up. The proxy wars we see popping up everywhere from Israel to Ukraine and beyond represent a distinct elevation of the global temperature.

As always, stock charts can foretell reality, because the folks whose large accounts are buying in the largest volumes are paid to know what is likely to happen before it happens. Bigs are not watching the news to see what just happened; they spend time in the corridors of power to see what may happen next year, next month, and to plan accordingly. This being why defense stocks started to look attractive late last year.

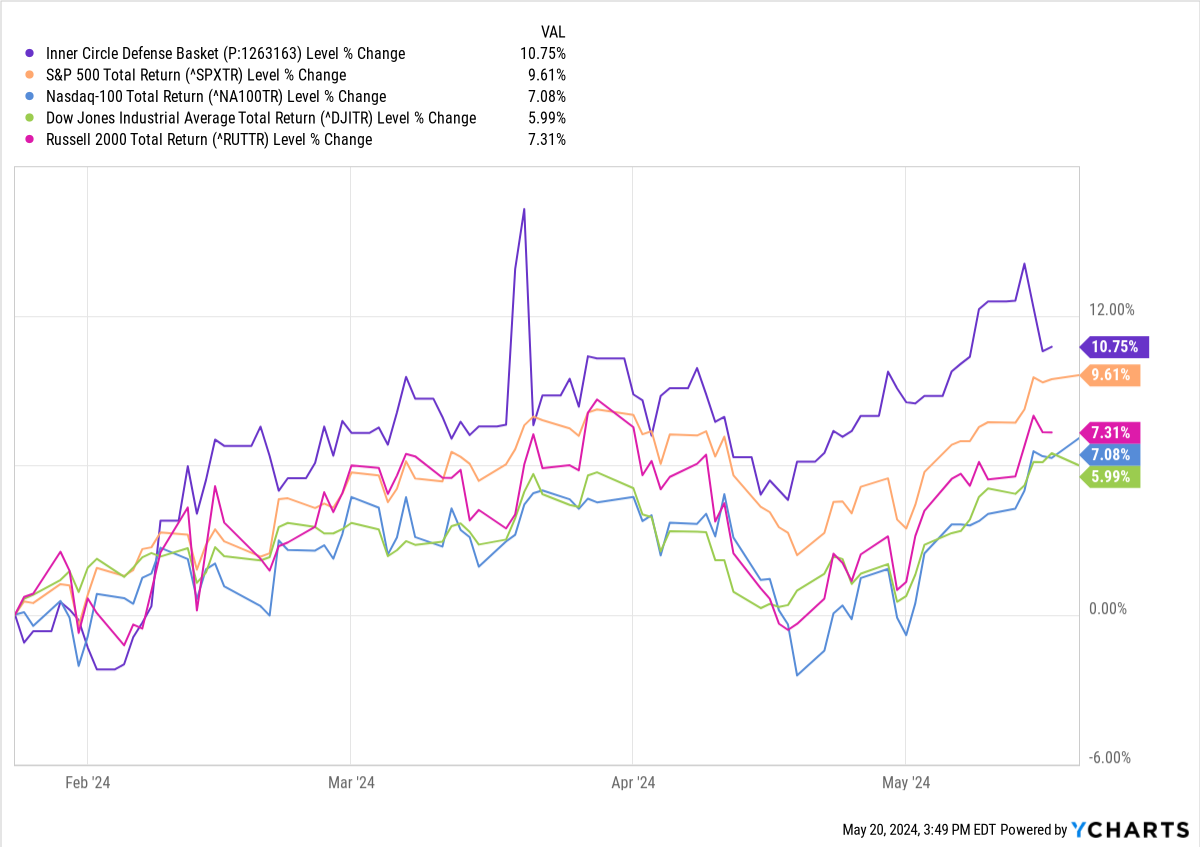

The Wyckoff Rotation method we overlay on our technical and fundamental analysis has proven very useful in following bigs around. Here, for instance is our Inner Circle Defense Sector Model Portfolio, vs. the S&P500, Nasdaq-100, Dow Jones 30 and Russell 2000, since inception in January this year.

In the middle of a tech boom, a few judiciously-chosen defense names have (thus far!) outperformed all the major indices.

This, in my view, is the reason to own $LHX; the fundamentals are OK, not wonderful, as you will see below. But the single-stock chart remains compelling I believe.

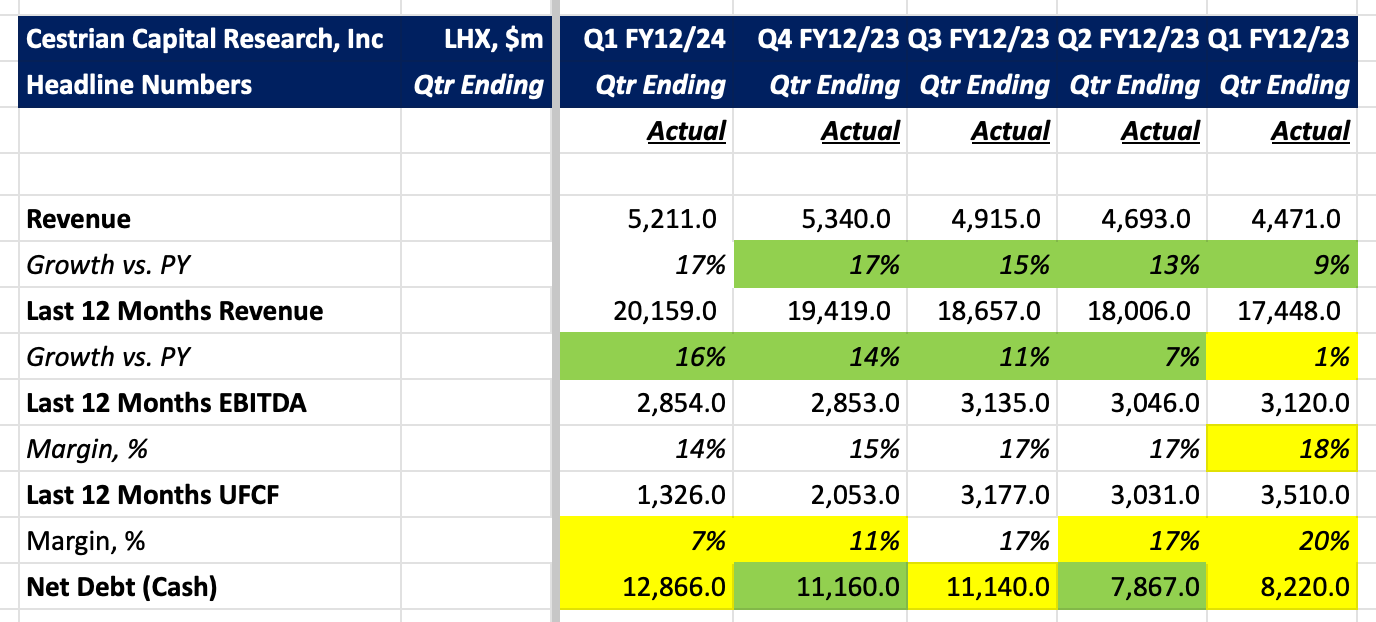

Below we lay out the headline numbers (before the paywall) and then take a look at the detailed financials, valuation analysis and our stock price projection, technical analysis and rating (after the paywall).

If you’re a free reader here, and you’d like to access the post-paywall stuff, you can sign up below either for our entry-level ‘Market Insight’ tier, or our full-monty ‘Inner Circle’ service. If you have any problems doing so, or you’d like to know more about what the pay services offer, you can reach us anytime using the contact form on this site, here.

L3Harris Headline Financials