Pinterest Q2 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Mood Board Remains In Its Happy Place

by Alex King, CEO, Cestrian Capital Research, Inc

Pinterest has morphed from a “sorry, what? why????” kind of business to a “oh right, sure I get it” kind of business. Thankyou Elliott Advisors. Most all pre-Elliott management bigs are now spending more time with their families, and so PINS shareholders get to spend more time with their families because they get to spend less time worrying about the fate of their holdings in PINS.

Consumer spending drives this business, but not your regular can’t-afford-McDonald’s-anymore kind of consumer, more your what-kind-of-green-paint-should-I-be-buying-this-season kind of consumer. And that kind of consumer is probably doing just fine and will probably continue to do just fine, DoomTwit notwithstanding.

Growth slowed this quarter and the guide is for a further deceleration - couple that with consumer spending worries and there you have your narrative for the 12% dump that the stock is showing a little after the open today.

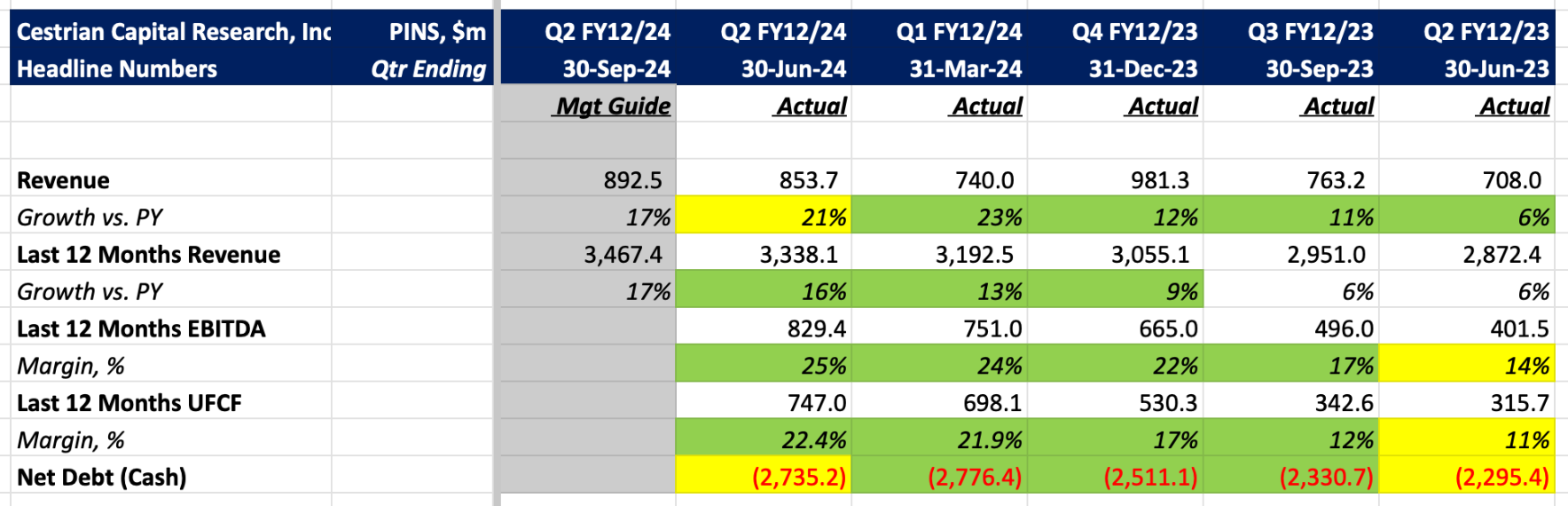

Here’s the headline numbers as of this quarter. If the market remains buoyant, and I think it will, I think there’s a good chance this company is sold - it’s trading at just 6x TTM revenue. If that revenue was subsumed in a larger company you can likely add 50-100% to the cashflow margins ie. take TTM UFCF margins to 30-40% let’s say. At 30% cashflow margins that’s a sub 20x cashflow acquisition at this price. So, even with an acquisition premium you get back to sub 30x cashflow. Someone will be running the slide rule over that one as leveraged loans and corporate bonds get cheaper with rate cuts.

Here’s the headline numbers.

Read on for our full financial analysis, valuation take, technical analysis and stock price target!