Perhaps Software Is Not Dead ( CRWD Q1 FY1/25 Earnings Review)

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Delicious!

by Alex King

This is what software experts are saying on Twitter / X right now.

These folks are fast learners. Software experts today, gamma squeeze experts yesterday, and rates bros last week. Impressive.

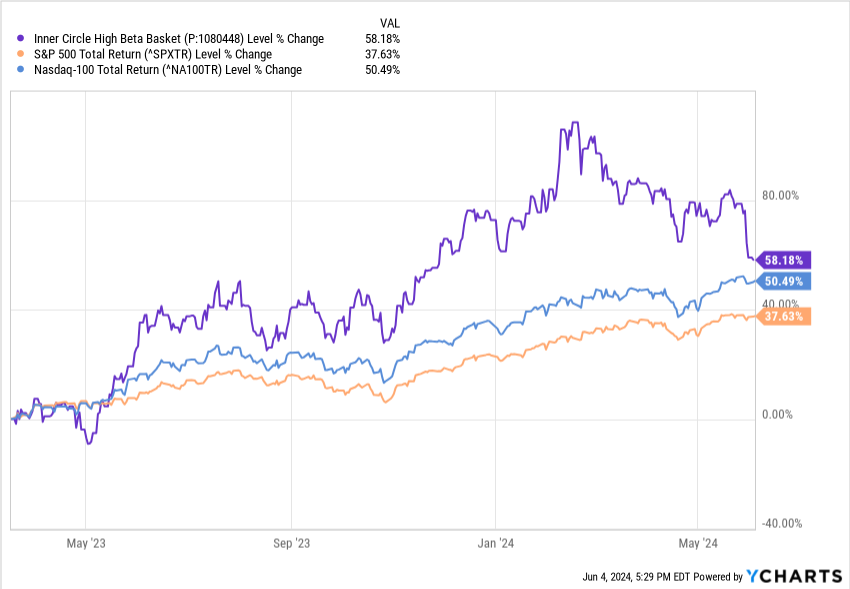

They do have something of a point though, because a whole bunch of enterprise software stocks peaked in February this year and have slowly dumped since. Here, for instance, is our Inner Circle "High Beta" model portfolio, total return since inception on 17 March 2023. Still nicely ahead of the S&P500 and the Nasdaq-100, but you can see that Q1 peak and the dump since then.

So is it true? Is it all over for software? Is Jensen the End Of History And The Last Man?

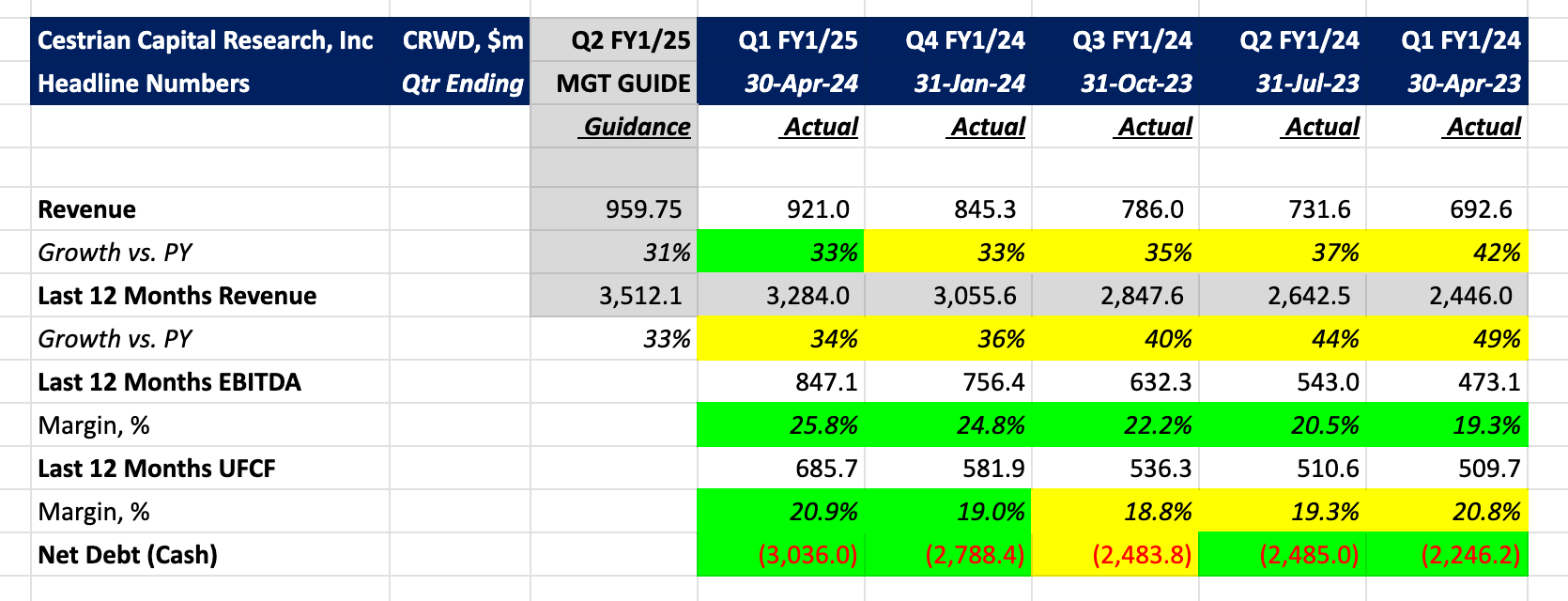

Well, maybe, but probably not. We've been looking over the software names we cover lately and cybersecurity is certainly standing out. Two such companies have seen revenue growth acceleration in Q1 of their FY1/25 - the first is SentinelOne ($S) and the second is CrowdStrike ($CRWD). One quarter's acceleration does not a reversal make, but it's an important step. Below you can see CRWD's headline numbers - after the paywall we go on to look deeper into the numbers, the valuation, our stock chart, rating and price targets.

Headline Financials