Party Like It’s … December 2022?!? (MDB Q1 FY1/25 Earnings Review)

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Going, Going …

Before we start - last call for launch-price Market Insight subscriptions. If you’re a free reader here and you’d like to move up to our entry-level pay service, our prices rise from the current $299/yr or $29.99/mo to $399/yr or $49.99/mo, tomorrow. If you sign up today you keep the current low price for as long as you remain a subscriber.

Can The Plates Spin Up Once More?

MongoDB ($MDB) is the very definition of a high-beta stock. As in, it overreacts vs. the S&P500. No wait. It is a manic-depressive stock which is either zooming up for no particular reason or, as happened yesterday, dumping back to bear market levels for the crime of seeing margins drop a little and growth being a little soggy. Which, I might point out, isn’t so different to what ZScaler told the market yesterday, and that thing is up 16% at the time of writing (7am Eastern). Now, personally, I am long ZS and I took gains in MDB many months back, so I am not complaining for my own accounts; but it just goes to show that many things conflate to deliver a stock price reaction; it’s not all about the numbers.

MDB is back at the levels last seen in December 2022 and as a result we move to Accumulate rating - though not without some concerns on the fundamental front, I have to say.

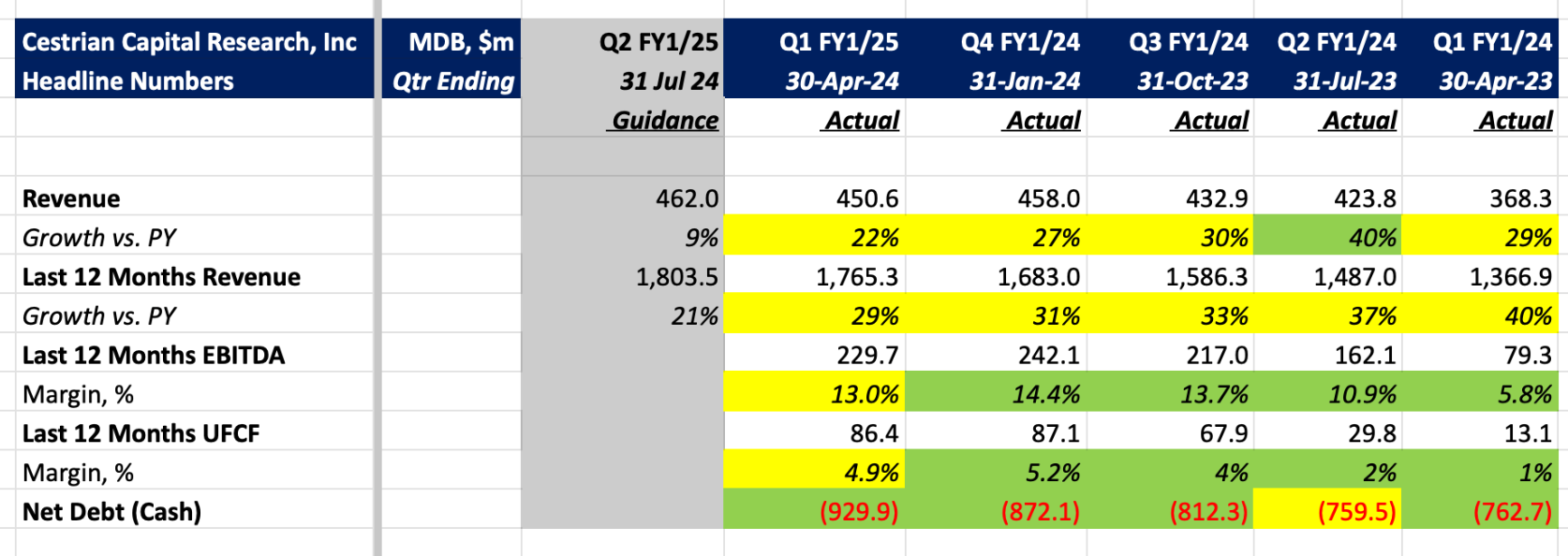

Here’s the headlines.

Summary Financials

Now let’s get into the detail and why o why it may be sensible to start building a position in this loser around now.