Palo Alto Q2 FY7/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

All In [the Cloud]

By HermitWarrior a.k.a. Richard Iacuelli

Our last Palo Alto ($PANW) earnings review (available here) made it pretty clear that they long ago ditched the notion of being a hardware company. Fast forward a few months and the message is the same - but subtly different.

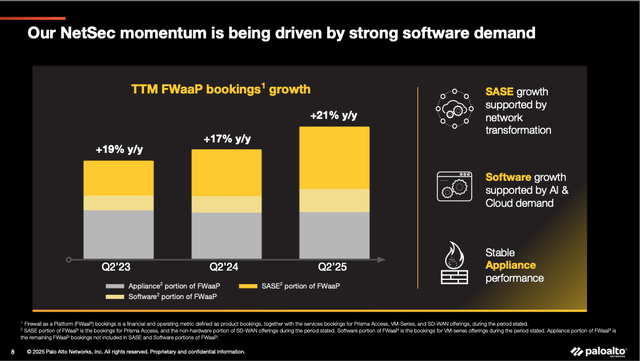

The focus on cloud services growth is still there, with accelerating bookings growth in Q2 (up 21% yoy) coming from cloud security services such as Secure Access Edge (SASE) and software firewalls, and the launch of their AI-enabled 'Cortex Cloud' service adding new capabilities to secure clients' cloud infrastructure (more on that later).

What's new is their realization that the increasing adoption of AI is fast becoming a tailwind for the same software-centric services they are focused on selling. This from the Q2 earnings prepared remarks delivered by CEO Nikesh Arora:

As the conversation around AI continues to get omnipresent and companies race to evaluate, experiment and deploy AI, they're discovering that some of the legacy [on-prem] architectures come in the way of their aspirations. Interestingly, this is resulting in a resurgence of cloud transformation projects, and consequently, demand for network security and network transformation.

This bodes well for Palo Alto - and for other cloud-first cybersecurity providers such as CrowdStrike ($CRWD), Zscaler ($ZS) and SentinelOne ($S) - and likely helped PANW's Q3 revenue growth guide tick up to 15%.

Let's take a look at the headlines.

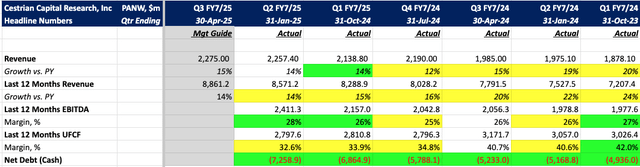

A 'steady as she goes' kind of quarter with Q2 revenue growth at 14% (they had guided to 13%) and EBITDA margins and net cash up. Unlevered free cashflow margins continued to trend down from the late FY23/early FY24 highs but are within the 25-35% range seen in quarters previous to that.