Palo Alto Q1 FY7/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

All roads lead to the Cloud

By HermitWarrior a.k.a. Richard Iacuelli

The folks at Palo Alto Networks ($PANW) are keen to make one thing very clear: They are not a hardware company. Or at least not much of one anyway. Perusing the Solutions overview of their web-site, one could be forgiven for thinking that this is in fact a pure-play Cloud Security provider; the word 'Appliance' doesn't appear at all (although, surprisingly, 'Hardware Firewall' does appear in the Products overview).

'Cloud' is the name of the game - and no longer just for storage or run-time environments - and the management team at PANW got this message long ago. The CEO is ex-Google (the epitomy of Cloud based services) as is the head of their Next Generation Security (NGS) business - oh and the Google CMO sits on the Board of Directors.

The shift to Cloud shows up strongly in their marketing, which like Fortinet's ($FTNT), is slick (their videos featuring action-star Keanu Reeves fighting off Keanu look-alikes, Matrix-style, are hard to miss on the web) and paints a picture of a vendor at the leading edge of cybersecurity, but also at where they're pointing the business.

Investments in Zero Trust, Cloud Security, Secure Access Service Edge (SASE) and AI are heavily promoted and designed to further drive the business - and the narrative - from hardware to services.

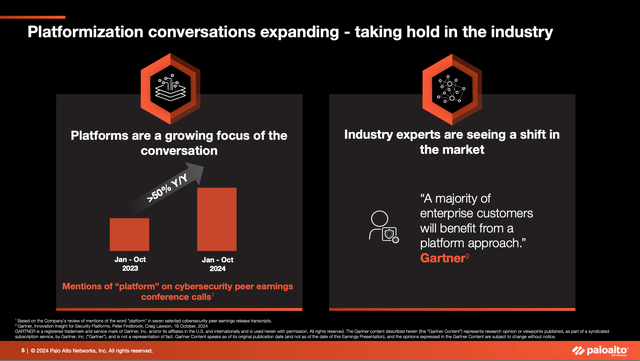

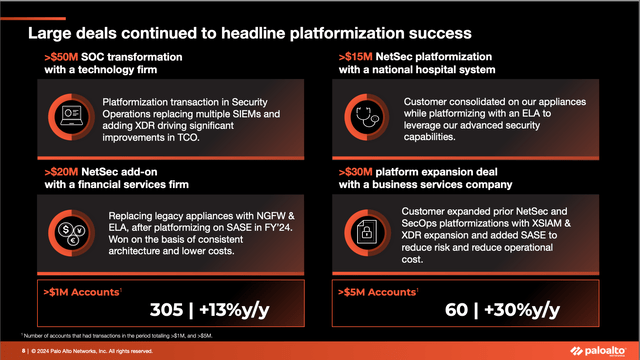

Subscription revenue now dwarfs product revenue by a factor of 5 to 1 for the latest quarter, up from 3 to 1 for Q1 2021. 'Platformization', a somewhat awkward term coined by PANW to describe vendor consolidation by end customers, is a key part of their strategy to grow Annual Recurring Revenue (ARR), a.k.a subscriptions.

Where FTNT built its business on a large base of small and mid-market business customers, large enterprise customers are a key focus for PANW and their success in this segment may be one reason that Zscaler made significant changes to their go to market model to be more account and relationship-centric, a key requirement of selling into/competing in the large enterprise segment. We'll explore this further in the upcoming ZS earnings release.

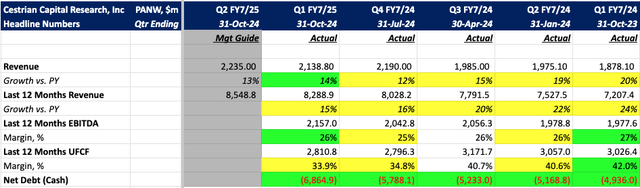

Let's now look at the Financials. Here are the Headlines.

Here's Alex's take on revenue growth last quarter:

The company is guiding for an acceleration of growth next quarter; if they can achieve that whilst holding margins at or around the current level, kudos to the management team.

Year on year Revenue growth did in fact accelerate in Q1, for the first time since Q4 '23, although management is guiding for only 13% growth, at the midpoint, in Q2. EBITDA margins improved while UFCF margins ticked lower. All in all a very solid performance.