PagerDuty Q2 FY1/25 Earnings Review.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Independence Days, Limited. Probably.

by Alex King, CEO, Cestrian Capital Research, Inc.

This will be our last earnings note on PagerDuty ($PD). No paywall as a result. This is a perfectly solid niche enterprise software business that does what us old folks would have called 'alerts' back when enterprise software hadn't been taught how to pretend it was cool. The stock was a 2021 darling, since when it has plummeted and keeps trying to dig down into the basement. Growth is declining, but the guide for next quarter is calling for that decline to arrest - good if it happens. EBITDA and cashflow margins are climbing nicely. The balance sheet is fine, not awash with cash, but fine.

I believe the fate of this niche enterprise software company will mirror the fate of so many other such names, which is that it will be acquired and consolidated into a larger player. If this happens it may offer a typical acquisition premium on the current price - call it 30-50% - but I don't think PD will hit new all time highs for a very long time if ever. A near term sale of the company would be welcomed by shareholders, I think.

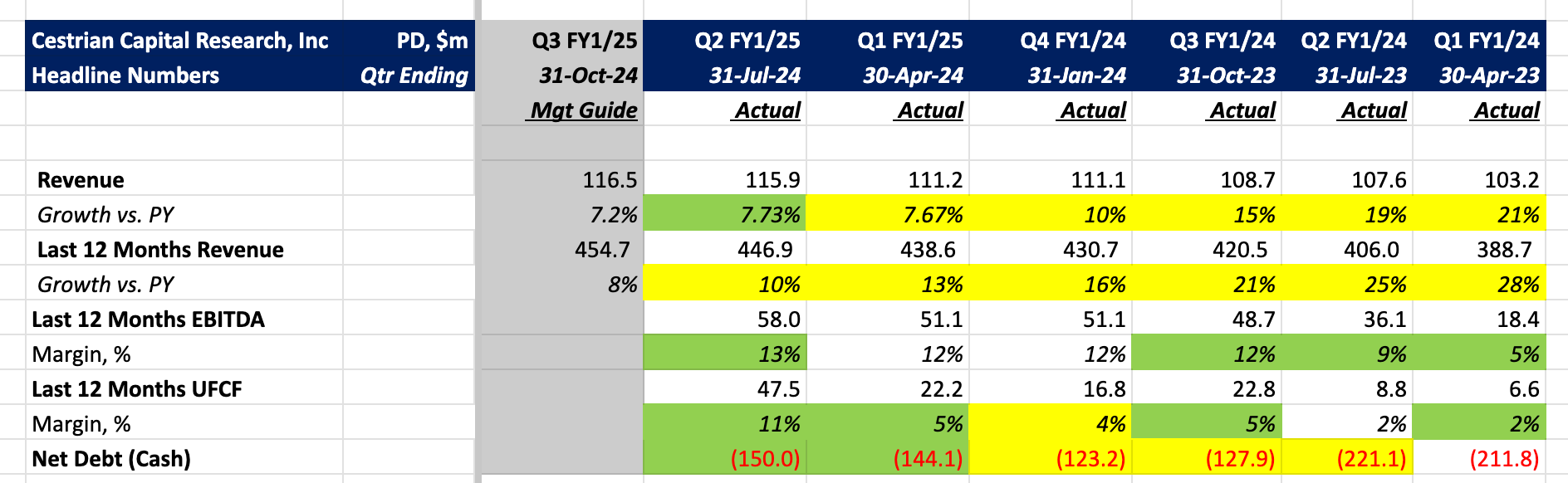

Here’s $PD headlines.

Read on for the financial detail, valuation, our stock chart and rating!

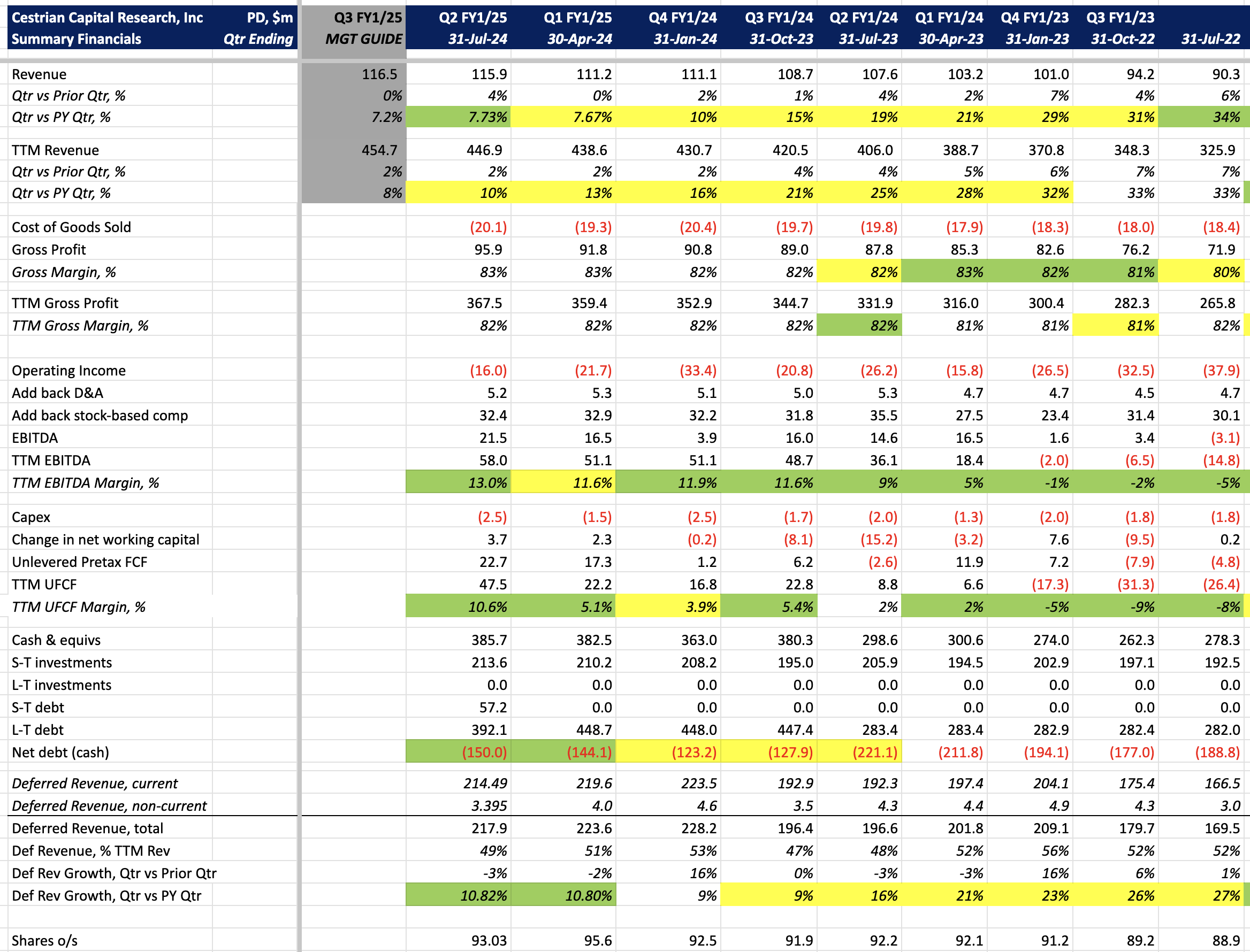

Financial Fundamentals

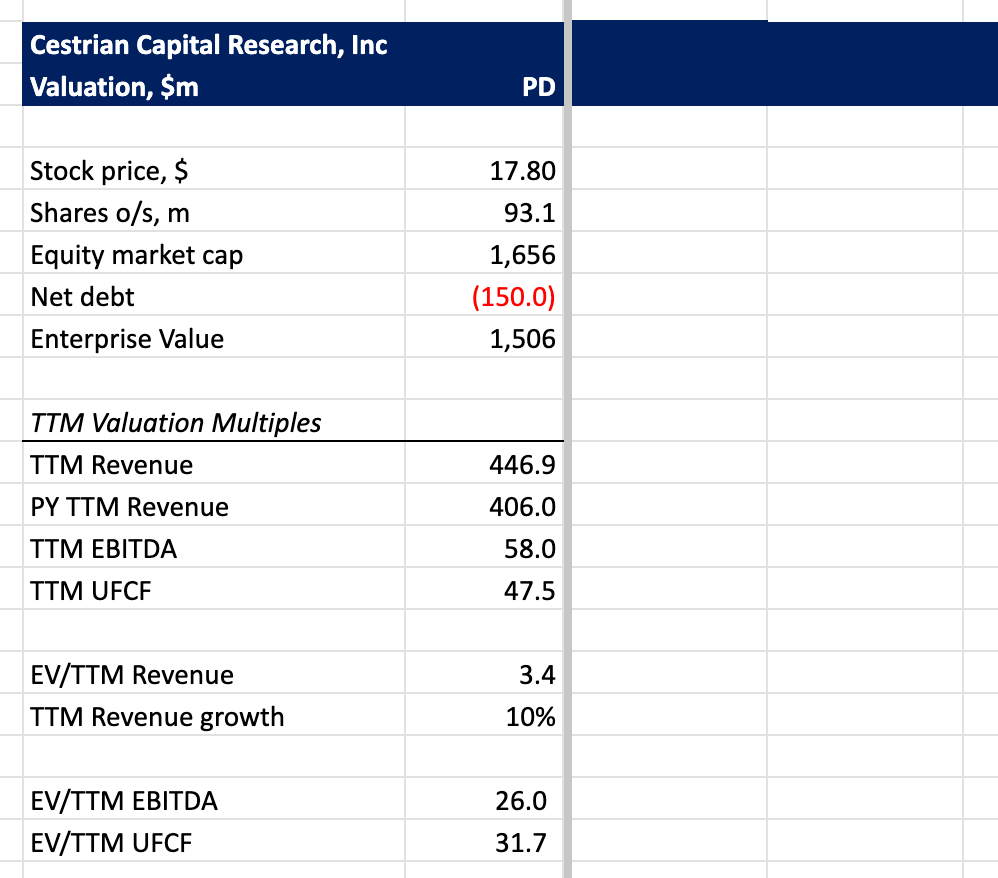

Fundamental Valuation Multiples

Even after continuous stock price declines since the dawn of telephony, the stock is still not all that cheap on an earnings or cashflow level. 3.5x TTM revenue is defensible I think.

Technical Analysis

Here’s our longer-term chart on PD.

Rating

We rate PD as, well, In The Danger Zone. I personally own a position in the stock.

Cestrian Capital Research, Inc - 12 September 2024.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold no positions in $PD.