Outta The Way, Bears!!

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Here To Help

Thinking only of you, of course - today’s market note is taken verbatim from our premium Inner Circle service daily note. Not coincidentally, today is the last day to sign up for Inner Circle at the current prices, before our 1 December price rise.

So if you like what you see below and you’d like to move up? Here’s what to do. Sign up for Inner Circle right here.

Better yet, if you are a paying subscriber here at Market Insight? Choose an annual subscription at Inner Circle and we will refund any unused part of your Market Insight subscription. Just let us know once you sign up for the Inner Circle annual - use this contact form - and we’ll get that good refund right back to you.

Now, read on!

GDP Anticipated, Partly Digested

by Alex King.

(Originally Posted Here.)

US equity indices ran up bigly in premarket and the early part of regular trading hours yesterday, in anticipation of and then in an initial reaction to US GDP numbers. The indices sold off towards the end of the trading day delivering what looked like a nothingburger for the S&P and Nasdaq. The Russell closed up some.

During the day high beta names remained elevated. This happens occasionally - scary stocks are bid up whilst the bigs sell off - and we can call that a mixed signal at best. It does not signal general bullishness to my eyes; for that you want to see high volume sustained buying in the major names.

After hours there were very positive earnings reactions to ho-hum numbers from software companies Salesforce ($CRM) and Snowflake ($SNOW). Both were up around +10% in the postmarket period. That does look like bullish sentiment, particularly for $CRM which is now something of a grandpa-tech name, becoming more akin to its alma mater Oracle as each year goes by. ($CRM is a Dow Jones 30 constituent).

And in the nearer term?

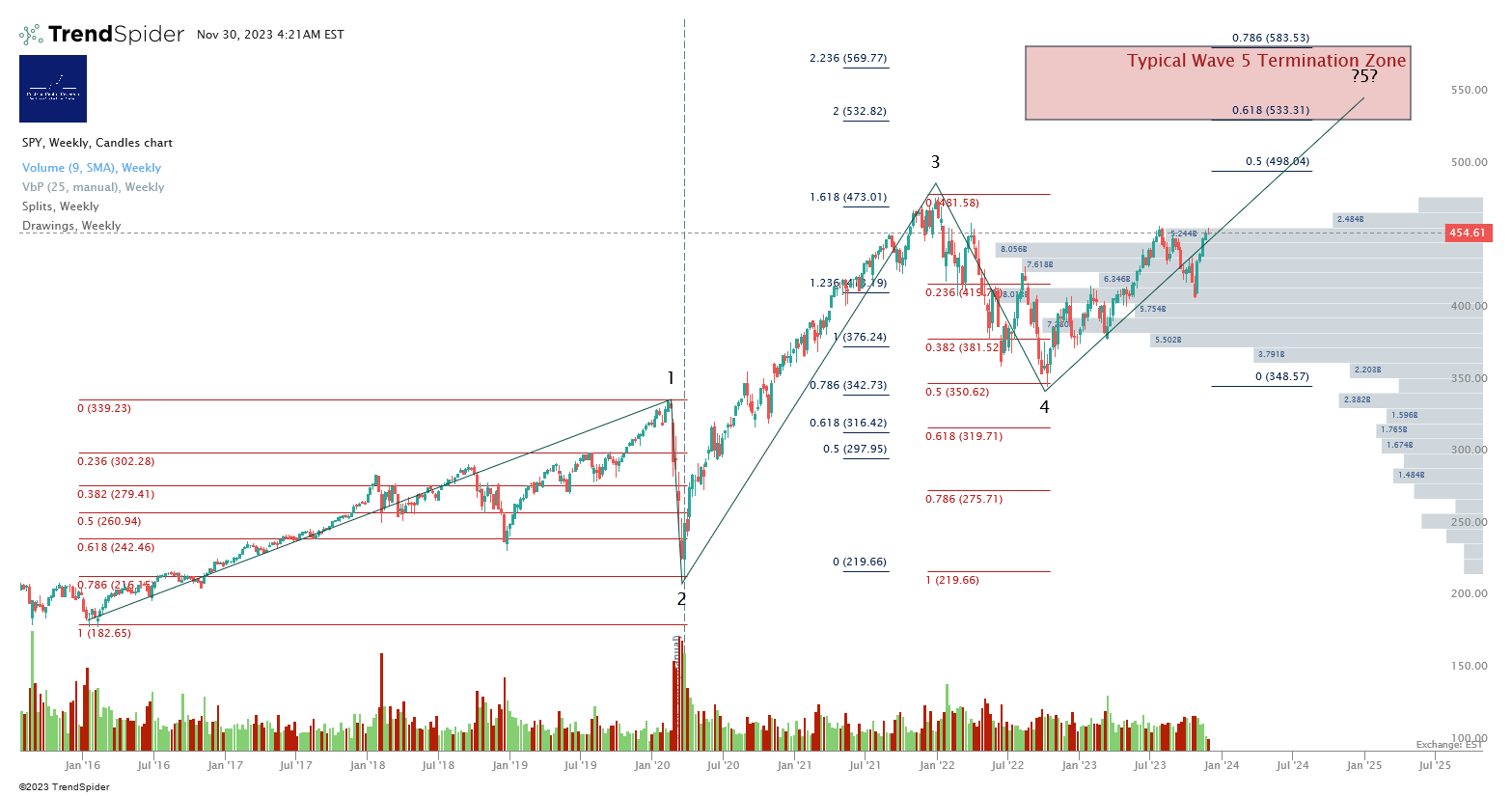

As I noted here on Tuesday, each of the indices are closing in on what looks to me to be local Wave 5 termination zones. So speaking personally I am preparing to hedge the long positions; carefully, because there is a chance that the ceaseless grind upwards continues. As always, paying Inner Circle subscribers will get Trade Disclosure Alerts on a real-time basis before any such short positions are entered into.

Let's Get To Work

Note - to open full-page versions of these charts, just click on the chart headings, which are hyperlinks.

US 10-Year Yield

S&P500 / SPY / ES / UPRO

Note the current price is right at the top of the last high volume node. Above this price there is hardly any unsold inventory. Which may mean the path to all time highs becomes easier if SPY >460ish.

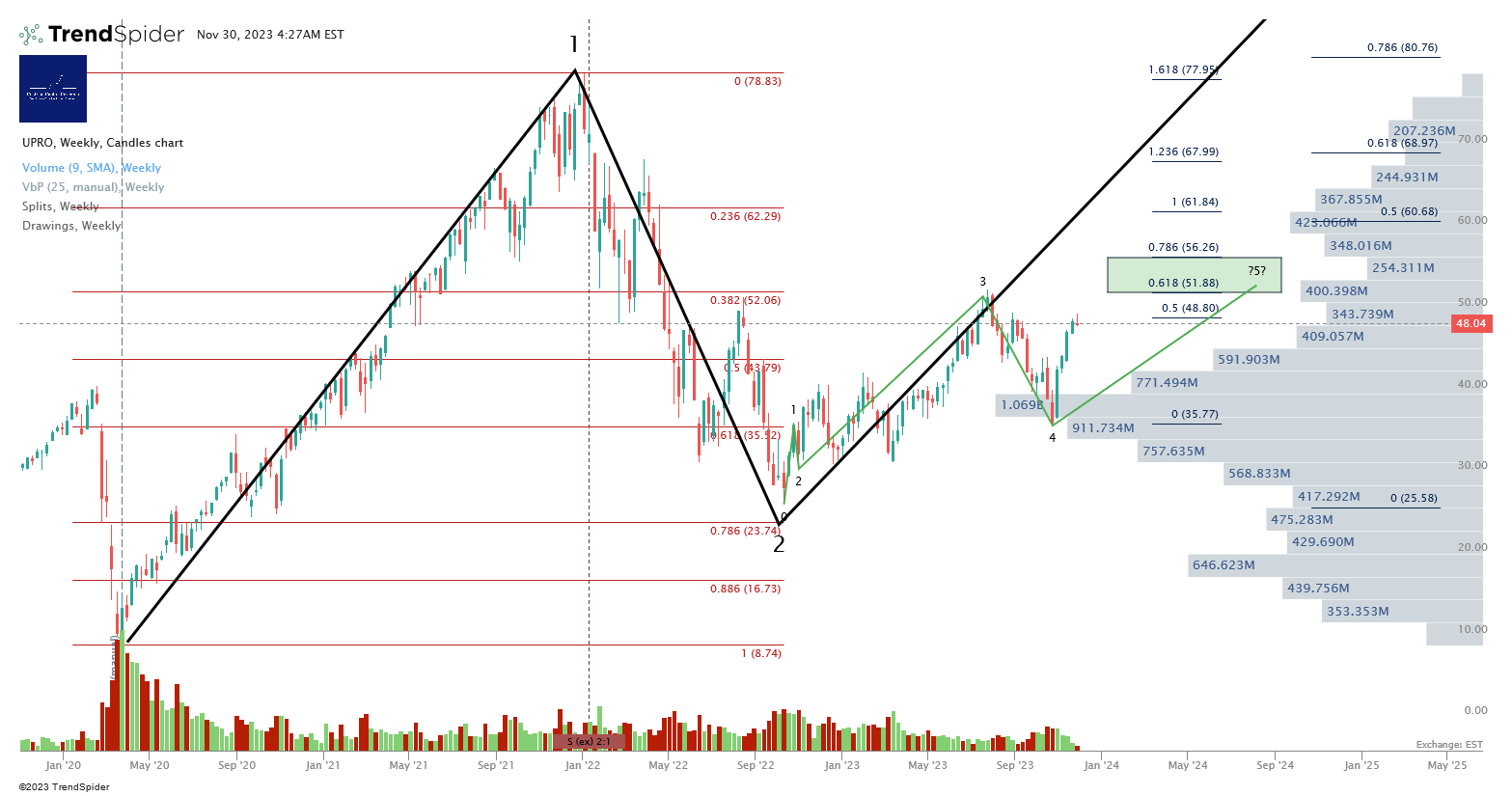

No change. $50-65 looks like the region to watch from the perspective of adding hedges or selling long UPRO positions. Currently $48.

Personal Trading Plan Disclosure: I currently hold UPRO long and unhedged. I am considering hedging with SPXU if and when UPRO gets to that W5 termination zone highlighted above.

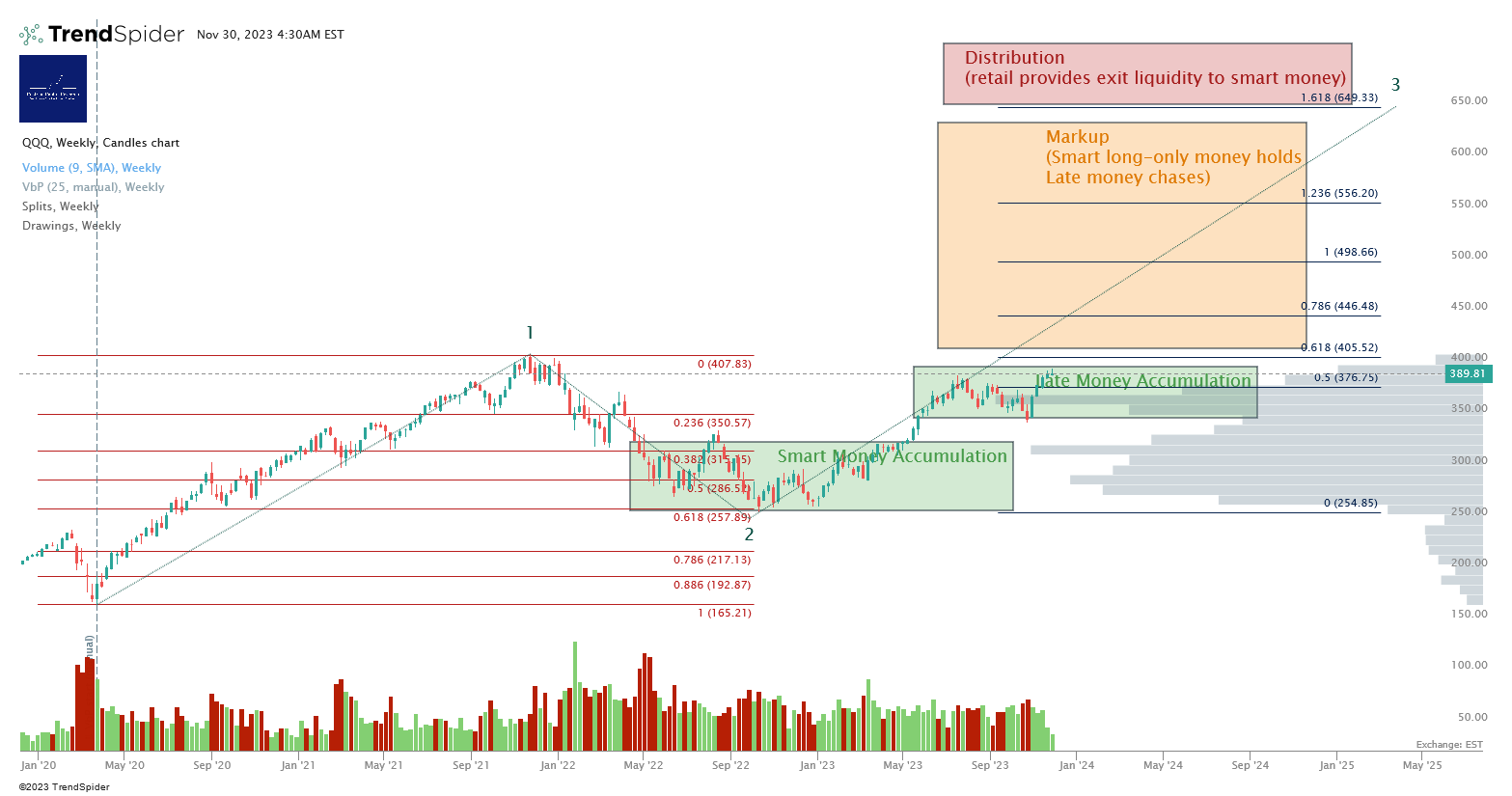

Nasdaq-100 / QQQ / NQ / TQQQ

No change to our larger-degree outlook. It will soon be time to test whether our base case is valid or too cautious.

No change. $49-55 looks like the region to watch from the perspective of adding hedges or selling long TQQQ positions. Currently $44.

Personal Trading Plan Disclosure: I hold TQQQ long and unhedged at present. I am considering hedging using SQQQ if and when TQQQ reaches the Wave 5 Termination zone highlighted above.

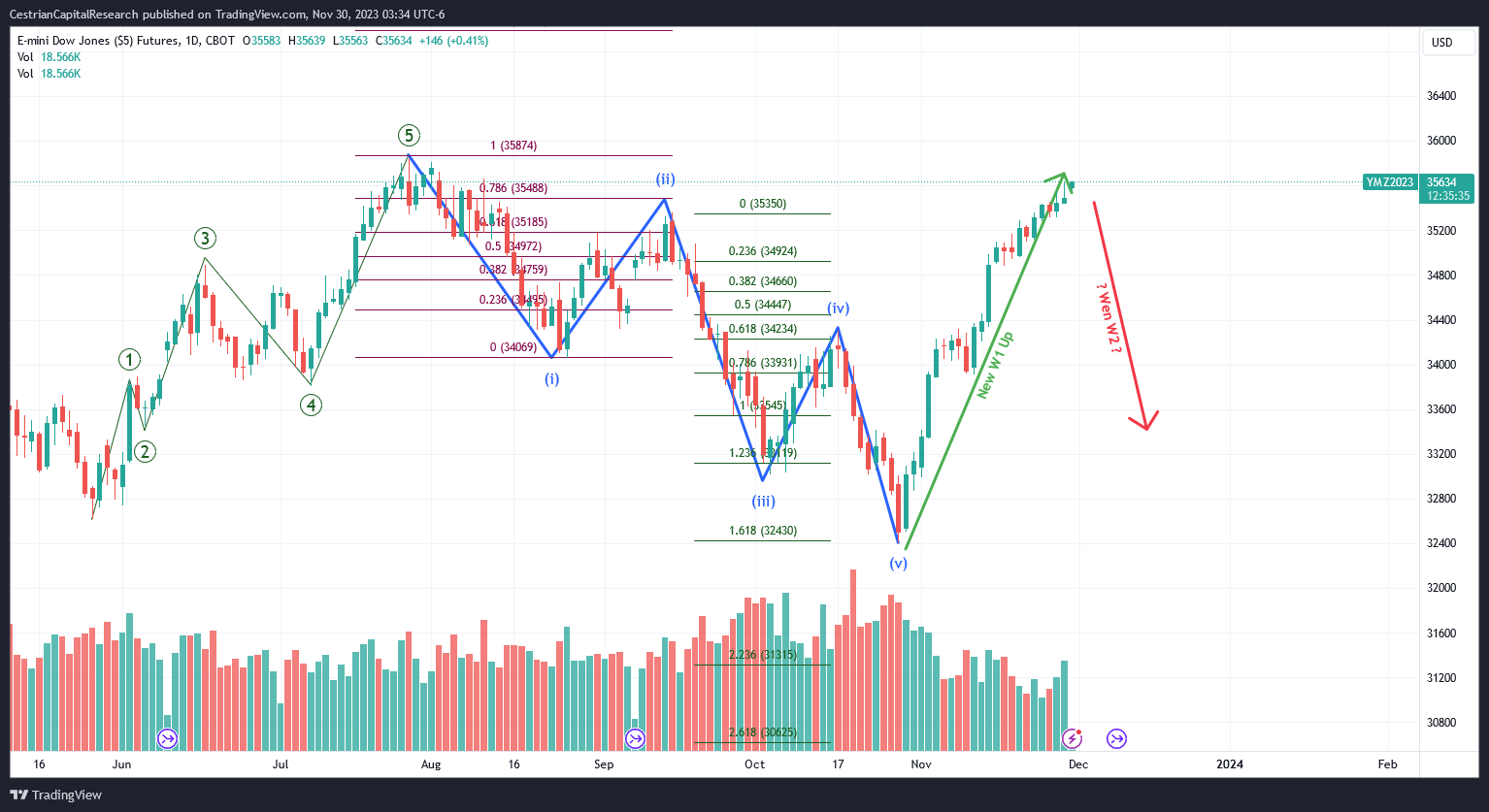

Dow Jones / DIA / YM / UDOW

That is one ginormous Wave 1 up.

$66 is probably the next level to see material resistance - that's the December 2022 and June 2023 double top.

Personal Trading Plan Disclosure: I hold UDOW long and unhedged. No specific plans to do otherwise for now.

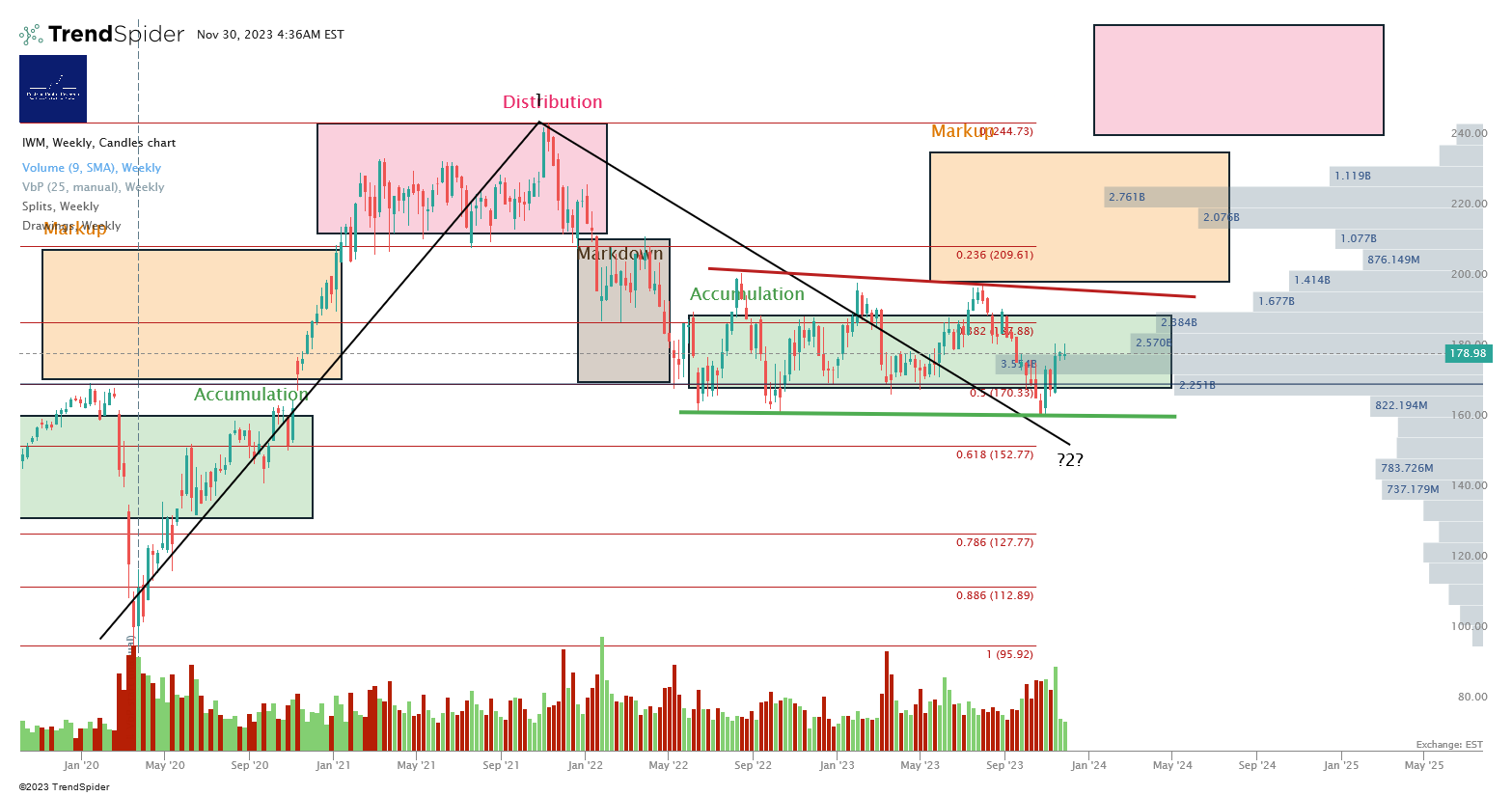

Russell 2000 / IWM / RTY / TNA

Personal Trading Plan Disclosure: I hold TNA long and unhedged at this time. No specific plans to do otherwise for the moment.

3x Levered Long XLK (Tech) - TECL

Typical implied W5 termination zone, $65-73

3x Levered Long SOXX (Semiconductor) - SOXL

Typical implied W5 termination zone, $28-33

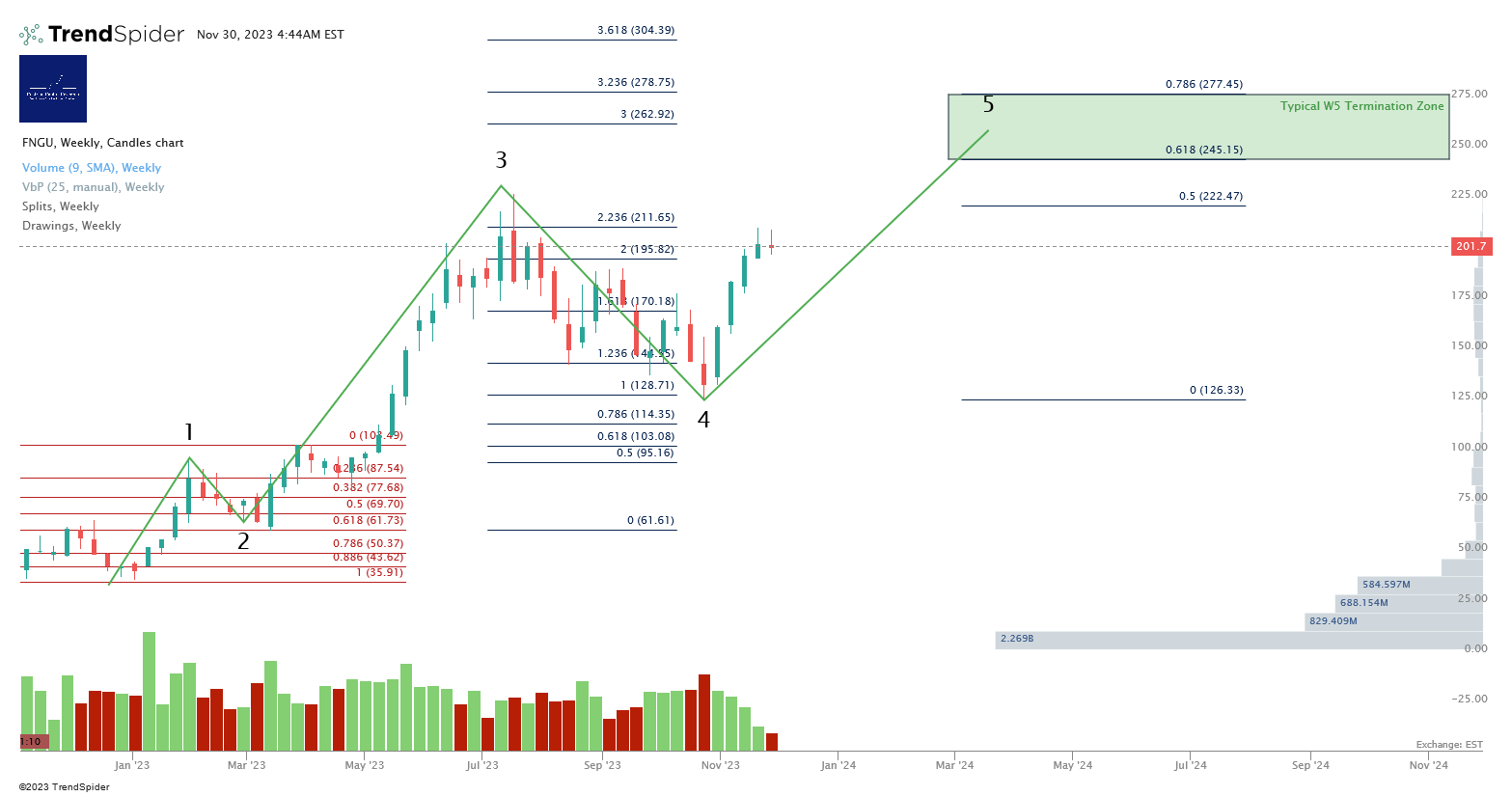

3x Levered Long Megacaps - FNGU

Typical implied W5 termination zone, $245-277

Alex King, Cestrian Capital Research, Inc - 30 November 2023.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, UPRO, TQQQ, UDOW, TNA, CRM